We appreciate each and every one of you for taking the time to read Market Minds. Buckle up and enjoy the free value, and you won’t want to miss the Colorado oasis.

Why April's Labor Data Matters More Than You Think

Source: Realtor.com

Stability in the Face of Tariff Shock

April handed us a surprise the market didn’t price in: strength. Despite the ripple effects of the Trump administration’s tariff rollouts earlier in the month, the labor market added 177,000 jobs, outperforming forecasts and delivering a much-needed injection of stability. Unemployment held at 4.2%, and wage growth remained at 3.8%, quietly beating pre-pandemic benchmarks.

Spring Listings Climb, But Hesitation Still Lingers

Listings continued their seasonal ascent in April, but pending sales lagged. Post-tariff uncertainty froze consumer sentiment. Confidence fell, and prospective buyers started to hit the pause button. But the jobs report is the kind of data that unfreezes the fence-sitters. Steady wage gains plus job security begins to shift the calculus from “wait” to “maybe.”

Sectors Signaling Spending Power

Healthcare, transportation, finance, and social assistance added meaningful headcount. These are stable sectors that historically correlate with first-time and move-up buyers. The implication? There’s a bedrock of steady income still forming underneath all the fear headlines.

The Real Leverage: Emotional Certainty

Rates are still high, inventory is climbing, and affordability isn’t rebounding. But when the job market shows resilience, it buys the market more than just liquidity. It buys time. Buyers don’t need perfection. They need confidence that things won’t get worse. And in April, that’s exactly what they got. The question isn’t whether they’ll come back, it’s how quickly you’ll recognize the shift in tone before the next buyer surge begins.

Buyers Aren’t Just Shopping, They’re Calling the Shots

Source: Business Insider

In Q1 2025, nearly 45% of home sales involved concessions. Not discounts, but tactical sweeteners to push deals across the finish line. The market hasn’t just cooled, it’s starting to thaw in favor of the buyer. There’s more inventory than demand, and with high rates suppressing urgency, sellers are getting pragmatic. The kind of pragmatic that costs them a few thousand to close.

The Price Mirage Is Cracking

Here’s the rub: Sellers are still mentally anchored to 2021 valuations. Median ask? $469K. Median close? $431K. That 9% delta is a psychological correction. Many of these sellers bought at the peak and are trying to recoup fantasy profits in a post-pandemic market. But reality bites, and it’s biting in the form of price chops and givebacks.

Your Edge Is Market Psychology, Not Just Metrics

You’re not looking at a national housing crash, but a localized buyer’s edge. Ten metros now report concession rates north of 50%, with Seattle leading the pack at 71.3%. The others read like a who’s-who of West Coast recalibration: Portland, San Diego, Denver, even L.A. — once impervious, now playing ball. It’s not just about where prices are going; it’s about how much sellers are willing to pay to hold firm.

Now Is the Time to Press

If you’ve been circling listings that feel slightly out of budget or out of touch, don’t wait for the price to drop. Assume flexibility. Sellers are signaling fatigue. They’re motivated. The smart move isn’t to wait, it’s to move with intelligence, offer below ask, and stack the deal with soft-dollar wins. The win here isn’t just the sale price. It’s the terms. And right now, the terms are yours to write.

Emotional ROI Over Financial Gain

Source: Fannie Mae

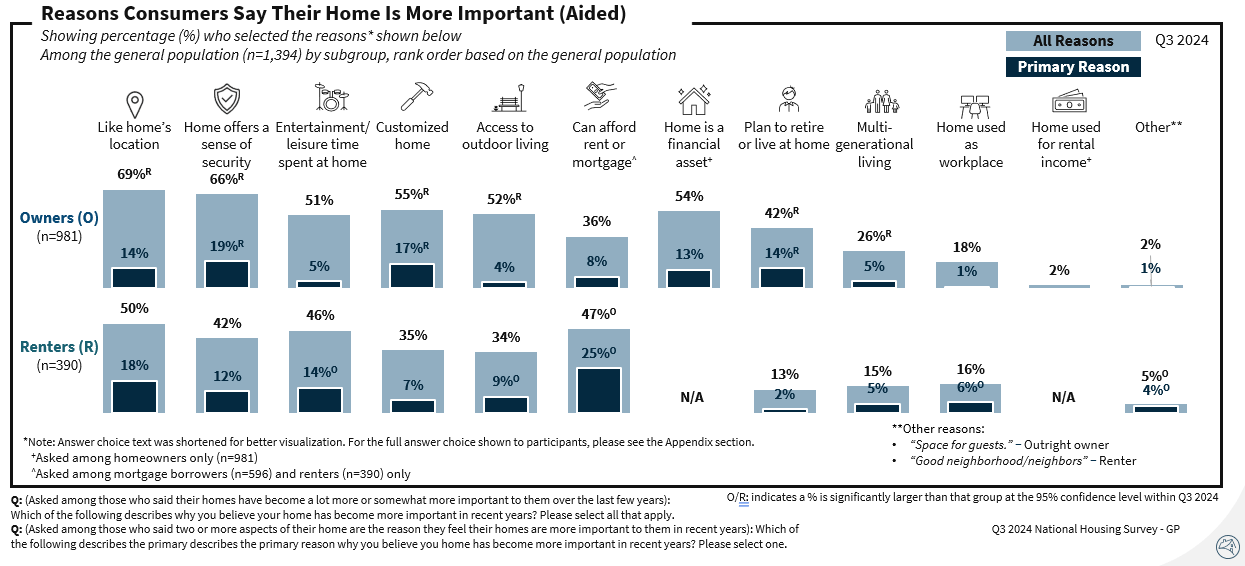

Forget the Zillow Zestimate. What your clients crave now isn't just price per square foot, it's security, autonomy, and a backyard big enough to plant tomatoes. Nearly half of U.S. consumers now say their home means more to them than it did pre-pandemic, and the top drivers aren’t granite countertops or proximity to Whole Foods. It’s about where the home sits and how it makes them feel. Location and emotional security are beating out even affordability concerns for homeowners who locked in 3% mortgage rates during the Great Repricing of 2021. Translation: most of your prospects know they couldn’t afford the home they already live in, and that’s only made them value it more.

Lifestyle Utility Is the New Value Driver

Forty-eight percent of surveyed homeowners pointed to specific, lifestyle-enhancing features as what makes their home more valuable now. We’re talking home offices, outdoor kitchens, hobby rooms, and space for multigenerational living. Add in the fact that 44% of those who made functional changes saved money or boosted income (think ditching a gym membership or reducing commute costs).

Aspirational Ownership Amid Affordability Pressure

Renters, increasingly squeezed by limited inventory and high rents, aren’t walking away from ownership dreams, they’re doubling down on them. But not for the reasons most think. A sizable chunk say they’d pay a premium for homes that allow for multigenerational living or offer proximity to amenities. These aren’t wants, these are deal-makers. And despite a market that’s bent toward renting, the psychology of ownership still carries weight. That aspiration isn't dying — it's just evolving.

Reposition Inventory for Emotional Fit, Not Just Financial Metrics

The agent who understands how to connect listings to lifestyle — who markets not just the square footage but the sanctuary — will win. Investors should track these buyer psychology shifts as leading indicators. Don’t just read comps. Read people.

Speaking Of Lifestyle Utility…

This Arvada, CO home, priced at $2M has so many unique photos we had trouble deciding which one to pick…

Check it out 👇

TL;DR (Too Long; Didn’t Read)

April’s labor report delivered a shot of confidence to a market gripped by post-tariff uncertainty. Strong job growth and steady wages signaled stability, giving buyers the psychological nudge they needed to re-engage, even in the face of high rates and affordability pressures. Sellers, meanwhile, are being forced to get realistic — 45% of Q1 sales included concessions, and the gap between list and close prices is widening as fantasy pricing collides with market reality. Buyers are chasing lifestyle, not just listings, and the winners in this market will be the ones who sell sanctuary, not specs.

Have a great weekend - we’ll see you next Saturday.

Cheers 🍻

-Market Minds Team