We appreciate each and every one of you for taking the time to read Market Minds. Buckle up and enjoy the free value, and you won’t want to miss the most expensive island we’ve ever seen.

The Financial Fluency Gap That's Tanking Your Pipeline

Source: Housingwire

Confidence ≠ Competence

You know what’s more dangerous than ignorance? The illusion of knowledge. According to the 2025 NextGen Financial Literacy Report, 67% of Gen Z and millennials are confident in their ability to make financial decisions. Unfortunately, fewer than half can correctly answer basic questions about credit scores, interest rates, or retirement planning. Confidence is through the roof. Comprehension? Basement level.

20% Down Is a Myth, But They Don’t Know That

Almost half of prospective homebuyers still believe they need 20% down to purchase a home. Only 8% knew the actual minimum requirement for a conventional loan. That’s not a knowledge gap. That’s a chasm, one that’s costing you qualified leads every single day.

TikTok Is the New Mortgage Broker

40% of Gen Z buyers trust influencers for homebuying advice. Not lenders. Not Realtors. TikTok is the open house. Instagram is the pre-approval letter. And ChatGPT? 61% say they’d use it for homebuying info… up from 35% in January. AI isn’t coming. It’s here. And it’s rewriting the rules of client education.

The Two Buyer Tribes

Buyers are clustering into two behavioural archetypes:

Stay Secure: 53% of respondents want stability. These are your long-term, play-it-safe clients.

Enjoy Life: 35% are driven by experience, not equity. They’re more vulnerable to myths, more impulsive, and more likely to treat a mortgage calculator like a Buzzfeed quiz.

Both camps are confused. But their confusion manifests differently. The "Secure" crowd delays decisions. The "Enjoy Life" tribe jumps in blind. You need different scripts, different tools, and different trust levers for each.

What This Means (If You’re Paying Attention)

You’re not selling homes. You’re selling clarity in a sea of noise. This is no longer a game of “who has the listing.” It’s a game of “who earns trust in a TikTok attention span.” If you’re not myth-busting on Instagram or offering AI-assisted tools, you’re not losing to another agent. You’re losing to ignorance.

The Quietest Way to Lose a Listing: Silence Before and After the Table

Source: BAM

Pre-Game Is Pipeline

You don’t win on the kitchen tour; you win in the three days before it. A pre-listing touch, tight package, 90-second video, social proof, does two things: it sets the frame (you’re the pro, this is a process) and it creates path dependence (the seller feels already “in” with you). In a low-inventory, high-stakes market, you’re not competing on price first, you’re competing on certainty. Certainty is built via sequencing: confirm, send, remind, arrive. Treat it like paid acquisition: each pre-touch nudges conversion. Skip it and you start in a hole.

Qualify Like a Lender, Not a Tourist

Walking in blind is venture capital without diligence. Where are they going, what number’s in their head, what problem are they solving (timing, liquidity, ego)? If you don’t surface the decision rule, you’ll negotiate against a phantom. Qualifying also tells you whether this is a listing or a counseling session. Your time is a P&L line; spend it where close probability is real.

Differentiate on Mechanism, Not Vibes

“Sign, site, pray” is a commodity. Sellers hire advantage, not adjectives. Your edge is a mechanism you can teach back: pre-market buyer matching, price-band launch cadence, media plan with frequency, offer-management protocol. If they can retell your process to their spouse after you leave, you’re sticky. If not, you’re a brochure.

Leave Behind a Memory Palace

Assume you don’t get ink on first pass. What survives when you’re not in the room? A concise, printed leave-behind (track record, testimonials, go-to-market plan) keeps you top of stack when decision fatigue hits at 9:47 p.m. Think of it as your “offline retargeting” that keeps comping your value while your competitors rely on hope.

Trust Is a Micro-Transaction Game

The fastest way to kill lifetime value: miss a promised Tuesday 3:00 call. Every micro-promise kept compounds credibility; every miss compounds risk. Reputation in sales is built like credit: small, on-time payments. Build a visible promise ledger (what you’ll do, by when) and pay it down publicly.

Have the Hard Talk Before the Price Talk

Sellers don’t pay you to flatter them; they pay you to protect them from themselves. Price, timing, and strategy aren’t “gotchas,” they’re professional guardrails. Frame truth as risk management: “Here’s the probability distribution if we list at X vs. Y.” Adults make better decisions with probabilities, not pep talks.

Follow-Up is the Deal, Not an Afterthought

Most competition stops after the second touch. You win on the seventh. Get permission for the next step while you’re still at the table (“Would Thursday 10:30 work to finalize photos?”). Pipeline isn’t what’s booked; pipeline is what’s scheduled next.

Talk Less, Close More

If you’re speaking more than the seller, you’re pitching, not diagnosing. Use loops: ask, mirror, label, confirm (“How does this land so far?”). The goal isn’t to be impressive; it’s to make them feel understood. Understanding lowers perceived risk. Lower risk closes.

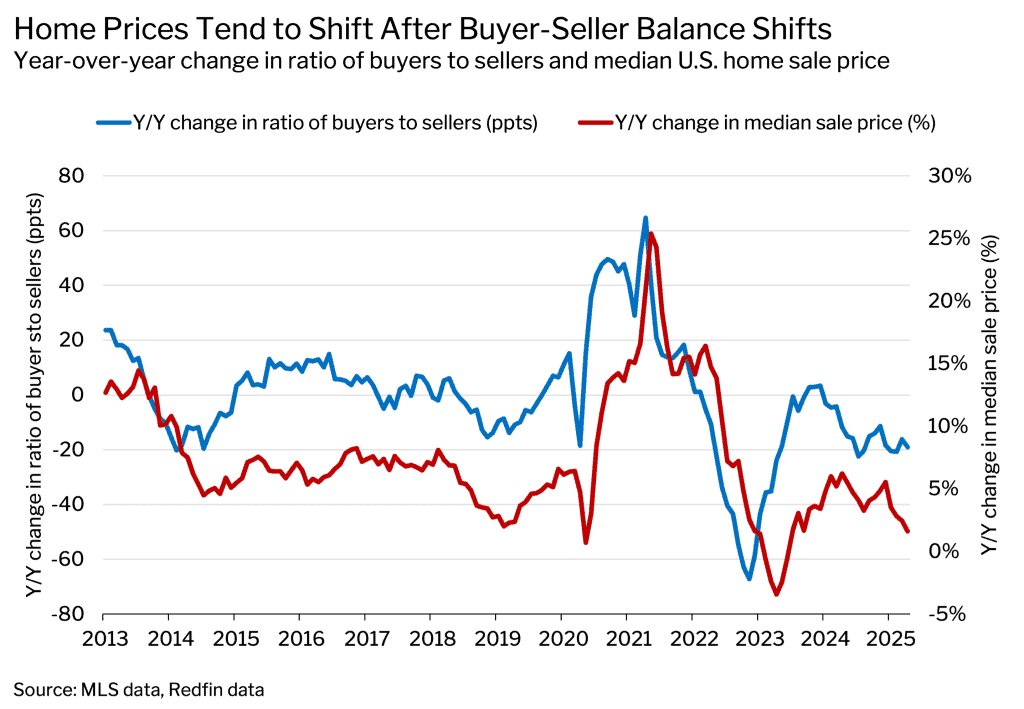

Source: Redfin

The New Buyer Metric No One’s Watching… But Should Be

Redfin just cracked open the black box of buyer demand. Using a proprietary economic model, they’re now estimating the number of active buyers in the housing market. Not leads, not pre-approvals, actual, searching, offer-writing buyers. And here's the kicker: the model’s not just some ivory-tower abstraction. It uses real-time, real-world data to estimate the true buyer pool in each region. If you're not watching this metric yet, you're flying blind.

Market Tightness = Pricing Power

Redfin’s model doesn’t just spit out a number, it gives you leverage. By calculating “market tightness” (the ratio of buyers to sellers), you can actually forecast who holds the upper hand. More buyers than sellers? Prices rise. More sellers than buyers? Expect softening. A balanced market? Negotiation is back on the table. This isn't Zillow price-guessing. This is power dynamics 101.

Search Time = Buyer Intent

The game-changer here is search time. Redfin knows how long the median buyer takes to find a home. That time is shrinking? Buyers are finding homes quickly, signaling strong demand. It’s stretching out? Demand is drying up, or there’s too much supply. The same way you'd watch average days on market, now you watch the buyer's clock. It's the real estate version of checking the pulse.

Forget Clicks. Follow Matches

Unlike consumer platforms that count clicks, Redfin’s model tracks matches, the economic equivalent of a transaction handshake. And by applying a Cobb-Douglas matching function (yes, they’ve gone full Nobel Prize econ on this), they're estimating buyer activity with astonishing accuracy. That gives you a real-time, region-specific snapshot of where the fire is… and where it’s fizzling out.

Price Trends Start Here

This buyer-seller ratio is the early warning system for price moves. More sellers than buyers? Expect pricing pressure. More buyers than sellers? You’ve got a runway. If you wait for comps to show this, you’re late. Price trends start not with transactions, but with friction, or lack thereof, in buyer-seller matchmaking.

Overwhelmed? Get Lost

Cromwell Island in Dayton, MT is listed for $72M. With 348 acres, nearly three miles of shoreline, and a half-finished 45,000 sq. ft. “Villa,” it’s the largest private freshwater island west of the Mississippi.

Check it out👇

TL;DR (Too Long; Didn’t Read)

You're not selling homes, you're selling clarity in a fog of misinformation and TikTok hype. Gen Z thinks FHA is a music festival and still believes 20% down is law. Meanwhile, they're getting mortgage advice from a guy in a bucket hat lip-syncing to Doja Cat. Here’s the play: Ditch the glossy brochures and start myth-busting on Instagram Reels. Show up on TikTok not to dance, but to dismantle disinformation. If you're not in their feed, you're out of their mind. Realtors, it's time to stop thinking like agents and start thinking like educators. Meet confusion with clarity. Meet confidence with competence. Meet clients where they are: scrolling, or watch your pipeline ghost you. The new lead magnet? Trust. And it comes dressed like a 15-second Reel that actually teaches them something.

Have a great weekend - we’ll see you next Saturday.

Cheers 🍻

-Market Minds Team