We appreciate each and every one of you for taking the time to read Market Minds. Buckle up and enjoy the free value, and you won’t want to miss… the home that blurs the line between architecture and art

The Housing Market Has Stopped Moving. Power Hasn’t

The headline number is lying to you

The national median list price parked itself at $419,999, inventory barely budged, and days on market look boringly consistent. This is what a market looks like when it’s exhausted, not healed. Stability here isn’t balance, it’s inertia. Buyers and sellers are both waiting for someone else to blink, and no one is blinking because rates, stuck near 6%, are giving just enough certainty to prevent panic and just enough pain to prevent enthusiasm.

Seller leverage is concentrating, not disappearing

Nationally, the Market Action Index says sellers still have a pulse. But zoom in and you see gravity at work. The Northeast is tightening its grip: fewer price cuts, faster sales, and the strongest seller leverage in the country. The Midwest, quietly and without coastal drama, is doing the same at far lower price points. Meanwhile, the South is absorbing the excesses of the last cycle. More cuts, softer demand, more time on market. Capital is flowing to discipline.

Price sensitivity is the real signal

New listings are coming in roughly $10,000 below the broader median. That gap matters. It tells you sellers aren’t testing the market anymore, they’re negotiating with it before buyers even show up. This is not capitulation. It’s realism. In markets with momentum, that realism gets rewarded with speed. In markets without it, it becomes the opening bid in a longer conversation.

Time on market is splitting the country in two

The national median of 91 days hides the story. Homes in the Northeast are moving faster despite higher prices. Homes in the West are expensive and patient, sellers holding the line while the clock ticks. The South is slower and more flexible. The Midwest is affordable and efficient. Velocity, not price, is the tell for where confidence lives.

Rates aren’t rescuing the market, they’re anesthetizing it

Mortgage rates near 6% aren’t low enough to reignite demand and not high enough to force liquidation. They’re doing something subtler and more dangerous: freezing behavior. That’s why inventory isn’t exploding and prices aren’t collapsing. The market isn’t strong. It’s sedated.

The real trade is local, not national

This is no longer a “housing market.” It’s a collection of micro-markets with radically different power dynamics. The mistake is thinking a flat national chart means safety. It doesn’t. It means selection matters more than timing. The next year won’t reward optimism or pessimism. It will reward precision.

The market didn’t move this month. The advantage did.

The Month Matters More Than the Map

Belonging Is Becoming a Housing Input, Not a Lifestyle Perk

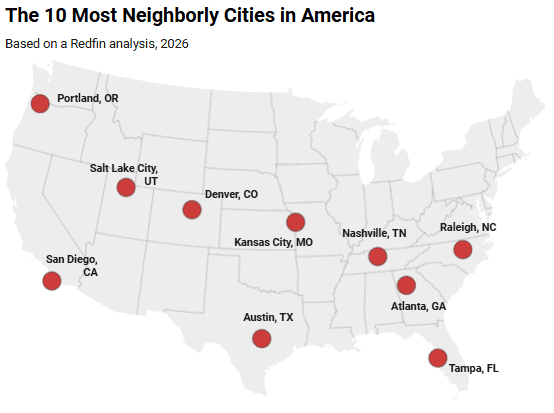

Redfin’s “most neighborly” cities aren’t just places where people wave more. They’re metros where social infrastructure is doing real economic work. Volunteerism, civic clubs, walkable neighborhoods, and low-friction social ties are acting like ballast in an otherwise jittery housing market. Prices in these cities aren’t spiking. They’re holding. That’s not accidental. In periods of uncertainty, buyers don’t stretch for square footage, they anchor to stability. And stability increasingly looks like community, not granite countertops .

Affordability Plus Stickiness Beats Growth Alone

Notice the pattern: Salt Lake City, Kansas City, Nashville, Raleigh, Tampa. None are speculative darlings. These are markets where people plan to stay, not flip. Modest year-over-year price moves paired with high engagement signal something important: transaction velocity may slow, but tenure lengthens. That’s good for pricing power over time. When people embed socially, they tolerate more market noise before listing. Inventory doesn’t flood. Volatility dampens. The month-to-month data matters more than the headline trend.

The Fence Is the Signal

Kansas City’s lack of fences isn’t a metaphor, it’s a data point. Cities that rank highest here share one physical trait: permeability. Walkability, shared parks, farmers markets, neighborhood events. These reduce isolation and increase informal monitoring. Translation: safer-feeling streets without higher taxes. Buyers may not articulate this, but they respond to it. Homes in socially dense micro-neighborhoods clear faster even when the broader metro softens.

Price Declines Aren’t Weakness When Community Is Strong

Denver, Austin, Atlanta, Raleigh all posted flat or negative YoY prices and still made the list. That combination matters. A softening price curve in a strong social environment is not a red flag, it’s an entry point. These are markets where demand isn’t evaporating, it’s pausing. People aren’t leaving. They’re waiting. Month by month, those pauses create windows that don’t show up in annual averages.

The Real Edge Is Temporal, Not Geographic

The throughline isn’t region. It’s timing. These cities reward attention to the month, not the myth. Community-driven markets don’t rip higher quickly, but they also don’t unravel quickly. The advantage goes to anyone tracking short-term shifts in inventory, days on market, and concessions, then acting before sentiment catches up. Doubt favors patience. And patience, right now, favors places where people still know their neighbors.

In other words: when the macro feels loud, follow the micro. And when the data conflicts, trust the month.

A brief sponsor break

Dalio: “Stocks Only Look Strong in Dollar Terms.” Here’s a Globally Priced Alternative for Diversification.

Ray Dalio recently reported that much of the S&P 500’s 2025 gains came not from real growth, but from the dollar quietly losing value. Reportedly down 10% last year!

He’s not alone. Several BlackRock, Fidelity, and Bloomberg analysts say to expect further dollar decline in 2026.

So, even when your U.S. assets look “up,” your purchasing power may actually be down.

Which is why many investors are adding globally priced, scarce assets to their portfolios—like art.

Art is traded on a global stage, making it largely resistant to currency swings.

Now, Masterworks is opening access to invest in artworks featuring legends like Banksy, Basquiat, and Picasso as a low-correlation asset class with attractive appreciation historically (1995-2025).*

Masterworks’ 26 sales have yielded annualized net returns like 14.6%, 17.6%, and 17.8%.

They handle the sourcing, storage, and sale. You just click to invest.

Special offer for my subscribers:

*Based on Masterworks data. Investing involves risk. Past performance is not indicative of future returns. Important Reg A disclosures: masterworks.com/cd.

Included because some investors track markets differently than headlines suggest.

Congress trading disclosures are public.

Most people never look at them.

A few platforms aggregate them into something usable.

If you care about how capital actually moves, not how it’s narrated, this is one of those datasets worth understanding.

February Is a Mirror, Not a Megaphone

Groundhog Day Economics

February in real estate feels repetitive because it is. Same headlines, same anxieties, same Zillow screenshots pretending precision is truth. The Groundhog Day riff isn’t a joke, it’s a diagnosis. Pricing, confidence, and momentum are looping. The opportunity isn’t to predict spring, it’s to be the adult in the room when the algorithm shrugs. In affordable, neighbourly markets, trust compounds faster than cleverness.

Attention Is the New Inventory

This piece isn’t really about content ideas. It’s about attention scarcity. Grammys, Super Bowl, Pizza Day, Valentine’s Day, pets. These aren’t distractions, they’re the last shared moments of civic culture. Owning mindshare locally now matters more than chasing national narratives. When rates flatten deals and headlines flatten nuance, relevance is hyperlocal or it’s invisible.

Affordable Wins on Familiar Streets

The most powerful suggestion buried here is the simplest: make the same day livable. The “perfect day in your city” isn’t fluff, it’s a value prop. Affordable regions don’t win on spectacle, they win on rhythm. Walkable mornings, known baristas, Friday pizza debates. This is how you frame affordability not as compromise, but as quality of life with a shorter commute to joy.

Status Is Replaced by Signal

February 4 is positioned as the “most important day in real estate history” with a wink, but the subtext is serious. Status used to come from offices, titles, and volume. Now it comes from signal clarity. Who cuts through the noise, who sounds human, who feels neighbourly. FaceTime beats production. Carousels beat theatrics. Consistency beats virality.

Posting Through the Winter

There’s an unglamorous truth here: momentum now is mechanical. Reels stall, carousels carry, and most people quit too early. February rewards stamina. In affordable markets, where margins are thinner and relationships longer, persistence is strategy. You don’t post to spike leads. You post so that when someone finally raises their hand, you’re the only familiar face.

Community Is the Moat

Pizza lists, pet parks, low-cost Valentine’s dinners. This isn’t lifestyle content, it’s infrastructure. You’re mapping the social operating system of your town. The neighbour who knows where to go, not the salesperson who knows what to say, wins the decade. Especially where price sensitivity is high and loyalty is earned one small recommendation at a time.

February isn’t about being louder. It’s about being closer.

Living Gallery

Listed at $5.993M, this Mission Hills, KS estate spans over 10,000 square feet on a secluded 1.3-acre wooded lot. Designed more like a curated exhibition than a traditional residence, every corridor, wall, and volume feels intentional—quietly demanding attention without ever asking for it. This isn’t a house you rush through… it’s one you absorb.

Check it out👇

The Power Move

Control didn’t come from movement, it came from restraint.

Sellers began listing homes below the national median, signaling they’re pricing for velocity instead of testing upside in a frozen market.

That choice quietly shifts power: in micro-markets with momentum and social stickiness, realism clears homes faster while others wait for rates to rescue them.

In an anesthetized market, the first concession is often the smartest one.

TL;DR (Too Long; Didn’t Read)

The housing market isn’t “stable,” it’s exhausted. Rates around 6% froze buyers and sellers in place, concentrating leverage into specific regions and even specific neighborhoods where velocity, not price, reveals confidence. At the same time, markets with strong social infrastructure — affordable, walkable, sticky communities — are quietly holding value and creating short-term entry windows that don’t show up in annual charts. And February isn’t dead season; it’s when attention, patience, and local relevance compound while everyone else waits for spring. The advantage didn’t disappear — it moved to the people tracking the month, the street, and the micro-signals others ignore.

Have a great weekend - we’ll see you next Saturday.

Cheers 🍻

-Market Minds Team

The content of Market Minds is provided for informational purposes only and reflects personal opinions based on sources believed to be reliable. It does not constitute financial, investment, legal, or professional advice. Each reader is solely responsible for their own decisions.