We appreciate each and every one of you for taking the time to read Market Minds. Buckle up and enjoy the free value, and you won’t want to miss the “home” with the best open floor plan we’ve ever seen.

Flipping Fatigue: Why the Quick-Buck Game Is Slowing Down

The Juice Isn’t Worth the Squeeze (Yet)

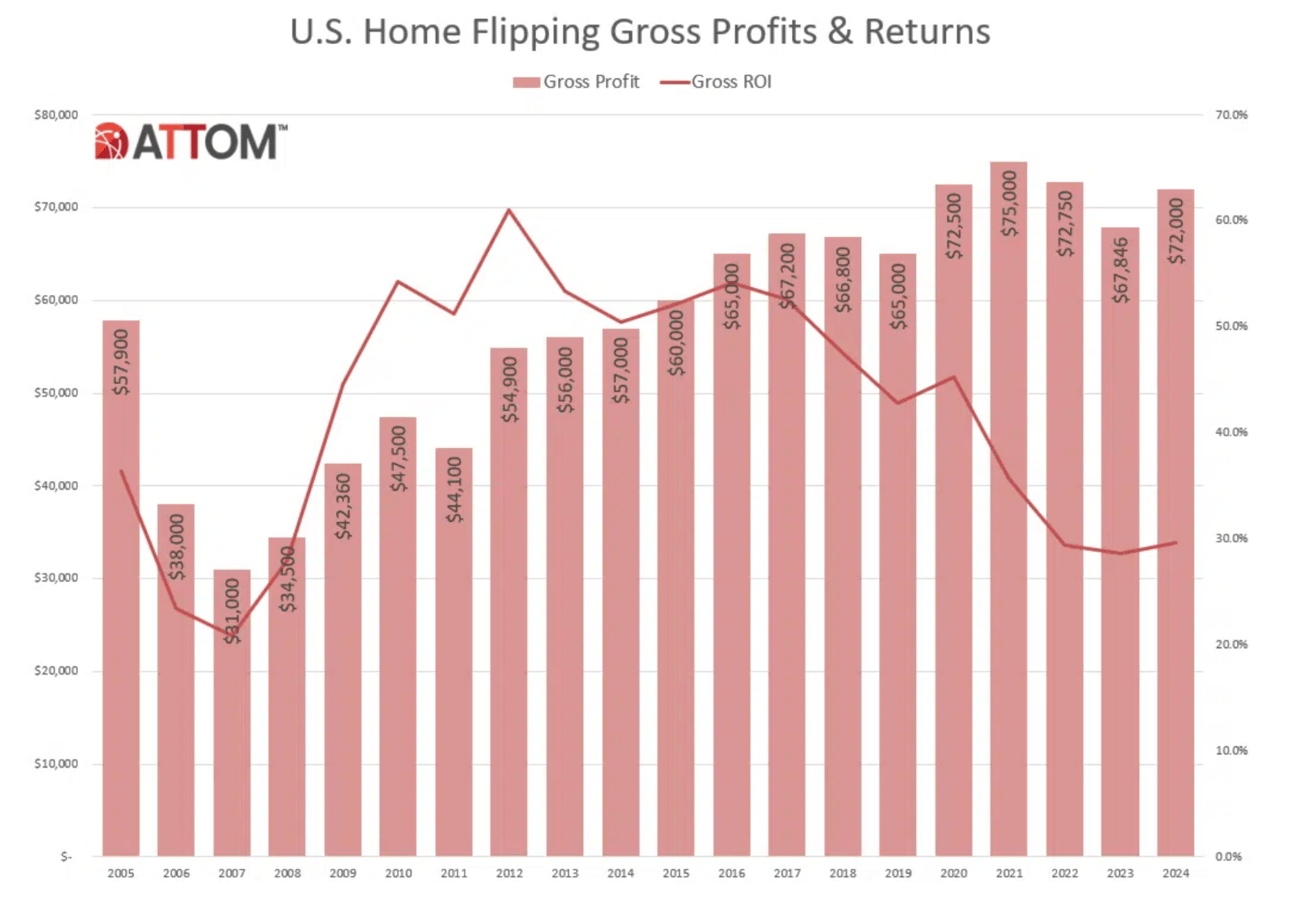

You already know flipping’s appeal: speed, scale, and a sense of control in a chaotic market. But 2024 wasn’t kind to that hustle. According to ATTOM’s year-end report, home flips dropped for the second consecutive year — a 7.7% decline from 2023 and a staggering 32.4% since the 2022 peak. This isn’t just a minor correction — it’s the market putting investors on notice. Despite a modest bump in ROI (from 28.6% to 29.6%), margins are still floating near decade lows. We’re not even back to 2022’s numbers, let alone the gold-standard 54.2% returns of 2016. Translation: flippers are working harder for smaller wins.

Why the Margins Are Stuck in the Mud

Price movement tells the real story. The median resale price on flipped homes rose 3.3% year-over-year, while acquisition costs increased 2.5%. That thin spread is where your profit lives — or dies. Renovation costs, holding costs, rate volatility? Still eating away at the bottom line. And forget cheap inventory: distressed assets — historically the lifeblood of high-margin flips — are drying up. The easy meat is gone. What’s left requires sharper blades, faster execution, and a stomach for thinner margins.

Cash Is Still King — Because Borrowing Is Brutal

Nearly two-thirds of flips were purchased in all-cash transactions last year. Financing dropped slightly to 36.8%, down from 37.8% in 2023. That’s not just a stat — that’s a strategic filter. If you can’t buy with cash, you’re not bidding in the same arena as the pros anymore. It’s not a meritocracy, it’s a liquidity contest. And when mortgage rates are straining at the seams and time kills deals, debt makes you slow — and slow loses.

Where the Math Works — and Where It Doesn’t

Look under the hood and you’ll find bifurcation. High-profit markets aren’t in the sexy coastal metros — they’re in the Rust Belt and the undervalued mid-majors. Cleveland, Buffalo, Rochester, Pittsburgh — all clocking ROI north of 70%. Meanwhile, Sunbelt darlings like Austin, San Antonio, and Dallas posted margins that barely beat out a 10-year treasury. You don’t need HGTV aesthetics; you need a spreadsheet and a local contact who answers on the first ring.

The West and South Are Cooling, But the Smart Are Moving

Flipping activity dropped hardest in Charlotte, Jacksonville, New Orleans, Denver, and Miami — all down double digits. But savvy operators are following growth markets on the fringe. Cities like Cedar Rapids (up 49.6%), Bellingham, WA, and Warner Robins, GA, are emerging as stealth players. Fewer eyes, more opportunity, and enough volatility to hide your spread if you move quick.

List It Like You Mean It: The New Signals That Command Premiums

Source: MarketWatch

The New Language of Price Perception

Buyers aren't just paying for square footage — they’re paying for vibes, and they’re doing it with surgical precision. Zillow’s latest data reveals that certain features, when named in the listing copy, correlate with serious sale premiums. Soapstone countertops? Add 3.5%. Wet rooms? 3.3%. White oak floors? 3.2%. The psychology is clear: buyers are burnt out on post-close renovations. “Remodeled” now carries a price tag — a $13K premium, to be exact.

White Oak and Wet Rooms Are the New Granite and Subway Tile

You’ve seen this shift coming. The HGTV generation wants their Instagram moment — and they’ll pay to avoid a trip to Home Depot. Soapstone is trending because it reads as curated. Venetian plaster? It whispers European quiet luxury. Teak decks and outdoor showers? They’re the open-loop story buyers want to live into. These aren’t just materials — they’re narrative devices in the buyer’s imagination.

The Cost Side Isn’t Light — But It’s Leveraged

These upgrades are not budget moves. Wet rooms start at $20K and can top $50K. Venetian plaster ranges up to $30 per square foot. But professional installation — and the aesthetic sophistication it implies — is what delivers the pricing power. You’re not just investing in material, you’re investing in sale psychology. And when you control the emotional trigger in a buyer’s mind, you control the premium.

With millions of homeowners anchored to 3% mortgage rates, the average hold time is stretching. That’s driving a surge in full-home remodels from owners who’ve decided to stay put and upgrade instead of move. That’s not just a construction trend — it’s a signal of inventory evolution. The next batch of listings hitting the market won’t be untouched legacy homes — they’ll be curated, highly renovated assets priced to compete against new construction. In other words: the bar is getting higher.

The Takeaway

In a tight market, you don’t get paid for your listing. You get paid for your narrative. And that narrative is written in keywords. The best ROI might not be in an extra bedroom — it might be in two words: “white oak.”

How Developers Are Beating the Math (and the System)

Source: The Real Deal

The Magic Number Is 99

New York development is having a moment of mathematical precision. Seventeen new projects have hit the city’s books since January, each one with exactly 99 units. That’s not a coincidence — it’s a workaround. The newly minted 485x tax program, meant to replace the expired 421a, delivers a punishing cost curve once projects cross the 100-unit threshold. Hit 100, and the $40/hour prevailing wage kicks in. Jump to 150, and you’re looking at $72/hour in some neighborhoods. So developers are capping their buildings at 99 — and in many cases, subdividing large parcels just to keep their unit counts under that magic line.

The New Development Game: Slice and Subdivide

If you’re holding land right now — or evaluating buildable parcels — the way developers are optimizing for cost has changed. The old play was maximize density. Now? It’s optimize cost-to-yield by carving up lots into multiple 99-unit footprints. BKREA’s Bob Knakal says this has become the dominant strategy on every rental site he’s touching. Forget mega towers. Think clusters of sub-century-unit buildings that qualify as large in massing but small on paper. In Brooklyn, Boerum Hill and Downtown are already seeing multi-building filings that game this exact structure.

Pencil First, Then Pour Concrete

This isn’t labor vs. capital — it’s a pro forma arms race. Developers like Joseph Safdie are running the math and finding that once you trigger wage mandates, construction costs spike 15% to 25%. That math just doesn’t fly with current interest rates, rent stabilization rules, and risk-averse lenders. Banks are watching the same spreadsheets. Safdie put it bluntly: “We’re only going to do a project that makes sense… and we know what the banks will lend.” This is more than optimization — it's survival.

The Irony of 485x: Policy vs. Reality

Labor leaders may have won the legislative round with 485x’s wage floors, but the market’s already counterpunching. If the goal was to generate more affordable housing and better jobs, the current dynamic is doing the opposite. Developers are shaving down project size to avoid the labor pricing trigger, which leads to more spread-out infrastructure (multiple cores, HVACs, etc.), not less. Meanwhile, the same amount of units may still get built — just with more complexity and likely fewer deeply affordable ones.

Giving “Open Floor Plan” A New Meaning

This Bowling Green, OH “home” has impressive square footage for the starting auction price that you may not want to miss out on…

Check it out 👇

TL;DR (Too Long; Didn’t Read)

Flipping homes is getting harder, with returns still near decade lows and distressed inventory drying up — forcing investors to work harder for smaller profits. Cash buyers dominate, and the highest margins now come from overlooked Midwest markets, not flashy metros. Meanwhile, in a market where buyers crave move-in ready homes, high-end features like white oak floors and soapstone counters are commanding major premiums, turning design into a sales strategy. Developers in NYC are also playing defense, capping projects at 99 units to sidestep costly labor laws — a workaround that reflects how rising costs and regulation are reshaping real estate math at every level.

Have a great weekend - we’ll see you next Saturday.

Cheers 🍻

-Market Minds Team