We appreciate each and every one of you for taking the time to read Market Minds. Buckle up and enjoy the free value, and you won’t want to miss the house you need to add to your vision board…

A Power Shift in the U.S. Housing Market

The Imbalance That’s Rewriting the Rules

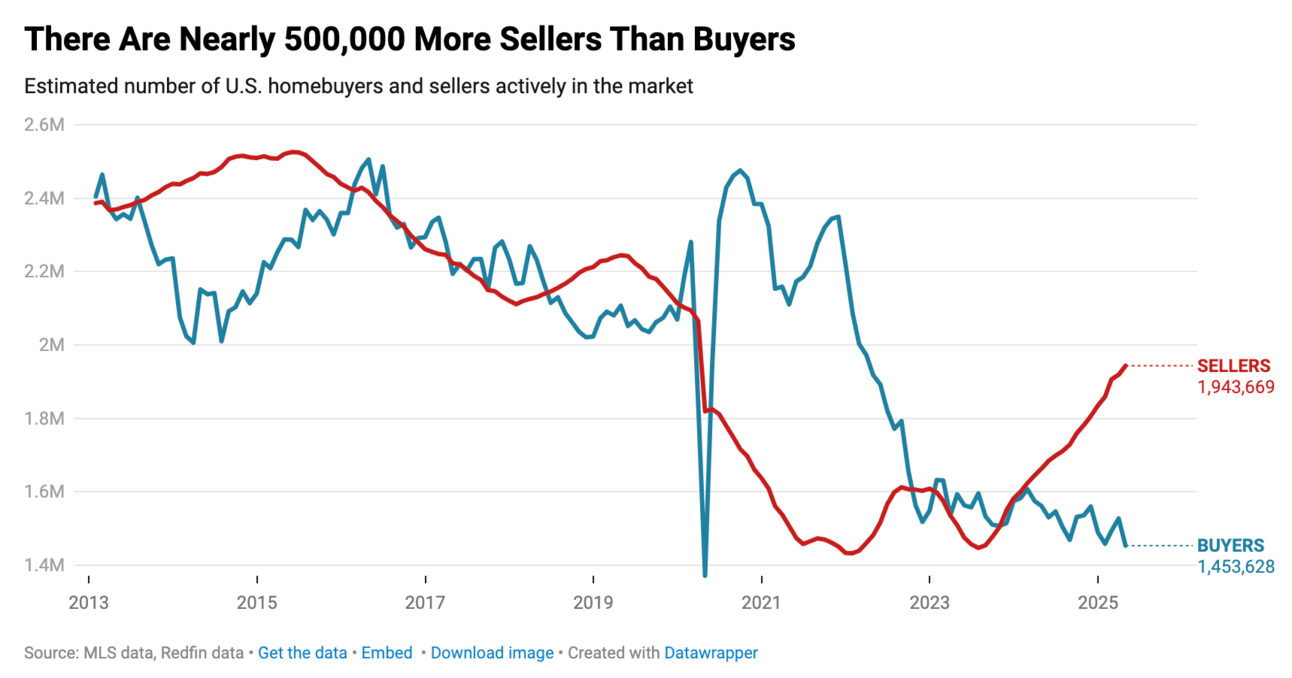

There are 490,041 more home sellers than buyers in the U.S. housing market right now, making it the largest gap since 2013. That’s not a typo. For every buyer, there are 1.3 sellers yearning for attention. Miami leads the pack with three sellers for every buyer, a striking signal that the days of bidding wars and waived inspections are behind us. Condos are taking the brunt, with 83% more sellers than buyers, while single-family homes have a more modest 28% imbalance.

The Myth of the Exception Is Dying

A stubborn reality: many sellers still believe their home is the unicorn that can defy gravity. They’re listing at yesterday’s prices, expecting pandemic-era premiums. But with 44% of homes sitting unsold for 60+ days (an April record since 2020) the market is correcting those expectations in real-time. The data doesn’t lie: price cuts or value-add improvements aren’t optional anymore, they’re table stakes.

Why the Smart Money Is Watching the Clock

Redfin’s call? A 1% price decline by year-end. Modest on paper, but loaded with implications. History shows that when sellers outnumber buyers, prices cool. It happened in 2018, and we’re seeing déjà vu at scale. Sell now or risk catching the falling knife later.

What’s Driving the Exodus

Buyers aren’t vanishing for no reason. Mortgage rates above 6.7%, record-high monthly payments, and economic anxiety are taking a toll. The easing of the “rate-lock” effect has flooded the market with listings. But these aren’t panic sellers; they’re pragmatic movers, now confronting a market that no longer bends to their terms.

The Power Shift Isn’t Seasonal

With the Sun Belt leading buyer’s markets and only a few metros like Newark clinging to seller-friendly conditions, the trend is national. And it's likely here to stay until affordability, not seller optimism, drives demand.

Mortgage Myths That Are Costing Buyers Big

Source: Realtor.com, Getty Images

Fear Is Winning (But It Shouldn’t Be)

Nearly 90% of Americans are anxious about affording a home. That part’s not surprising. But here’s what should rattle you: nearly half of prospective buyers don’t understand key mortgage terms. Not "don’t understand well"—don’t understand at all. And it’s this knowledge vacuum that’s quietly boxing people out of the market.

Rates Aren’t the Villain

Seven in ten buyers think mortgage rates are the highest they’ve ever been. They’re not. We’re sitting below the historical average. But perception is reality, and buyers convinced they’ve “missed the boat” are freezing up, in turn delaying offers, passing on approvals, or not even looking. Meanwhile, they’re also missing the reality: sub-3% rates aren’t coming back. Not next year. Not the year after that.

The Down Payment Lie Still Lives

Only 37% know you don’t need 20% down to buy. And just one in four understand that a credit score in the 500s can still land you a mortgage. This is basic eligibility 101. But that gap in knowledge is still filtering qualified buyers out of the funnel before they even step inside a lender’s office.

APR and PMI: Two Acronyms That Separate the Pros from the Guessers

It’s one thing to get approved. It’s another to understand what you’re paying for. Almost half of potential buyers don’t know what APR or PMI mean. That’s thousands of dollars left on the table, every year, for thirty years. Buyers who understand how APR works negotiate better. Buyers who know what PMI protects make sharper, more strategic down payment decisions.

No Map, No Compass

A quarter of Gen Z and nearly as many millennials don’t even know where to start. They’re not lazy or disinterested. They’re lost. Without a single trustworthy voice to guide them, they’re turning to the loudest ones instead. And with federal consumer agencies under pressure, that trusted guidance is becoming harder to find.

The Renter Surge: Where Today’s Volume Becomes Tomorrow’s Value

Source: BAM

Renters Just Set a Record and They’re Only Getting Warmer

There are now 46 million renter households in the U.S. which is the largest number ever recorded. Zillow’s platform is showing a historic surge in rental traffic. Application rates, lease creations, and apartment views are all breaking previous highs, with early June expected to see the year’s peak activity. Incentives like “first month free” are already tapering off, signaling landlords feel confident they don’t need bait. Translation: renters are biting on urgency, not discounts.

Inventory Is High, But So Is Action

Over 2 million active rentals are listed on Zillow, thanks in part to a 2024 construction wave that added more rental stock than any year since the '70s. But this isn’t a flood of stagnant inventory. It's moving. Quickly. The freebie era is receding because demand is now meeting, even outpacing, supply in hot markets.

Mobility = Leverage

Renters are four times more likely to move than homeowners. Every application, every lease, every inquiry is an early buying signal happening in slow motion. They’re choosing where to live now and who to listen to later. Many are high-income, low-equity earners stuck on the sidelines by mortgage rates. Others are in transition—relocating, downsizing, or holding off for a more stable buying environment.

Ignore Renters, Starve the Pipeline

The mistake most professionals make? Thinking of renters as noise in the system. Every lease signed today is a potential buyer tomorrow. Every smart touchpoint: concierge-level rental service, affordability calculators, proactive follow-up, cements trust. And when they’re ready to convert, they won’t go with the most aggressive pitch. They’ll go with the most consistent voice.

Vision Board Worthy

This Stilwell, KS home listed for $6.995M has it all—10+ acres, an incredible backyard, and a car collection you won’t want to miss.

Check it out 👇

TL;DR (Too Long; Didn’t Read)

There are now nearly half a million more sellers than buyers in the U.S.—the largest gap in over a decade—forcing a correction in pricing expectations as homes sit longer and bidding wars fade. At the same time, misinformation is quietly sidelining buyers, with many still believing they need 20% down or misunderstanding terms like APR and PMI, costing them real opportunities. Meanwhile, renters just hit an all-time high at 46 million households, many of whom are high-income but rate-locked out of buying—making them a prime, long-game audience. What’s unfolding isn’t seasonal noise; it’s a structural reset where those who move early and educate persistently will win.

Have a great weekend - we’ll see you next Saturday.

Cheers 🍻

-Market Minds Team