We appreciate each and every one of you for taking the time to read Market Minds. Buckle up and enjoy the free value, and you won’t want to miss the Nashville home if you’re an Airbnb investor!

Spring Thaw: Signs of a Shift

Source: AP News

Inventory Rising, Pressure Easing

For the first time in years, listings are climbing. Active inventory rose nearly 30% nationally in March compared to the year prior. Some major metros like Denver, San Diego, and Vegas posted gains north of 60%.

Listings are lingering longer, buyers are negotiating harder, and in several metros, prices are bending. In Austin, Miami, and Kansas City, median listing prices dropped more than 6%.

Sellers: From Dictators to Diplomats

What was once a seller’s sovereign state has become a co-op board. Concessions are back. Sellers are buying down mortgage rates, covering closing costs, even fixing things they used to scoff at. Inspection waivers are no longer a given — buyers are actually inspecting. And when sellers do hold firm on price? They’re often tossing in sweeteners to get deals across the line.

But don’t mistake this for generosity. Days on market are climbing, and sellers know buyers have options. The pandemic-era FOMO has turned into "prove it."

Mortgage Rates: The Double-Edged Sword

Mortgage rates remain high — but crucially, they’ve stopped their ascent. A 30-year fixed is hovering around 6.6%, down from the 7% we saw in January. If the trade-war-induced economic slowdown continues, the Fed may face renewed pressure to cut, nudging rates lower.

Still, affordability remains brutal. The median household is now spending nearly half of its income to afford a median-priced home. Even if rates ease, the pressure won’t — unless prices follow.

The Reality Behind the Data

This newfound inventory is a fraction of what’s needed. Total unsold homes? Still 44% below the pre-pandemic norm. And prices, even where softening, remain up 47% over the last five years. For many first-time buyers, this is a pyrrhic victory — the gates are opening, but the moat remains wide.

We’re witnessing not a buyer’s market, but a market looking for balance. The psychology of scarcity is cracking, and the first-mover advantage is shifting from those who listed to those who lingered.

Why the Housing Market Isn’t as Exposed as You Think

Source: NMP

Equity Cushions Are Holding Firm

Even in a hypothetical 10% price correction, the sky wouldn’t fall. According to BatchService, the average U.S. mortgage still sits on a 62.2% loan-to-value ratio. That means the typical homeowner has built up serious equity — a buffer deep enough to absorb price shocks without triggering a wave of distress sales or foreclosures.

Most of that cushion was created during the 43% price surge from March 2020 to June 2022. Borrowers who locked in homes during that window — especially pre-2022 — are in enviable positions. They’ve seen appreciation and they’re paying down principal at a faster clip thanks to low interest rates.

The Newcomer Gap Is Growing

But here's the caveat: not everyone has that buffer. Borrowers from mid-2022 through 2025 are sitting on thinner margins. Not only did they buy in a flatter market, but they also did so at much higher rates — meaning more of their monthly payment goes to interest, not equity.

This divergence between early-cycle and late-cycle borrowers is quietly creating a two-tiered homeowner class. One group is equity-rich and rate-locked. The other is rate-strapped with slower amortization and limited upside. Understanding this bifurcation is key to seeing where future stress — and opportunity — could emerge.

Inventory: A Quiet Shift of Power

National inventory is still below 2019 levels, but the story under the hood is more nuanced. As of March 2025, 58 major metros are now above their pre-pandemic inventory benchmarks. Just three months earlier, that number was 41.

Markets like Cape Coral and San Antonio, once pandemic darlings, are now grappling with affordability ceilings and overbuilt pipelines. Builders there are slashing prices or offering mortgage buy-downs — and that’s bleeding into resale comps. In these regions, buyers are no longer showing up with hats in hand. They’re negotiating (and winning).

The Geography of Leverage

Midwest and Northeast metros, largely skipped by the pandemic migration wave, never over-inflated. They also haven’t overbuilt. As a result, inventory remains tighter, and sellers hold more cards.

Meanwhile, in parts of the Sun Belt, leverage is slowly shifting to buyers. Inventory is up. Builders are blinking. And early-stage equity isn’t what it used to be. This isn’t a crash, but it is a recalibration. And markets that spiked hardest are now recalculating fastest.

Final Thought: Equity as Insulation, Not Immunity

The early-cycle equity is real, and it’s powerful. But the late-cycle borrowers and the softening Sun Belt markets tell a more complicated story. The next disruption won’t come from underwater mortgages. It’ll come from liquidity bottlenecks and migration inertia.

How Tariffs and Turbulence Are Driving a Luxury Real Estate Tailwind

Source: NY Post

Capital Flight from Stocks Is Fueling High-End Housing

When global markets bleed $10 trillion in value in a matter of days, money doesn’t vanish — it moves. Trump’s tariff-driven economic drama has triggered a classic investor reflex: flee the intangible and land in the concrete. That means real estate, particularly luxury real estate, is having a moment. Not because it’s trending, but because it’s stable. Tangible. And historically sticky in value.

Even after a 15% S&P drawdown, the upper crust isn’t tapped out. Equities still make up the lion’s share of their portfolios, while real estate is underweighted — just 18.7% of their asset base. The capacity for high-end property investment isn’t just intact, it’s underutilized. That’s a setup.

Luxury Listings Are Lean

Despite increased interest, supply in the luxury tier is contracting. Homes over $1 million now make up just 12.8% of listings, down from 13.6% last year. Yet they’re moving slightly faster, with time on market ticking down to 75 days. And while the sub-$1 million segment is seeing more price cuts, reductions in the luxury bracket are holding steady.

The affluent buyer still leads with equity and shrugs at rates. These transactions are less about borrowing costs and more about capital allocation.

Russian Money Returns

Another signal worth watching: Russian wealth is reentering the U.S. market. A reported uptick in Russian buyers eyeing $10–$20 million homes in New York marks a subtle but potent trend. Despite political tensions, legal exposure appears to be fading as regulatory pressure on oligarch cash weakens. If that channel reopens more broadly, expect a resurgence of ultra-luxury transactions that once defined pre-2014 Manhattan.

High-End Real Estate Is Becoming the Safe Play

The luxury market isn’t just weathering the storm — it’s benefiting from it. When you can’t trust markets or political stability, you park capital in something that doesn’t vanish when a tweet lands. Price cuts are rare, inventory is thin, and high-net-worth buyers still have dry powder.

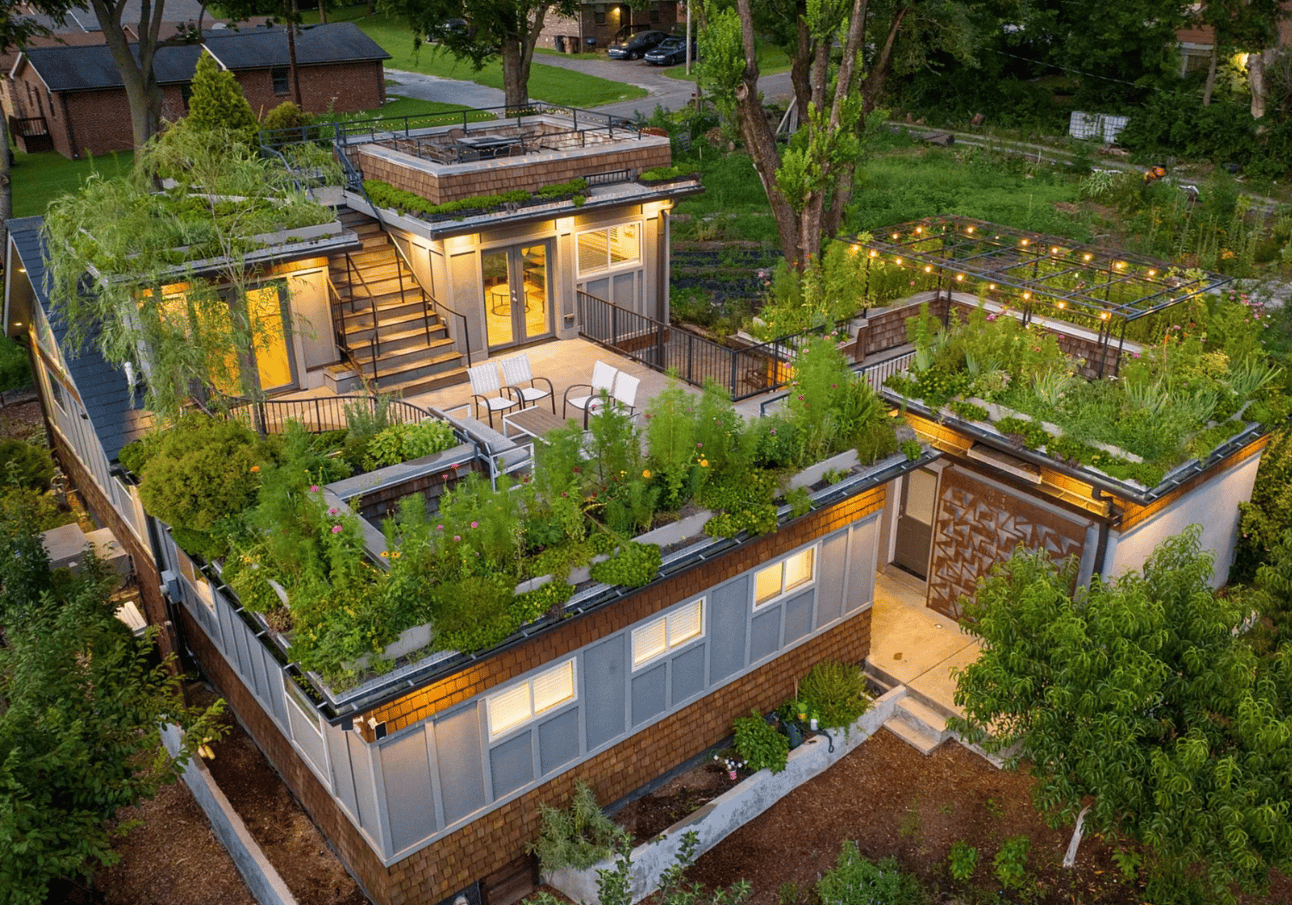

Separate Apartment + Rooftop Garden = Investor Dream

This Nashville, TN home, priced at $895,000 is not only a “famous” house featured in magazines and commercials, but also a successful owner-occupied Airbnb with an attached apartment to generate additional income.

Check it out 👇

TL;DR (Too Long; Didn’t Read)

The U.S. housing market is showing early signs of a shift, with inventory rising and buyer leverage returning in key metros. Sellers are making concessions again, and while mortgage rates remain high, they’ve stabilized—though affordability is still out of reach for many. Most homeowners are insulated by strong equity positions, but newer buyers face tighter margins, creating a two-tiered market. Meanwhile, global economic volatility is pushing capital into luxury real estate, where inventory is tight, price cuts are rare, and the wealthy are viewing high-end homes as a stable investment hedge.

Have a great weekend - we’ll see you next Saturday.

Cheers 🍻

-Market Minds Team