We appreciate each and every one of you for taking the time to read Market Minds. Buckle up and enjoy the free value, and you’ll have to let us know if this week’s house is “top 10” worthy.

Spring Freeze: The Market’s Seasonal Revival That Never Came

Source: WSJ

Inventory Is Up, But Buyers Aren’t Biting

You’d expect spring to kickstart the market like a double espresso. Instead, we got a cold splash of reality. Listings are rising, yes. But that inventory surge isn’t a sign of health. Prices are still near record highs, and mortgage rates have settled into the uncomfortable 6.75% range (double what they were just a few years ago). That pricing environment has paralyzed buyers. So, sellers are stuck in limbo. Which means homes are lingering on the market longer, even in metro areas like San Antonio, which hit near-record listings in March.

Old Rules Are Breaking Down in the Sun Belt

Texas and Florida, once the darlings of post-pandemic migration, are facing a recalibration. Prices there are either flatlining or falling. Builders were aggressive in recent years, and now they’re overstocked. They’re offering incentives just to get product off the books. But that puts existing home sellers in a bind: how do you compete with developers who can throw in a 5-figure rate buy-down?

Condos and Vacation Homes Are on the Chopping Block

Florida is experiencing a surge in listings, particularly condos. Why? Soaring insurance costs and new regulatory hurdles have made these properties expensive and cumbersome to maintain. Add in Canadian snowbirds divesting due to a heated trade war, and the result is oversupply with limited demand.

Prices May Be “Up” Nationally, But That’s a Misleading Metric

The national home price is still inching upward, but it’s a mirage. Supply is still 16% below pre-pandemic norms, but that gap is narrowing, and the areas propping up prices (mainly the Northeast and Midwest) are outliers due to supply shortages. The broad trend? Price deceleration and localized downturns. The longer interest rates hover in the high 6s, the more we transition from a seller’s market to a stalemate.

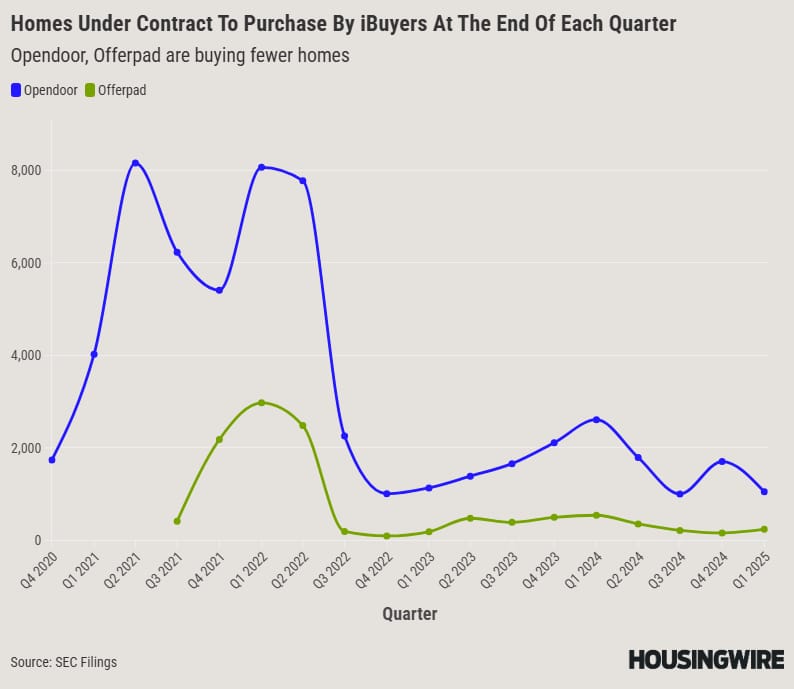

iBuying on Ice

Source: HousingWire

The Algorithm Meets the Ceiling

Opendoor and Offerpad were supposed to be the disruptors—real estate’s answer to Uber. Instead, they’ve become a case study in how fast tech optimism collides with market realities. The core problem? iBuying demands velocity: high volumes, quick flips, predictable margins. None of those exist in today’s market. Mortgage rates are sticky in the 6.75% range, pricing is volatile, and volume is at multi-decade lows. The algorithm can’t price chaos. And now, the math no longer works.

From Threat to Afterthought

In 2021, the industry scrambled to copy them. Zillow, Redfin, Keller Williams, even Realogy (now Anywhere) tried to grab a piece of the iBuying pie. But now? They’ve all pulled out. The business is too capital-intensive, too margin-thin, and too exposed to macro shocks. Zillow exited in 2021 after their model couldn’t read the post-pandemic spike. Redfin followed in 2022. The result: Opendoor and Offerpad are alone in a sandbox that’s shrinking—and they’re bleeding money to stay in the game.

No Volume, No Viability

The data doesn’t lie. Opendoor bought just 14,684 homes in 2024, down from nearly 35,000 in 2022. They’re under contract for barely 1,000 homes now. Offerpad? A paltry 245. At these levels, the model isn’t just inefficient. It’s existential. With their shares near $1, both companies risk delisting. Their options are dwindling: merge, pivot, or pray for a market reversal.

Expansion into Services Looks Like Diversion

Offerpad is attempting to pivot to offerings like mortgages, title, a renovation spinoff. But these are revenue trickles, not tides. Opendoor, by contrast, has shuttered its side ventures and focused on survival. The common thread? Cost-cutting. Opendoor has already slashed 39% of its workforce since April 2023. There’s little fat left. And without a breakthrough in volume or a white knight with cash and a vision, the ceiling keeps getting lower.

The 3% Handcuff: Why It’s Costing You More Than You Think

Source: KCM

A message to pass on to potential seller clients:

That Low Rate Isn’t a Golden Ticket

You’re not alone. Millions are gripping tightly to their 3% mortgage rate like it’s a winning lottery ticket. But here’s the paradox: what feels like financial security today may be silently limiting your future. That sub-4% loan doesn’t help if your home no longer fits your life (or if sitting still is letting wealth slip through your fingers one appreciation cycle at a time).

Future Prices Are Quietly Creeping Up

Let’s get real about what the data says: prices are projected to rise steadily over the next five years. That $400,000 move-up home? It could easily be pushing $480,000 by 2030. Even if appreciation slows in the short term, the long game remains intact. And if you know your life will evolve due to things like family changes, career moves, downsizing goals, that ticking clock matters.

Waiting for 3% Is a Fantasy

Hoping for the return of rock-bottom rates is like waiting for Blockbuster to stage a comeback. The Fed has made it clear: the days of 3% are behind us. Rates may cool, but not enough to justify a 5-year wait that adds $80,000 to your next purchase. The savings from a lower rate are likely to be dwarfed by higher principal costs.

It’s Not “Why Move?”—It’s “When?”

The most expensive decision isn’t always buying—it’s waiting too long. If a move is even remotely on your radar, locking yourself in with outdated math could mean paying a premium later. The real edge isn’t in perfect timing. It’s in understanding your trajectory and taking action before the market does it for you.

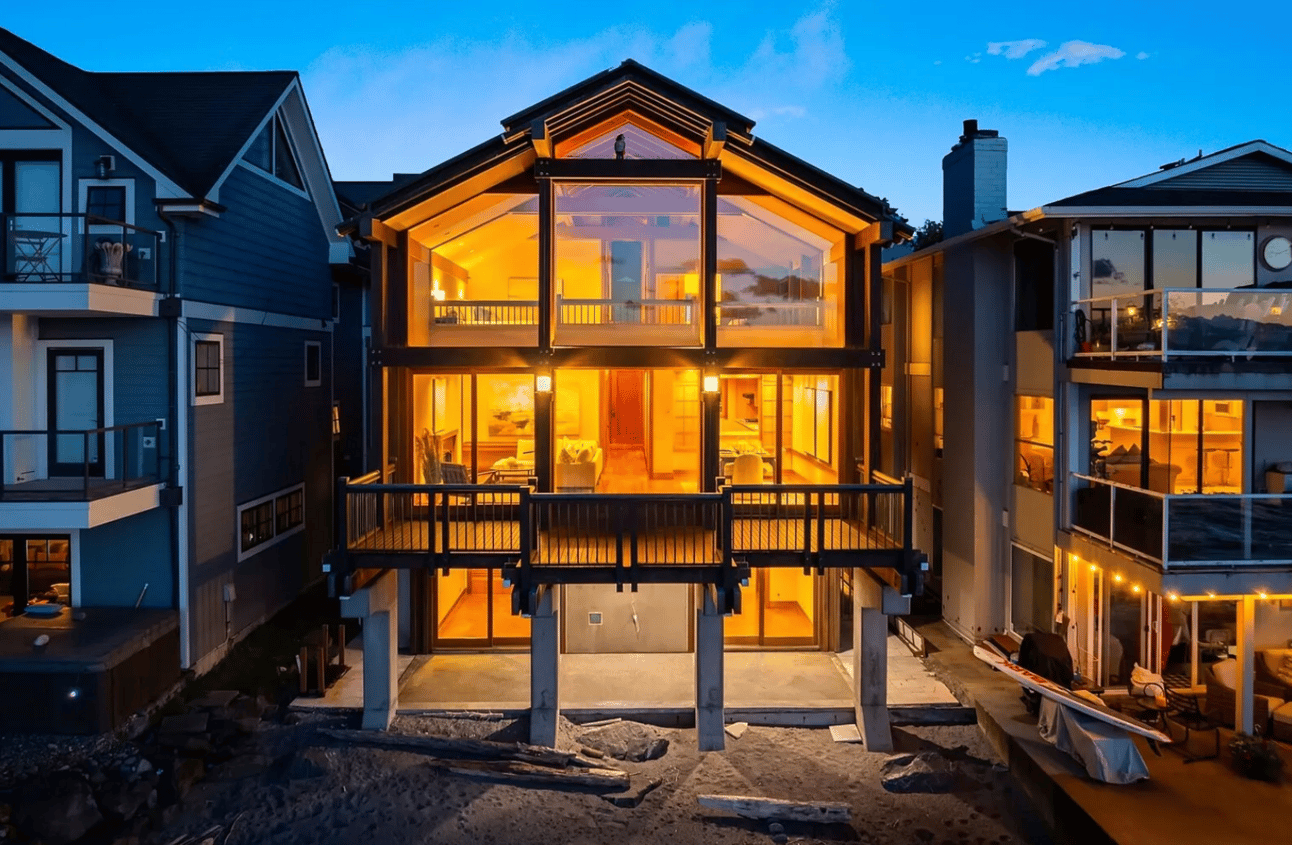

Named Top 10 Houses in Seattle History:

This Seattle, WA home listed at $3.85M was once named one of the top 10 greatest homes in Seattle history.

While you likely haven’t seen too many Seattle homes if you live outside the area, let us know if you think you’d agree…

Check it out 👇

TL;DR (Too Long; Didn’t Read)

Spring brought more listings, but not more momentum—buyers are sidelined by high prices and 6.75% rates, leaving homes to linger even in markets like San Antonio. iBuyers like Opendoor and Offerpad are collapsing under the weight of a broken model that can't function without volume, with layoffs, losses, and delisting threats piling up. Meanwhile, homeowners clinging to 3% mortgage rates may be locking themselves out of future gains, as home prices are projected to rise and rate drops won’t come fast enough to offset rising costs. The longer the market stays in limbo, the more expensive waiting becomes.

Have a great weekend - we’ll see you next Saturday.

Cheers 🍻

-Market Minds Team