We appreciate each and every one of you for taking the time to read Market Minds. Buckle up and enjoy the free value, and you won’t want to miss the “home” being auctioned off this month!

Is It Enough to Shake the Market Loose?

A Small Drop, A Big Question

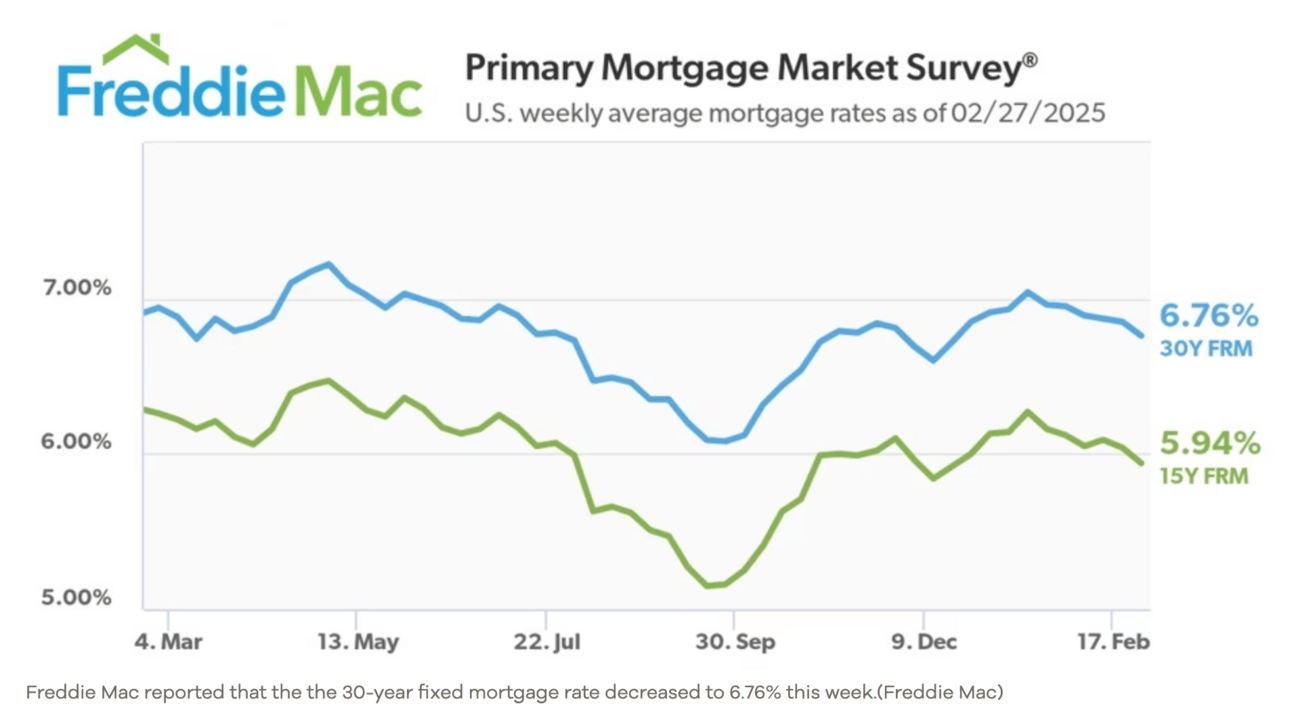

Mortgage rates just hit their lowest point in two months, sliding to 6.76%. That’s not exactly cheap money, but it’s enough to shift sentiment in a market that has been locked in a staring contest between buyers and sellers. Inventory is growing. Prices are softening. But the real question is: will this be the moment the market finally unsticks?

The Standoff Continues

Buyers have been running the numbers, trying to justify prices that were set in an era of 3% mortgage rates. Sellers, meanwhile, are anchored to what their neighbor’s house sold for a year ago, unwilling to budge unless they absolutely have to. The result? Homes are sitting 11 days longer on the market than they were a year ago, and 16.8% of sellers have already cut their asking prices—the highest February price-reduction rate since 2016. The pressure is building.

The Inventory Shift is Happening—Slowly

New listings have climbed for seven consecutive weeks, up 2.5% year over year. The overall number of homes for sale has jumped nearly 28% compared to early 2024. That’s good news for buyers who’ve been waiting for options. But the reality is, inventory growth is still being outpaced by affordability concerns. Until rates break lower—or sellers truly adjust expectations—the market will keep moving at a crawl.

The Window of Opportunity

The next move belongs to those who recognize where leverage is shifting. Buyers have time, options, and negotiating power they haven’t had in years. Sellers who move first—before inventory builds further—are the ones who will avoid the real price cuts coming this summer. The market isn’t collapsing, but it is recalibrating. And in a recalibrating market, those who act decisively don’t just survive—they win.

Fixer-Uppers Are Back—But Not Where You’d Expect

Source: Yahoo!

The housing market isn’t what it was five years ago. The days of bidding wars and instant flips are fading, but opportunity hasn’t disappeared—it’s just moved. If the latest data is any indication, the best places to find undervalued homes that can be transformed into serious profit are no longer in the Sun Belt boomtowns. Instead, it’s the Northeast, where century-old homes and shifting migration trends have quietly made states like Maine, West Virginia, and New Jersey prime targets for the next wave of flips.

Old Homes, New Money

Maine tops the list for fixer-upper availability, with over a third of its housing stock built before 1960. These homes aren’t just relics—they’re potential goldmines. As affordability constraints push buyers away from new construction, renovated older homes are commanding premiums. The play here isn’t just about finding distressed properties; it’s about recognizing where demand is going. In states with aging housing stock and growing populations, buyers are willing to pay for turnkey renovations that save them the headache of updates.

The Flipping Trap—And How to Avoid It

Not all fixer-uppers are worth the effort. While properties in suburban and rural areas tend to offer the best value, the key isn’t just finding a cheap home—it’s knowing where buyers are paying a premium for renovations. That means skipping vanity projects like pools and instead focusing on upgrades that drive real resale value: kitchens, bathrooms, and additional living space. Smart flippers budget at least 20-30% over initial estimates for renovations—because surprises in plumbing and electrical aren’t just possible, they’re inevitable.

The Play Moving Forward

The smart money follows migration. States like Maine and New Jersey have seen sustained in-migration since 2020, and as supply remains tight, the appetite for well-renovated homes will only grow. While first-time flippers should brace for longer timelines, seasoned investors are already adjusting their models to reflect a market where patience is rewarded and margins come from strategic improvements, not quick flips.

Exclusive Listings and the Future of Real Estate

Control is the New Currency

The most valuable asset in real estate isn’t land—it’s control. And while most of the industry is busy debating NAR’s Clear Cooperation Policy, Compass has been quietly executing a strategy that changes the game: exclusive inventory. In just seven months, the company has more than doubled its private exclusive listings from 2,500 to over 6,000, making up nearly 30% of its total listings. Add in “Coming Soon” listings, and that number jumps to 35%.

The Netflix Effect—But for Real Estate

If this feels familiar, it should. Remember when Netflix was the one-stop shop for streaming before Disney, Apple, and HBO pulled their content to create their own platforms? That’s exactly what’s happening in real estate. The traditional MLS model—the industry’s version of an open marketplace—is being challenged. Instead of every buyer having equal access to listings, inventory is being funneled through select brokerages and agents.

For sellers, it’s a strategic decision: maximize exposure through the MLS or leverage exclusivity to create perceived scarcity. Either way, the days of real estate being a fully open market are fading.

Who Wins in an Exclusive-First Market?

The rise of private listings is more than just a tactical shift—it’s a fundamental change in how deals get done. Compass’s three-phase strategy encourages homeowners to start with a private exclusive before going public, and with over half of February’s new listings starting this way, the model is working.

Opendoor is experimenting with exclusive inventory, and in markets like Australia, this model is already the norm. The trend line is clear: exclusive content isn’t just a differentiator; it’s a power move that reshapes the entire industry.

FREE Step-by-Step Playbook to Running Seller Lead Campaigns on Google (No Opt-In Required)

Ready to supercharge your lead generation? Our Free Google Ads Seller Lead Playbook is exactly what you need to get there. This comprehensive guide breaks down step-by-step strategies that leverage Google Ads to bring in high-quality seller leads—without the guesswork.

You’ll get the proven tactics on crafting ads we use and spend $1M+/year on. Plus, it’s completely free, so you can start implementing these high-impact strategies today without any upfront cost.

To your success 💪

Noah’s House??

This Christchurch, New Zealand “home” might top our most unique list.

Check it out 👇

TL;DR (Too Long; Didn’t Read)

Mortgage rates have dropped to 6.76%, sparking speculation about whether the market will finally loosen up. While inventory is rising and prices are softening, buyers are still cautious due to affordability concerns, and sellers are hesitant to adjust their expectations. Meanwhile, the real estate investment landscape is shifting, with fixer-uppers in the Northeast becoming prime opportunities as older homes attract buyers seeking affordability. Additionally, Compass is leading a shift toward exclusive real estate listings, following a "Netflix-style" model that prioritizes controlled inventory over open-market access, signaling a major industry transformation.

Have a great weekend - we’ll see you next Saturday.

Cheers 🍻

-Market Minds Team