We appreciate each and every one of you for taking the time to read Market Minds. Buckle up and enjoy the free value, and you won’t want to miss the home with a price tag you won’t believe…

2025: Where the Yields Are—and Aren’t

The Gold Rush Moves South and Midwest

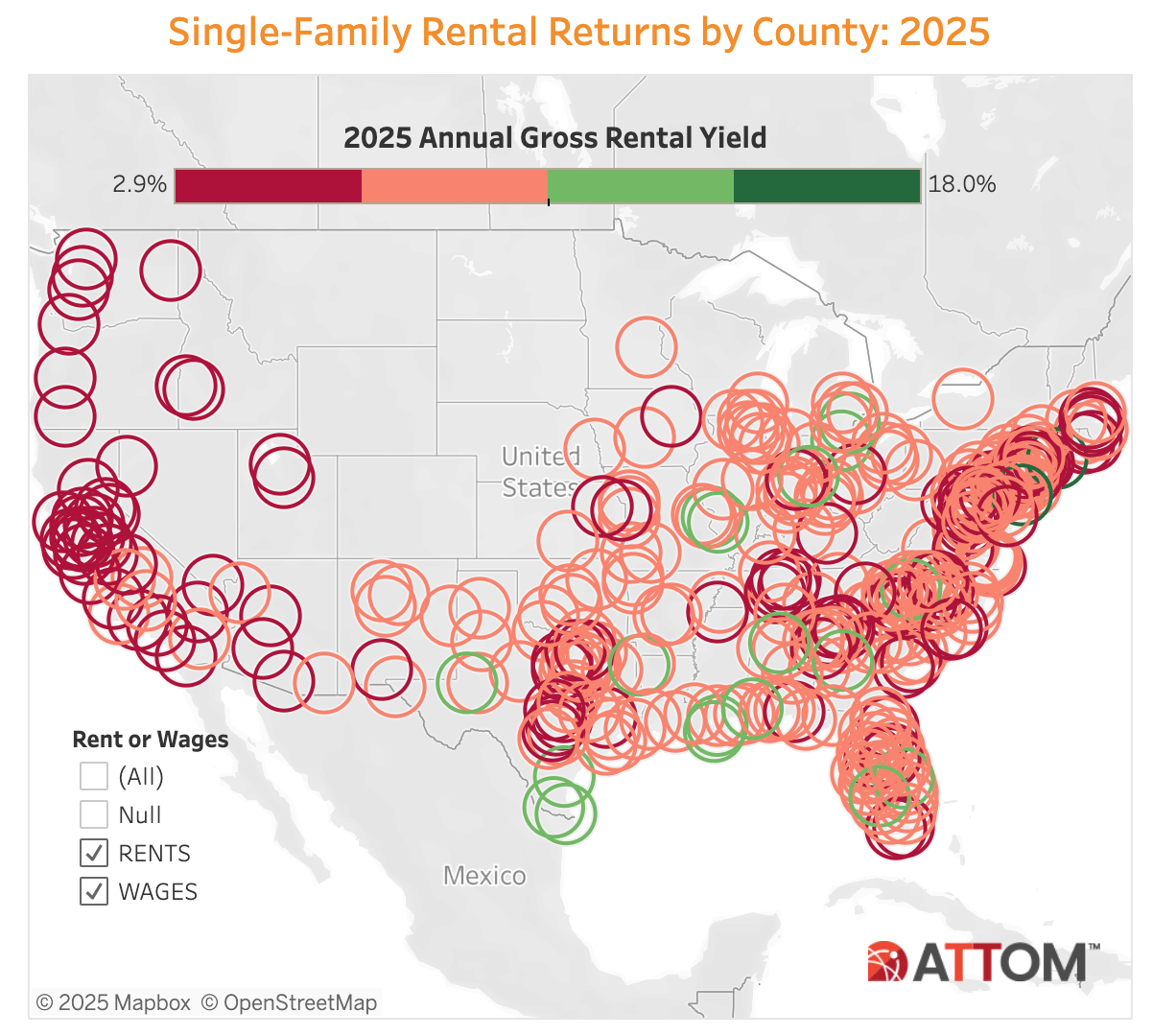

Real estate investment, like any asset class, rewards those who get in at the right time, in the right place. According to ATTOM’s latest report on single-family rental (SFR) markets, the best yields for 2025 will be concentrated in the Midwest and the South. Suffolk County, NY, and Atlantic City, NJ, are leading the pack with projected rental yields of 18% and 16.8%, respectively. Meanwhile, Birmingham, Mobile, and Odessa are emerging as high-yield markets, proving that secondary and tertiary cities still hold massive potential—especially in states with landlord-friendly laws and growing job markets.

Why Rental Returns Are Slipping Nationwide

The catch? Overall rental yields are shrinking. ATTOM reports that in nearly 60% of the analyzed counties, rental returns are dropping from 2024 to 2025. The culprit? Rising home prices outpacing rent growth. Investors who got in years ago are sitting pretty, enjoying the fruits of appreciation, but for new buyers, the math is getting harder. Median home prices have risen faster than rents in more than half the country, cutting into gross rental yields. If this trend continues, the high-yield rental play will require surgical precision—picking the right market at the right time.

The No-Go Zones: Where Returns Are the Worst

If you’re looking for strong rental yields, steer clear of the West Coast and select high-priced metros. ATTOM’s data puts San Francisco, San Jose, and Nashville among the lowest return markets, with gross rental yields as low as 2.9%. Investors in these areas are banking on long-term appreciation rather than cash flow—a strategy that works when interest rates are low and demand is strong but becomes risky in a high-rate environment.

The Rental Market’s Tipping Point: What Happens When the Flood Slows to a Trickle?

Source: Redfin

A Record Apartment Glut—For Now

There’s never been more choice in the rental market. In Q3 2024, 142,900 new apartments hit the market—an all-time record—and nearly half of them are still sitting empty three months later. Landlords are throwing out incentives like free parking and discounted rent just to get tenants in the door. But don’t expect these deals to last forever.

The Construction Pipeline is Drying Up

The rental boom that started during the pandemic is finally slowing. Construction permits for new apartments are down nearly 10% year-over-year. This isn’t an immediate crisis—there’s still a backlog of units coming to market—but once those get absorbed, the leverage shifts. Fewer new apartments mean landlords regain pricing power. Today’s rent discounts could become tomorrow’s rent hikes.

Vacancies Are Up, Rent Growth is Flat—For Now

The vacancy rate for buildings with five or more units ended 2024 at 8.2%, the highest since early 2021. Rent growth has slowed to a crawl, up just 0.4% year-over-year, with median asking rent at $1,607—still $100 below its peak. But remember: the rental market is cyclical. When supply shrinks, prices adjust.

Studios Are the Exception to the Rule

While larger apartments are filling up at a slower pace than last year, studio apartments are seeing stronger demand. Their absorption rate jumped from 42% to 50%, likely because their supply hasn’t surged like other unit types. This signals a potential shift: renters are downsizing, and affordability is driving leasing decisions.

The Future of Housing: What’s Changing and What to Do About It

Source: BAM

Small Households, Smaller Homes, Bigger Impact

One- and two-person households are rising fast, shifting home demand toward smaller, more affordable properties. Builders are finally catching up, reversing decades of oversized home construction. The key drivers? Delayed life milestones, lower birth rates, and an aging population. The days of the 4,000-square-foot McMansion as the default new build are over.

Demographics Will Rewrite Housing Demand

Population growth in the U.S. is slowing dramatically. The Census Bureau’s 2050 forecast is now 80 million people lower than it was in 2008. Birth rates are plummeting globally. Immigration will increasingly become the economic lifeline for regions that want to sustain demand and avoid housing gluts. Some markets will thrive; others will stagnate.

A Remodeling Surge is Coming

Trapped by ultra-low mortgage rates, homeowners aren’t moving—they’re renovating. Aging housing stock and record levels of home equity are fueling a long-term remodeling boom. That’s already creating opportunities in home improvement financing, contractor partnerships, and resale strategies that go beyond the traditional “buy-sell” model.

The Baby Boomer Sell-Off Will Be a Slow Burn

Freddie Mac estimates that 9.2 million Boomer-owned homes will change hands by 2035. That’s a tidal wave of inventory—but don’t expect it to hit all at once. Right now, demand from Millennials and Gen Z is strong enough to absorb the shift. But in the 2030s, we’ll likely see a structural shift in supply, pricing, and homeownership trends.

The Home Insurance Crisis is Getting Worse

Premiums jumped 33% from 2020 to 2023, with states like Florida and Louisiana seeing rates double. Some regions are on the verge of becoming uninsurable, which means mortgage lenders will start pulling back. If an area is uninsurable, it’s unfinanceable—and that could reshape real estate values in risk-prone markets.

Build-to-Rent is Cementing Its Place in the Market

A record 9.5% of new single-family homes in 2023 were built for rent. Institutional investors are betting big on this model, particularly in the Sun Belt, where rental demand remains high. That’s increasing rental supply but also putting long-term pressure on for-sale inventory in those regions.

Big Builders Are Taking Over

National builders like Lennar and PulteGroup are swallowing market share, outcompeting smaller builders with their scale, financing power, and cost advantages. Smaller builders, squeezed by rising costs, are being pushed into luxury development, leaving a gap in the mid-priced housing market. That’s why new construction is still skewing expensive, despite demand for affordability.

FREE Step-by-Step Playbook to Running Seller Lead Campaigns on Google (No Opt-In Required)

Ready to supercharge your lead generation? Our Free Google Ads Seller Lead Playbook is exactly what you need to get there. This comprehensive guide breaks down step-by-step strategies that leverage Google Ads to bring in high-quality seller leads—without the guesswork.

You’ll get the proven tactics on crafting ads we use and spend $1M+/year on. Plus, it’s completely free, so you can start implementing these high-impact strategies today without any upfront cost.

To your success 💪

The Highlights Don’t End…

This Palm Desert, CA home has features and a price tag you won’t believe…

Check it out 👇

TL;DR (Too Long; Didn’t Read)

In 2025, the best real estate rental yields are shifting to the Midwest and South, while high-priced metros like San Francisco and Nashville are offering some of the worst returns. Nationwide, rental yields are declining as home prices outpace rent growth, making market selection more critical than ever. The rental market is experiencing an oversupply of apartments, but with construction slowing, today’s rent discounts may turn into price hikes once supply tightens. Meanwhile, demographic shifts, rising home insurance costs, and institutional investment in build-to-rent properties are reshaping housing demand, with smaller homes, remodeling booms, and large builders dominating the landscape.

Have a great weekend - we’ll see you next Saturday.

Cheers 🍻

-Market Minds Team