We appreciate each and every one of you for taking the time to read Market Minds. Buckle up and enjoy the free value, and you won’t want to miss the house with NO REASON for a $900k price increase.

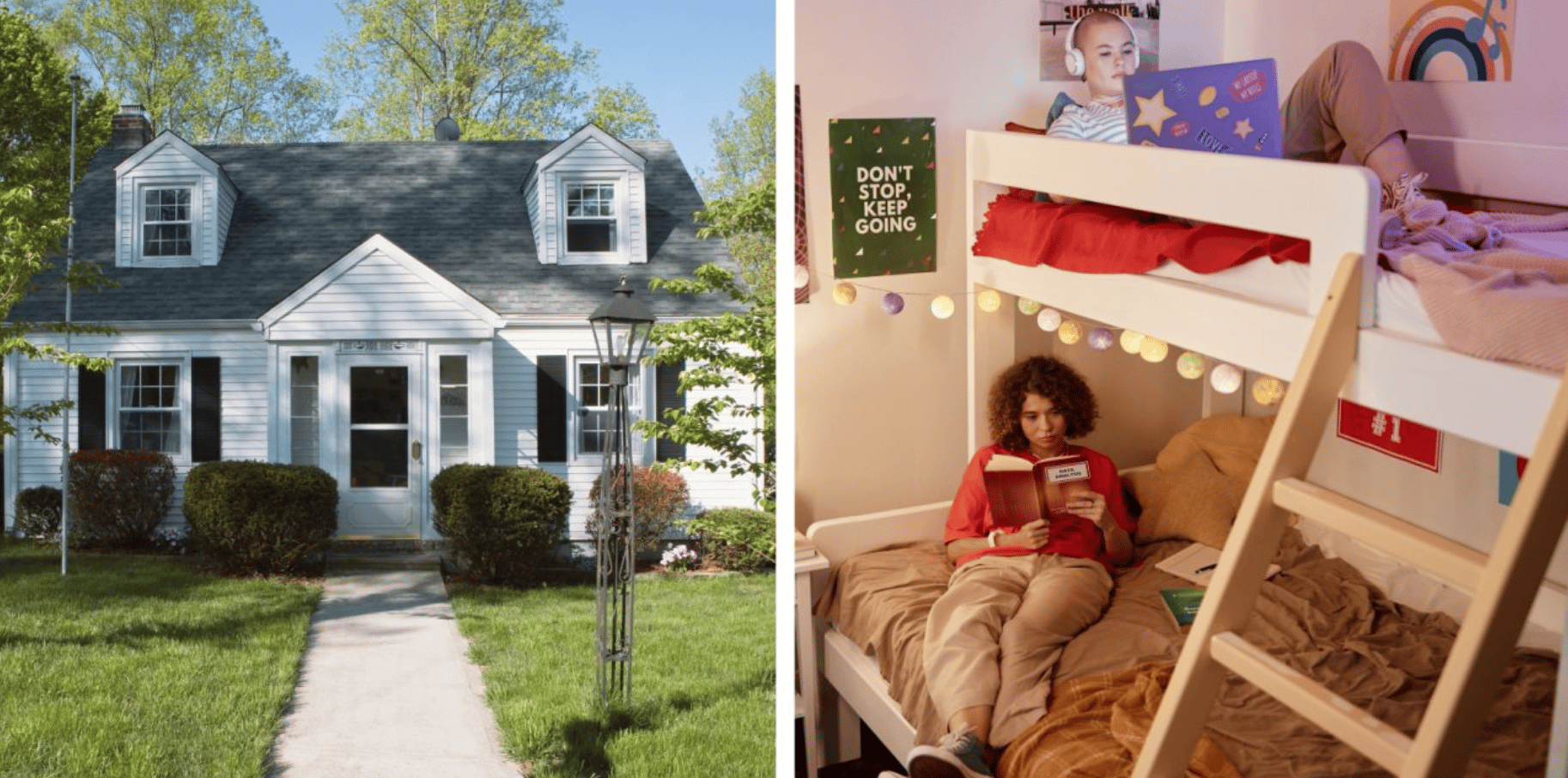

Dorms Are Dead Money

Source: BAM

When Tuition Is the Smaller Bill

The dirty secret of higher ed isn’t tuition…it’s housing. The average student at a four-year public university pays $9,834 in tuition but $12,302 for room and board. The diploma costs less than the dorm. That delta has become the crack in the door for real estate.

The 23 Markets Where Math Beats Mascots

At 23 universities, the numbers don’t lie: buying a home near campus is cheaper than paying for the dining hall burritos and cinderblock walls. At Temple University, a $234,799 house can save a family nearly $30,000 in three years and spin off $73,000 in equity over a decade. Run the numbers at Marshall, Delaware, Alabama, or Memphis and you see the same pattern. A diploma and a deed, in one package.

Parents as Accidental Landlords

The setup is simple: 10% down, roommates covering two-thirds of market rent, and modest appreciation. Suddenly, the monthly “cost” of ownership falls under the dorm bill. At LSU, ownership penciled out to $900/month net of roommates. Try finding a dorm cafeteria plan cheaper than that. Yes, parents take on taxes, insurance, and a maintenance call or two, but the upside is undeniable: instead of receipts, you’re collecting rent and equity.

The Long Game: Equity > Meal Swipes

This isn’t about three years of cheaper housing. It’s about reframing college as a wealth transfer opportunity. Instead of $50,000 evaporating into dorm fees, families can position themselves for six-figure gains by the time their kid hits grad school. And unlike tuition, the investment doesn’t expire with the diploma. The property can be held, rented, or sold into a market where alumni and incoming students keep demand steady.

The Housing Market’s Waiting Game

Source: Inman

Fannie Mae Blinks

Fannie Mae just trimmed its sales forecast by 222,000 homes across 2025 and 2026. Why? Because inflation isn’t cooling as quickly as hoped, meaning mortgage rates won’t ease at the pace buyers (and sellers) are praying for. Think of it less as a collapse, more as a reset in expectations: 6.5% rates by year’s end, 6.1% in 2026. Still high enough to keep affordability strained, still low enough to keep inventory tight.

When GDP Cools, So Does Housing

The economy is running on fumes. GDP growth is crawling at 1.1%, and consumer spending has nearly flatlined. That’s the real anchor on housing: families are cautious, not reckless. Even with the Fed poised to cut short-term rates by 150 basis points over the next 18 months, the bond market will dictate where mortgage rates actually land. The last time rates were cut, mortgages went the other way.

The Builder’s Dilemma

Single-family starts are down 8% from last year, with builders putting up just 931,000 homes in 2025. Confidence has cratered since January, and new home sales are losing steam as resale inventory inches higher. Builders are watching the same thing you are: affordability. Without it, even 2% rebounds in construction won’t feel like momentum.

Housing affordability is no longer just a real estate story. It’s shaping monetary policy itself. As Robert Dietz of the NAHB put it, affordability now sits at the “center of the outlook for economic growth and inflation.” Translation: the Fed can’t ignore housing. If affordability worsens, expect sharper pivots in rate policy.

The Opendoor Surge

Source: Business Insider

The 2,000% Bet

Eric Jackson, the hedge funder who correctly rode Carvana’s rebound, has just doubled down on Opendoor. With the CEO stepping aside, he now sees the stock surging to $82 by year’s end (a nearly 2,000% gain from where it trades today). Absurd? Maybe. But beneath the meme-like froth is a provocative thesis: Opendoor stops being an iBuyer and starts being the digital bridge between buyers and sellers. Think Airbnb for housing: asset-light, global, and without real competition.

The Death of iBuying, the Birth of Something Else

Jackson’s case rests on a pivot away from inventory-heavy iBuying, which has crushed margins and balance sheets across the sector. Instead, he argues Opendoor is better positioned to evolve into a transaction platform, owning the interface but not the asset. That shift removes capital drag and turns scale into a strength. If it works, it doesn’t just disrupt Zillow or Rocket Mortgage, it sidelines them entirely.

Founder DNA and Retail Mania

The call isn’t just about strategy. Jackson wants founders Keith Rabois and Eric Wu back at the helm, to restore “founder DNA” and credibility. Add in his own interest in a board seat (representing the swelling retail base) and the stock becomes a phenomenon as much as a company. Retail volumes spiked at $124 million in July, making Opendoor less a stock and more a movement.

The Bigger Picture for Housing

If Jackson is right, the story isn’t about Opendoor’s share price…it’s about control of the transaction layer in real estate. Whoever owns the digital front door owns the industry. An asset-light Opendoor would no longer be a distressed home-flipper; it would be a tollbooth on every residential deal. That’s why the “Airbnb of housing” analogy matters: Airbnb didn’t just monetize short-term rentals, it reshaped how people think about lodging itself.

Disclaimer: Not financial advice.

Renovated? Where?

This Swansea, MA home had quite the price bump after a few years off the market. And it doesn’t look like anything has been touched. Or maybe it’s just the HORRENDOUS listing photos.

Check it out👇

TL;DR (Too Long; Didn’t Read)

Dorm living is quietly the biggest expense of college, often eclipsing tuition itself. In over 20 markets, the math favors buying a home near campus: parents can cut costs, build equity, and even turn into “accidental landlords” with roommates covering most of the mortgage. At the macro level, housing affordability remains the economy’s pressure point—Fannie Mae is trimming sales forecasts as sticky inflation keeps rates higher for longer, slowing builders and weighing on demand. Meanwhile, hedge funders are betting on a radical pivot at Opendoor: if it transforms from iBuyer to transaction platform, it could seize the “digital front door” of real estate, reshaping the industry the way Airbnb did lodging.

Have a great weekend - we’ll see you next Saturday.

Cheers 🍻

-Market Minds Team