We appreciate each and every one of you for taking the time to read Market Minds. Buckle up and enjoy the free value, and you won’t want to miss your chance for some GREEN.

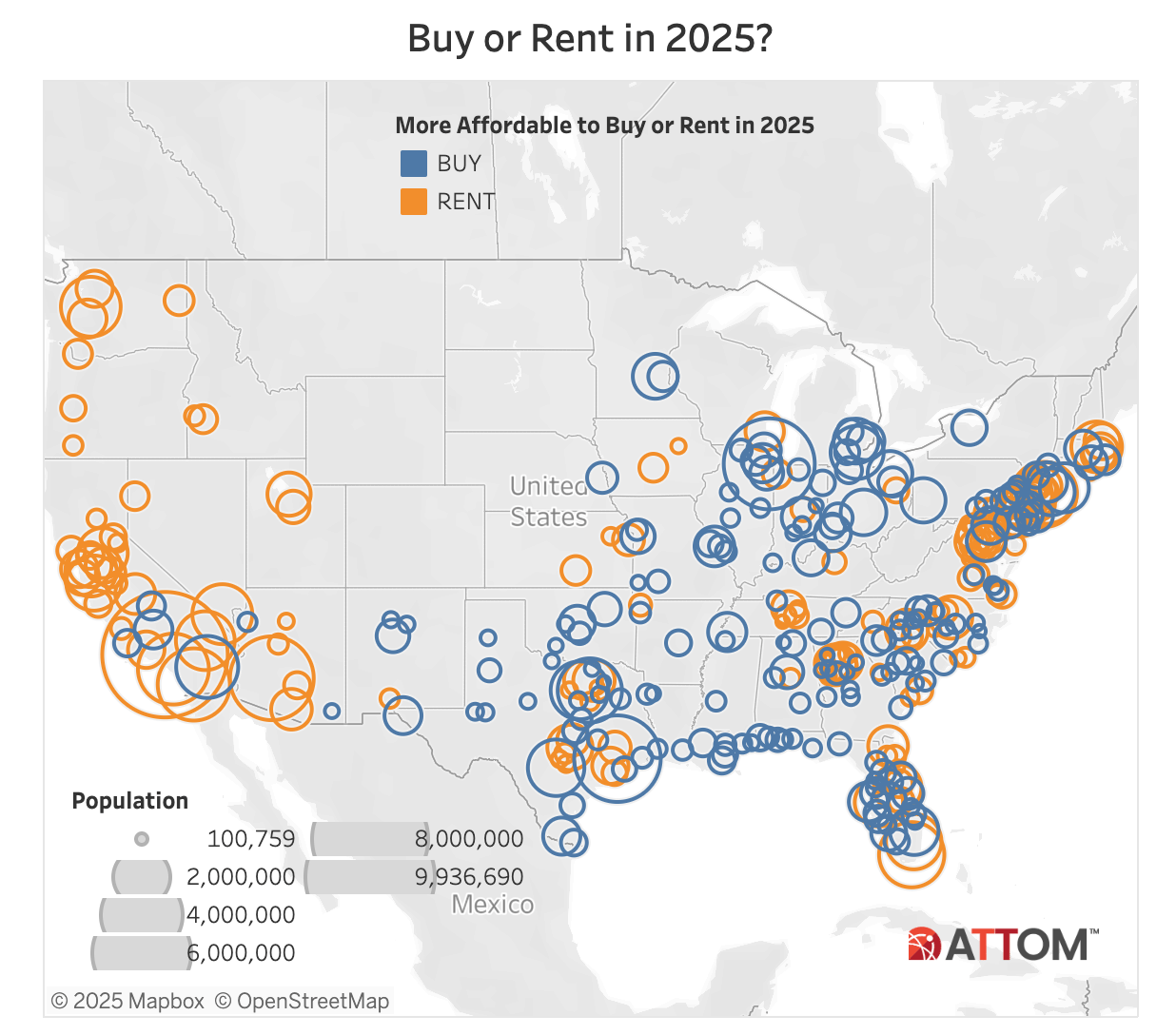

The Rent vs. Buy Reality Check

Buying Is the Better Deal—If You Can Afford It

The latest ATTOM data confirms what many in the industry suspected: in most U.S. markets, owning a home is cheaper than renting—at least on a monthly basis. But before you start celebrating, let’s be clear: that’s only true if you can afford the steep upfront costs. Down payments remain a significant hurdle, often exceeding $200,000 in high-demand areas. And while mortgage rates have slightly softened, they’re still in territory that makes financing expensive.

The Market Is Moving, and It’s Not Slowing Down

Home prices are outpacing rent increases in two-thirds of the markets analyzed. This means that while renting may feel like setting money on fire, buying could feel like being trapped in an ever-escalating game of financial Jenga. Prices continue to rise, but so does the demand for ownership—meaning competition isn’t going anywhere. If mortgage rates tick up again, affordability could take another hit, leaving late entrants with fewer options.

Regional Disparities Create Strategic Investment Plays

The affordability of homeownership is highly regional. The Midwest remains the most accessible, with homeownership costs taking up a smaller portion of wages. The South follows closely behind, while the Northeast is split. The West? A different story entirely. In about 80% of Western counties, renting remains the more affordable option—suggesting that investors and developers may need to rethink their strategies for multifamily vs. single-family opportunities.

Wages Are Rising, But So Are Prices

Here’s the kicker: while wages are increasing in most markets, home prices are still outpacing them in over half of the U.S. That means affordability remains a moving target. Investors looking at rental properties should pay attention to the 28% of markets where rent is outgrowing wage increases—this is where landlords still hold the leverage.

The Takeaway: Buy If You Can, Rent If You Must—But Be Smart Either Way

For those who can scrape together the down payment, buying is the smarter financial play. But it’s not an easy path. The markets remain competitive, prices are still climbing, and the cost of borrowing is anything but cheap. Investors should focus on markets where rental demand is outstripping wage growth, while agents should guide clients with clear-eyed realism: the dream of homeownership is still alive, but the entry ticket is more expensive than ever.

Zillow and Redfin Just Changed the Rental Game

Source: Redfin

The Rental Listings Power Move

Zillow and Redfin are joining forces, with Zillow becoming the exclusive provider of multifamily rental listings on Redfin’s platform. This isn’t just another corporate handshake—it’s a fundamental shift in how rental inventory is marketed. The move consolidates listings from Zillow, Rent.com, ApartmentGuide.com, and Realtor.com under one syndication pipeline, giving rental properties far more exposure with less effort.

More Eyeballs, More Leads—But Fewer Options for Landlords

With Redfin tapping into Zillow’s listing network, landlords advertising with Zillow get a broader reach across multiple high-traffic platforms without needing to list properties separately. The catch? This makes Zillow the gatekeeper of multifamily rental marketing. If a property isn’t on Zillow, it’s losing visibility. And while this expanded network will likely drive more leads, it also raises questions about pricing control—Zillow isn’t in this for charity.

The Bigger Strategy at Play

Zillow is steadily tightening its grip on the real estate pipeline, and this partnership puts it in an even stronger position to dominate the rental market. Multifamily landlords and property managers will have fewer independent marketing channels, making Zillow’s pricing and lead generation strategies a non-negotiable factor in the rental equation. This move could be a warning shot for independent listing services—consolidation is happening, and staying off the dominant platforms will mean playing catch-up.

What to Watch Next

Zillow’s rental listings jumped from 37,000 to 50,000 in a year, and with Redfin now in the mix, that number is set to grow even more. This deal could push other platforms into similar consolidation moves, tightening the power of big listing networks. The takeaway? Adapt to the platforms that control the market, or risk being invisible to renters.

The ADU Boom: A Lifeline for LA’s Housing Market—or a Missed Opportunity?

Source: AHA

Pasadena Bets Big on ADUs

As Los Angeles scrambles to rebuild after the devastating January wildfires, Pasadena is doubling down on accessory dwelling units (ADUs). With a new round of ADU loans available, homeowners have a rare opportunity to access financing, design, permitting, and construction assistance—all with the city’s backing. The result? A push to convert unpermitted units and build new “granny flats” that could reshape the local housing market.

From Niche to Necessity

ADUs have quietly evolved from a solution for aging parents into a broader strategy for multigenerational living and rental income. In 2016, Los Angeles approved just 80 ADUs. By 2022, that number exploded to 7,160, thanks to state-level deregulation. The latest push—fueled by disaster recovery—only accelerates this shift, with cities like Long Beach offering $250,000 loans to homeowners willing to rent ADUs to low-income tenants.

Manufactured Housing Steps In

Prefab and modular home builders are capitalizing on the ADU surge, streamlining production to meet demand. Companies like Hapi Homes are marketing ADUs as an affordable, fast-track solution to LA’s housing crisis. But even with streamlined permitting and lower construction costs, the average ADU still costs around $180,000—far less than a single-family home but still a financial hurdle for many.

Political Roadblocks Could Stall Progress

Despite the momentum, Los Angeles County is making moves that could slow ADU expansion. Local lawmakers are suspending key housing laws, including SB9, which allows lot splits, and SB35, which fast-tracks approvals. The reasoning? To maintain “community character” in fire-affected areas like Altadena. In practice, these suspensions could limit the fastest path to increasing LA’s housing stock when the city needs it most.

A Critical Moment for the Market

The wildfire recovery effort is exposing a larger divide in California’s housing policy: the push for density vs. the resistance to change. ADUs are proving their value, both as a rapid response to housing shortages and as a long-term shift toward more flexible property use. But if lawmakers keep pulling the brakes, the opportunity to rebuild smarter—and more affordably—could slip away.

Dominate Your Market with the Postcard Pack

Use these editable postcards to dominate your desired area.

If you’re committed to adding another source of leads to your business, try it out for FREE here.

To your success 💪

Colorful Investment Opportunity

This colorful Astoria, OR Victoria is listed at $450k and has quite the investment opportunity inside. Let’s just say, there may be a reason why the home was painted green.

Check it out 👇

TL;DR (Too Long; Didn’t Read)

Owning a home is cheaper than renting in most U.S. markets, but high upfront costs and rising prices make affordability a challenge, especially as mortgage rates fluctuate. Meanwhile, Zillow’s exclusive rental listing partnership with Redfin consolidates market control, expanding landlord reach but limiting independent marketing options. In Los Angeles, ADUs are gaining traction as a housing solution, with financing and prefab construction boosting supply, though local policy roadblocks threaten progress. Overall, both homeownership and rental markets are evolving rapidly, requiring investors, buyers, and landlords to adapt strategically.

Have a great weekend - we’ll see you next Saturday.

Cheers 🍻

-Market Minds Team