We appreciate each and every one of you for taking the time to read Market Minds. Buckle up and enjoy the free value, and you won’t want to miss the 5-story castle!

Listing Dilemma: Real Estate’s Reset Moment

Homes Are Lingering, and It’s Not Just the Weather

You’ve likely felt it—what used to be a weeklong sprint to contract now looks more like a sluggish stroll. The average U.S. home took 47 days to go under contract in March, the slowest pace for that month since 2019. That number is a tell. It signals not just softer demand but also misaligned expectations from sellers still living in the 2021 fantasy where overpricing was a flex, not a liability.

Sellers Are Competing With Each Other (And Losing)

Inventory hit a five-year high in March, not because owners suddenly want to cash out at peak prices, but because they can’t afford to wait anymore. Divorce, relocation, and financial strain—particularly from rising property taxes and insurance premiums—are pushing hands. Many of these sellers bought at the top and are now pricing with desperation disguised as optimism. That gap between listing price and reality? It’s widening. The typical home sold for roughly 1% below asking in March—a quiet correction hidden in plain sight.

Buyers Are Pulling Back, Not Bidding Up

Only 27% of homes sold above list price in March, the lowest share since 2020. The dopamine rush of multiple offers? That’s gone. What remains is a buyer who’s more cautious, more patient, and less willing to overextend. As list prices float upward and sale prices tread water, the market enters a standoff. Price growth is already decelerating, now just 2.5% year over year—the slowest since September 2023. Expect that trend to continue until sellers recalibrate or listings expire.

Supply Is Up, But Don’t Confuse It With Liquidity

Yes, more homes are being listed. But more listings in a market where homes don’t sell quickly doesn’t mean liquidity—it means congestion. Sellers think more inventory is a tailwind. It’s not. It’s a price anchor. And unless they adjust, many will simply ride the MLS carousel until fatigue or financial pressure forces a change in pricing strategy.

A Geographic Split Is Brewing

Markets like L.A. and D.C. are seeing listing spikes (+23.5% and +15.8% YoY, respectively). But those increases come with specific narratives—natural disaster fallout in LA, federal layoffs in D.C.—that aren’t national but could signal future regional volatility.

The Psychology of Pause in Real Estate

Source: Getty Images

Big Purchases Are Being Benched

Over 30% of Americans are hitting pause on major buys—homes included. And it’s not a soft delay. Nearly a quarter are scrapping plans altogether. This isn’t about affordability per se. It’s sentiment. When buyers lose faith in the future, they hoard liquidity. And sentiment is sticky. Once people talk themselves out of a major purchase, inertia keeps them on the sidelines longer than logic suggests.

Tariffs and Mortgage Whiplash: A One-Two Punch

Construction costs are climbing, thanks to tariffs. Mortgage rates, meanwhile, are still swinging like a bar fight. The result? A pricing squeeze that doesn’t come from sellers or builders—but from macro policy. Buyers aren’t just reacting to prices; they’re preemptively opting out of volatility. That’s the shift. People aren’t just cautious—they’re tired of getting whiplash.

Flat Prices and a Glimmer of Rate Relief

The upside of all this? Flat-to-declining demand has a gravitational effect on prices. If demand continues to limp along, price inflation won’t hold. Combine that with the Fed’s desire to ease if recession odds materialize, and you’re staring at the beginning of a rate reset. That’s your opportunity window. It’s narrow. But it’s real.

Retail Sales Rose, But Don’t Be Fooled

Yes, U.S. retail sales jumped in March. But don’t mistake that for confidence. Much of that bump was likely front-loaded, reactionary spending on things like cars before prices rise further. The same reflex hasn’t translated to housing. This is a consumer willing to splurge on today, but hesitant to bet on tomorrow.

Why Your Listings Strategy Just Got More Important

Source: Modern Media LLC

Zillow Isn’t Showing the Whole Picture Anymore

Thanks to new industry rules and commission crackdowns, fewer listings are making their way onto the major consumer-facing portals like Zillow and Redfin. Some are delayed. Others don’t appear at all. Brokerages are starting to hold listings close, offering early or even exclusive access through their own platforms before syndicating out. The effect? Buyers are now navigating an incomplete map. Sellers may get a private preview—but at the cost of reach. And the portals? They’re threatening to penalize the holdouts.

Buyers Are Losing Transparency, Brokers Are Gaining Leverage

This shift creates a two-tier marketplace. Casual buyers are flying blind unless they’re plugged into a brokerage’s network. Meanwhile, big brokerages and teams are quietly consolidating control of access. If you control the first look, you control the outcome. And in a low-trust, low-visibility market, that’s power. It’s not a fairer system. It’s just a more fragmented one.

Commissions Haven’t Cracked, But Confusion Has Spiked

Despite headlines, agent commissions haven’t meaningfully dropped. But consumer understanding of the system has. That confusion is your opportunity—because buyers and sellers unsure of the rules are more open to guidance. Those who can clearly articulate the new playbook will win trust and loyalty. And right now, trust is harder to come by than financing.

Inventory Is Up, But It’s Not a Free Market

Yes, inventory in March climbed almost 30% year over year. That’s not the green light it might seem. High rates and policy uncertainty are muting urgency. Buyers are window shopping. Sellers are hesitant. And in the middle sits a radically restructured information ecosystem, where access is increasingly private and asymmetric.

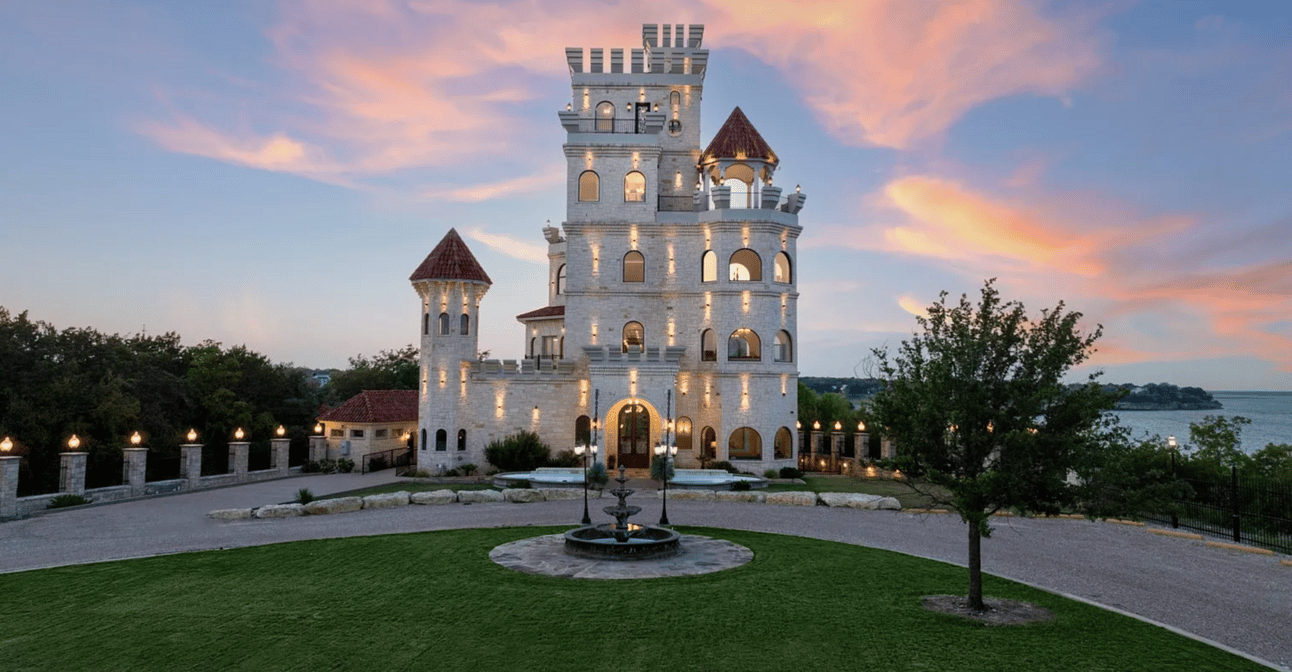

5-Story Fortress

This Clifton, TX home, priced at $4.9M has views that are just as breathtaking as the exterior…

Check it out 👇

TL;DR (Too Long; Didn’t Read)

The real estate market is slowing to a crawl, with homes taking longer to sell and a growing disconnect between seller expectations and what buyers are willing to pay. Inventory is rising, but it's driven by financial pressure—not confidence—and listings are sitting longer as overpriced homes clog the system. Buyers, weary from rate volatility and rising costs, are pausing or walking away entirely, creating a standstill that’s more psychological than financial. At the same time, new rules are fragmenting listing visibility, giving brokerages more control while leaving consumers in the dark—making trust and access more valuable than ever.

Have a great weekend - we’ll see you in two Saturdays on May 3rd.

Cheers 🍻

-Market Minds Team