We appreciate each and every one of you for taking the time to read Market Minds.

Buckle up and enjoy the free value, and you won’t want to miss… the Malibu oceanfront home that makes $20 million look surprisingly reasonable.

The Great Unfreeze: Why 2026 Will Be the Year the Housing Market Starts Moving Again

Source: keepingcurrentmatters

More Movement, Not Mayhem

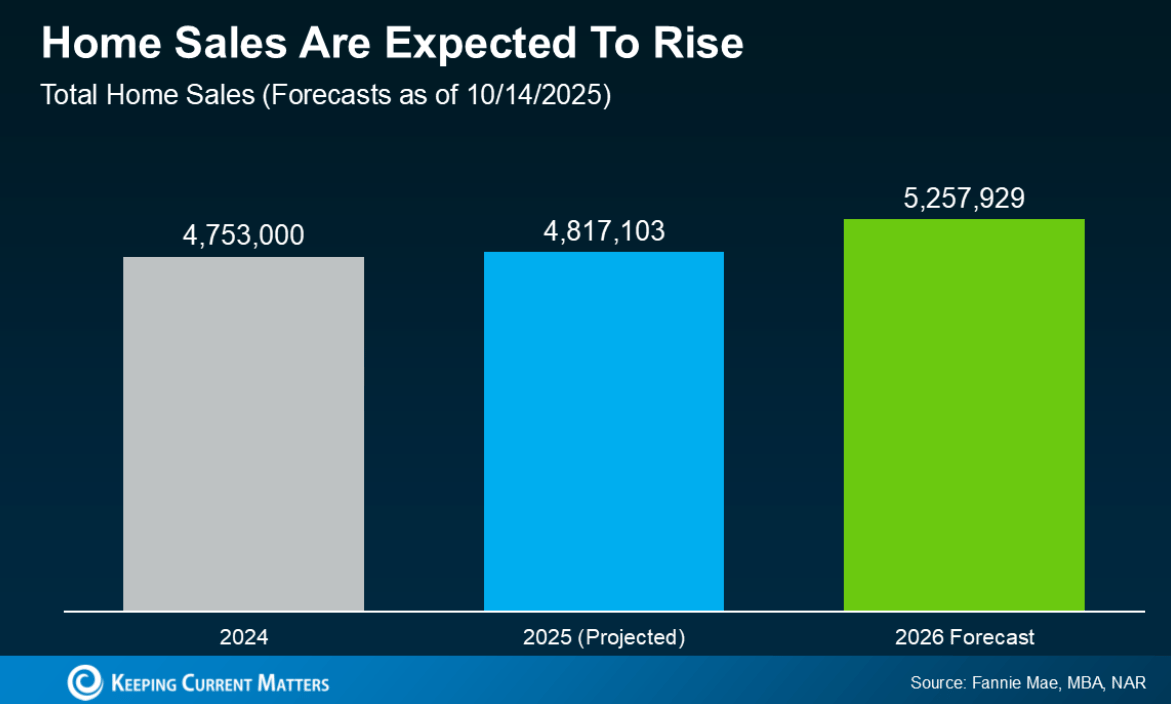

You’ve seen it, the holding pattern. Buyers stalled by affordability, sellers handcuffed by low-rate golden handcuffs, and the market looking more like a standoff than a dance floor. But 2026 might finally break the deadlock. Forecasts show a resurgence in transactions, and not because of some mythical crash or bubble. It’s simple: people need to move, and they’ve waited long enough.

The Interest Rate Stairs (Not an Escalator)

Expect mortgage rates to decline, but don’t confuse “decline” with “drop off a cliff.” Rates are doing the slow, wobbly stair-step down. Not sexy, but effective. Picture high 5s to low 6s by mid-2026. Not game-changing on paper, but in real terms? That’s hundreds off monthly payments, and thousands more buyers back in the pool. Translation: tighter bidding, quicker deals, and a hell of a lot more price stability.

Prices Will Rise Slowly. And That’s a Good Thing.

The 20%-year-over-year mania is over. So is the waiting-for-a-crash delusion. We’re entering an era of moderate price growth, think low-single digits. Predictable, boring even. And that’s precisely why it’s powerful. Investors can model returns with confidence. Buyers can plan without panic. And agents? You get clarity. Stability isn't sexy, but it makes you money.

Inventory: The Real X-Factor

Forget national stats. The market’s real story in 2026 will be hyperlocal. Areas with fresh inventory will outperform, period. Those without? More stagnation, more price tension. It won’t be one market, it’ll be 400 micro-markets with wildly different dynamics. This is where sharp operators separate from the pack: by knowing which zip codes are loosening up, and which are still in a chokehold.

THE SPREAD NARROWS: Why Mortgage Rates May Actually Fall (For Real This Time)

Source: keepingcurrentmatters

Confidence Is the New Capital

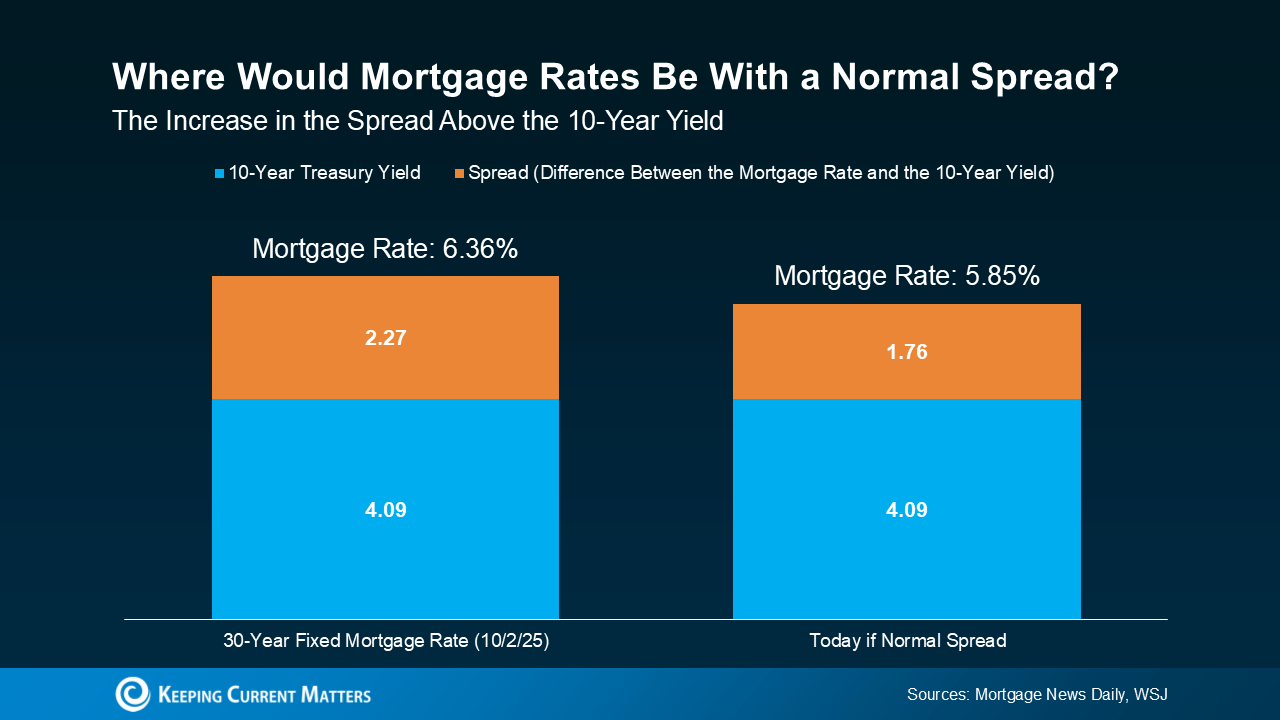

There’s a decades-long dance between mortgage rates and the 10-year Treasury yield. Normally, they two-step in sync, yield goes up, mortgage rates follow. But lately, that rhythm has been offbeat. The spread between them, usually a predictable 1.76 percentage points, ballooned as economic uncertainty blew a foghorn across the bond market. The result? Mortgage rates spiked beyond fundamentals. Now, as fear recedes and clarity creeps in, that spread is quietly tightening.

The spread between Treasury yields and mortgage rates has been a barometer of fear. For two years, that fear premium was costly. Think: panic-baked borrowing rates that punished buyers and froze deals. But now, that irrational spread is shrinking. Translation: if the 10-year yield merely holds or drops slightly (as many expect), mortgage rates could settle back into the upper 5% range by late 2025. That’s not a moonshot. That’s mean reversion.

Watch the 10-Year. It’s Whispering, Not Screaming

The yield on the 10-year Treasury sits around 4.09%. Add the average historical spread, and you’re staring at a “fair value” mortgage rate of 5.85%. We’re not there yet. But the path to that number is clearing. This isn’t hopium. It’s basic bond math and behavioral economics colliding: Less volatility, more predictability, cheaper money.

The Real Rate Reset

This isn’t just about buyers, it’s about velocity. Lower rates are the dopamine hit this market needs to snap out of paralysis. That could mean more inventory, more comps, more activity and yes, more opportunity to price risk intelligently. If you’ve been waiting, watching, or waffling, the time to tighten your strategy is now. The next 12 months won’t just shape transactions, they’ll shape trajectory.

The Real Estate Leadership Recession

Source: Housingwire

The Death of Figurehead Management

You’ve seen the type: the regional VP who shows up for photo ops, rocks a golf swing better than their pipeline, and coasts on past wins. Those days are over. Leadership in real estate, particularly on the lending and mortgage side, is undergoing a reset, not unlike a downturn in the market. And if you’re not ahead of this shift, you’re behind it.

At a recent Sales Mastery event, a trio of senior mortgage execs gave the clearest signal yet: The industry is no longer tolerating “empty suit” leadership. The message? Leaders who don’t add daily, tactical value are a cost center, not an asset. The real currency in today’s lending climate is character and competency, not charm and a comped trip to Hawaii.

You’re Only Leading If You’re Sweeping the Ice

Think curling. That’s the metaphor Natalie Overturf used and it stuck. The job of leadership today? Remove friction. Clear the ice. If your team isn’t moving faster because of you, they’re moving away from you. Accessibility is no longer optional. The Zoom tower is not where leadership lives anymore; it’s at the transaction level, in the inbox, on the call, inside the CRM.

Overturf’s internal “mastermind” groups where top producers share wins and transparency is the cultural currency, are the closest thing this industry has to an antidote to churn. Retention is the new recruiting, and it starts with a Slack message, not a signing bonus.

The Rule of Threes and the Risk of Mediocrity

Movement Mortgage’s Bill Hart dropped a framework borrowed from college athletics that should be in your playbook. Your team breaks down into threes: your 1s need recognition, your 2s need love and accountability, and your 3s well, they either need to evolve or move on. Allowing mediocrity isn’t just a soft management decision, it’s an infection. If you tolerate average, you’ll never attract elite.

Hart’s push for radical transparency, like integrating performance dashboards directly into Salesforce, isn’t about micromanagement, it’s about clarity. The kind of clarity that builds trust, drives alignment, and makes underperformance painfully obvious, even to the underperformer.

The End of the Free Ride

Jeremy Bordner of loanDepot said it plainly: “If you’re working for someone who isn’t hustling harder than you, that’s a red flag.” During the refi boom, it was easy to hide, to ride the wave and double income while halving effort. But that era’s over. This isn’t about hustle porn or grind culture; it’s about recalibrating expectations in a normalized market.

In short: real estate, especially the capital side, doesn’t need more “leaders.” It needs operators, listeners, coaches, and systems thinkers. People who bring more value than they extract. People whose calendars are accessible and whose performance is visible. People who clear the ice.

If you’re managing a team, ask yourself: Am I a layer? Or am I clearing the way?

In case you wanna wait by the sea… lets do it iconic

Source: Zillow

Listed at $19.995M, this 24818 Malibu Rd home doesn’t just flirt with the ocean, it lives on it. With 60 feet of rare beachfront, a bespoke bar area, and custom white oak cabinetry, it’s the kind of place where even the surfboards have their own storage. The primary suite runs the length of the house, complete with an outdoor shower and enough walk-in closet space to host a cocktail party. Malibu minimalism, fully leveled up.

Check it out👇

The Power Move

Clarity beat charisma in the real estate reset.

At Sales Mastery, execs made it clear: “Leaders who don’t add daily, tactical value are a cost center, not an asset.”

That reframed leadership from optics to output, not who shows up, but who clears the path.

Performance is the new personality.

Email Was Only the Beginning

Four years in the making. One event that will change everything.

On November 13, beehiiv is redefining what it means to create online with their first-ever virtual Winter Release Event.

This isn’t just an update or a new feature. It’s a revolution in how content is built, shared, and owned. You don’t want to miss this.

TL;DR (Too Long; Didn’t Read)

The housing market isn’t waiting for a crash, it’s waiting for clarity. Think less demolition, more defrost. By 2026, rate fatigue, life needs, and waning golden handcuffs will force hands off the chessboard and back into the game. Mortgage rates won’t plummet, but they’ll wobble just low enough to reignite movement. Inventory will be the new currency, and zip codes, not headlines, will drive value. Translation: Opportunity isn’t coming, it’s thawing. Smart operators are already mapping the drip.

Have a great weekend - we’ll see you next Saturday.

Cheers 🍻

-Market Minds Team