We appreciate each and every one of you for taking the time to read Market Minds. Buckle up and enjoy the free value, and you won’t want to miss the home that could use some motorized shades…

Why Land Is the Next Big Battlefront

Source: Business Insider

While headlines scream about high mortgage rates and sluggish home sales, a quieter revolution is unfolding in the real estate underworld. It’s not about buildings, it’s about the ground beneath them. The new kings of this realm are land bankers: private investors buying up tens of billions in construction-ready lots, not to flip, not to build—but to wait. And their silent bet? The inevitability of another homebuilding boom. They’re building a pipeline, not a subdivision.

A Hedge Against the Housing Hangover

The spring selling season was a dud. Builders dropped prices, threw in freebies, and still ended up with the largest stockpile of unsold new homes since 2009. Yet, behind the scenes, they're gobbling up land. Not with their own money, but through option deals with land bankers. These deals free up capital, reduce risk, and allow builders to control land without owning it outright. In a world where capital is king and Wall Street scrutinizes every quarterly earnings report, this “land-light” strategy is not only smart, but also essential.

Risk Off, Pipeline On

Here's the model: builders put down a 10-20% deposit with land bankers, securing future development rights while avoiding the financial burden of ownership. They can pause, rework, or delay projects without torching their balance sheet. It’s risk arbitrage. And the result? Builders now control more land than ever—nearly 2.4 million lots, up 71% since 2020. And 75% of those lots are controlled through options, not ownership. This is the real supply chain of housing: not lumber or labor, but leverage.

Land Is the New Margin Call

For investors and agents with a sharp pencil, this is the canary. When capital flows into land despite weak home sales, it’s not speculation—it’s a conviction trade. Builders know it’s not easy to ramp up production quickly. Land banking gives them the agility to do just that. When the market turns, those holding the best-positioned land will be the first to benefit. Think of it as preloading inventory for a future demand spike.

The GFC Hangover and the New Rules of Play

The ghosts of 2008 still haunt the homebuilding industry. Back then, builders hoarded land with borrowed money and many didn’t live to tell the tale. Today’s approach is cautious and capital-efficient. Land bankers offer builders flexibility, optionality, and speed without the exposure. The model is more hedge fund than homebuilder. And while it may not guarantee lower prices for buyers, it does grease the gears of supply. That’s the win.

June's Turning Point: A Market That’s Waiting

Source: Reuters

Sales Fall, Prices Rise

Existing home sales fell 2.7% in June, dragging the market to its weakest level since September 2024. Yet prices hit a new high ($435,300 on average, up 2% year over year). That disconnect? Many buyers are out of the game, either sidelined by mortgage rates near 7% or spooked by economic uncertainty. Meanwhile, those holding the inventory cards aren’t folding; they’re just listing strategically.

Inventory Pops Where It Hurts

Total inventory climbed nearly 16% compared to last year, reaching 1.53 million units. Markets like D.C., Texas, and Florida are seeing inventory pressure from economic churn and job losses, especially in federal-heavy metros. At the same time, inventory remains tight in strongholds like New York, keeping prices sticky even as activity slows. This is less about a flood of sellers and more about buyer hesitation.

Price Momentum Is Eroding Fast

Redfin data shows price gains are losing steam. National home price growth slowed to 3.4%, the softest in two years. In cities like Tampa, Austin, and Dallas, prices are already retreating every month. D.C. is the bellwether: annual appreciation there collapsed from nearly 11% in March to under 3% in June. The longer inventory builds while rates hover near 7%, the more price cuts will follow. Not a crash, but a recalibration.

The Buyer Pool Is Shallow and Stressed

First-time buyers made up just 30% of June’s sales. That’s far from the 40% benchmark for a healthy market and reflects a tough entry environment: high rates, low affordability, and growing job insecurity. Homes are sitting longer, too: 27 days on market vs. 22 last year. That signals fatigue, not frenzy. Distress, however, remains remarkably contained. Foreclosures and short sales made up just 3% of all transactions. Unlike 2008, this is a demand-led slowdown, not a forced liquidation cycle.

Sideways Before Sunrise

With the Fed signaling no near-term rescue for housing and no major rate cuts likely until 2026, the smart money isn’t betting on a fast rebound. The story for the rest of 2025? A flatline in activity, modest corrections in overheated metros, and more strategic plays by cash buyers, who now represent nearly a third of all sales.

Bot-Boosted Credibility

Source: New York Post

One in Four Reviews Aren’t Real Anymore

A new study reveals that nearly 24% of Zillow reviews for real estate agents in 2025 were likely written by AI, a staggering 558% increase since 2019. That’s a huge issue where perception is divorced from reality, and where the most polished profile may not reflect the most competent professional.

Trust Is the New Scarcity

Zillow has become a gatekeeper in consumer decision-making. Its reviews are often the last word before a client reaches out. But if nearly a quarter of those reviews are AI-generated, the currency of trust gets devalued. In an industry where reputation is leverage, synthetic praise is not only misleading but also a distortion of market intelligence.

The Silent Arms Race of ‘Fake Clout’

This isn’t just about fake reviews, it’s about a widening gap between actual performance and digital persona. Agents with real client results now have to compete not only on service but on algorithmic polish. And with no disclosure rules from Zillow, users have no idea what’s real and what’s GPT. The platforms won’t police it, or at least we don’t think so…

What Happens When Authenticity Becomes a Luxury?

When AI reviews start to outweigh real testimonials, trust moves off-platform. Conversations, referrals, direct feedback—those will become the premium channels for client decisions. It’s a return to private signal in a world drowning in public noise. Those who ignore it will chase bots. Those who get ahead of it will chase loyalty.

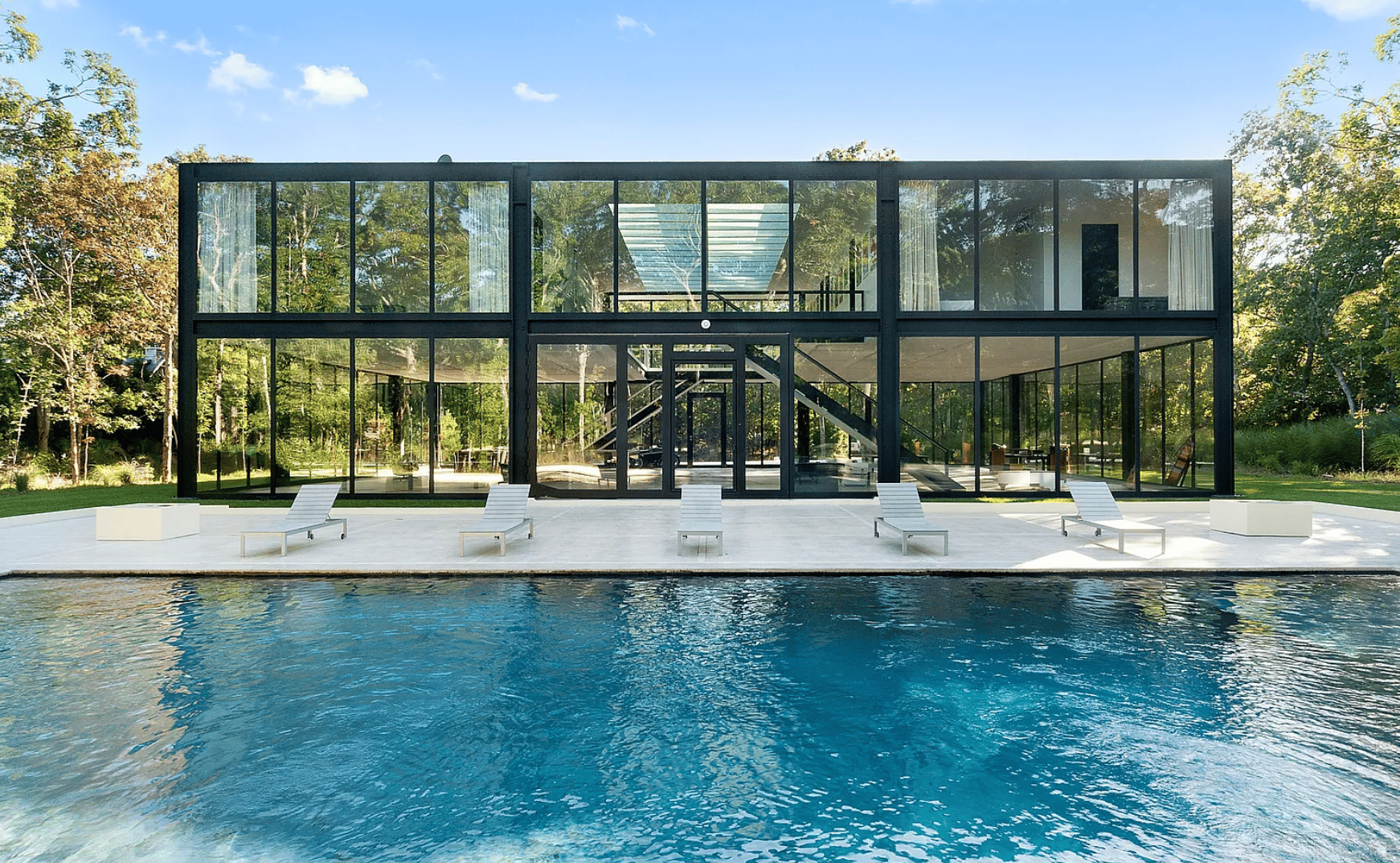

Big Glass Cube

This East Hampton, NY home is listed at $5.999M and is sure to come without an “it feels too closed off” objection.

It’s a true way of knowing EXACTLY what 10,000 square feet looks and feels like…

Check it out 👇

TL;DR (Too Long; Didn’t Read)

While home sales slow and mortgage rates stay high, the real action is underground—literally. Builders and investors are quietly locking up millions of lots through land banking, preparing for a future boom without overextending capital today. Meanwhile, home prices remain elevated despite rising inventory, revealing a market stalled by affordability, not distress. And as nearly a quarter of Zillow agent reviews are now likely AI-generated, trust is shifting offline—where real relationships, not algorithms, will drive the next wave of deals.

Have a great weekend - we’ll see you next Saturday.

Cheers 🍻

-Market Minds Team