We appreciate each and every one of you for taking the time to read Market Minds. Buckle up and enjoy the free value, and you won’t want to miss the mid-century modern.

Mortgage Rate Jitters: A Market in Flux

Source: HousingWire

Mortgage Rates Whipsaw as Fed Hints at Policy Shifts

Mortgage rates have become a rollercoaster, climbing to as high as 7.25% recently before easing slightly. The Federal Reserve’s shifting tone, particularly after comments from Fed President Chris Waller, has sent ripples through the market. Waller’s suggestion that rate cuts could come as early as mid-2025 sparked optimism, though uncertainty remains high. Investors are now recalibrating expectations, and the bond market—tied closely to mortgage rates—continues its volatile streak.

Labor Market Weakness Signals Housing Stress

While the Fed insists the labor market is “solid,” cracks are forming in key areas like residential construction. This sector has already experienced its first negative jobs report since the pandemic-era recovery began. If mortgage rates remain elevated, the risk of a labor recession could deepen, particularly for residential builders struggling with a surplus of completed, unsold units. The data shows labor softness may force the Fed’s hand toward easing policy—a potential tailwind for the real estate market.

Housing Starts: A Telltale Warning

The slowdown in housing permits and starts isn’t just a headline—it’s the canary in the coal mine. Residential construction metrics have dipped to recession levels, raising concerns about oversupply and limited new investment in key markets. Builders are increasingly cautious, exacerbating inventory issues in the near term but possibly setting the stage for stronger price recovery if demand rebounds.

Actionable Insight: Be Ready for a Pivotal Spring

As we move into 2025, all eyes are on inflation, labor markets, and the Fed’s next moves. For investors, the uncertainty creates opportunities to position yourself ahead of potential rate cuts. Meanwhile, agents should focus on market-ready strategies that highlight current inventory advantages while preparing for an eventual boost in affordability if rates fall.

How Absentee Owners Can Transform Your Year

Source: BAM

Why Absentee Owners Are the Ultimate Untapped Resource

Absentee owners often sit on properties they don’t want but don’t know how to offload—making them an exceptional opportunity for smart operators. These properties may be vacant, underperforming rentals, or inherited homes creating more stress than value. By identifying absentee owners and addressing their pain points, you can create opportunities that others overlook.

This isn’t just a theory—one agent in Virginia closed 40 deals in a single year using this strategy. That’s real business, backed by systems, focus, and a clear understanding of absentee owner motivations.

The Playbook: Three Simple Steps to Success

1. Build Your List

Start by purchasing a database of absentee owners. Tools like Pioneer Data Solution, Mojo Dialing Solutions, or DealMachine can provide targeted leads at a low cost. Cross-check each lead against the Do Not Call registry to ensure compliance. For those on the list, create an email or direct mail campaign to stay on their radar.

2. Make the Call and Open the Door

Reaching out is the heart of this strategy. Whether you dial yourself or hire an inside sales agent, the script is simple:

“I’m working with an investor interested in buying properties in your area. Would you consider an offer for yours?”

Most owners will be curious enough to start a conversation. Even if they don’t sell immediately, they’ll remember your call when they’re ready to make a move.

3. Offer Multiple Solutions

When you secure an appointment, visit the property with three offers in hand:

What they can get as-is.

What they could get with repairs.

A fast, cash offer through you or an investor partner.

This approach ensures you’re positioned as a problem-solver rather than a salesperson. In one year, this method led to six personal property purchases and 34 additional transactions with buyers and investors.

Scaling Your Strategy: From One Deal to Generational Wealth

This method doesn’t just generate leads—it creates an ecosystem of opportunity. Every absentee-owner conversation opens doors to untapped deals, investor relationships, and even personal investments. When done consistently, it can lay the foundation for long-term wealth creation.

The key to success is treating this as a system. Make consistent calls, refine your messaging, and invest in tools to track and follow up.

The Los Angeles Wildfires: A Housing Market on the Brink

Source: Redfin

Devastation and Displacement: The Ripple Effect of Lost Homes

The Palisades and Eaton wildfires have destroyed or damaged 6,354 homes—14% of the properties within the fire perimeters. Of these, 86% were completely destroyed. For context, this loss exceeds the annual number of new single-family permits issued across Los Angeles County.

This destruction is amplifying the region's existing housing crisis. Rental markets are experiencing unprecedented pressure, and displaced homeowners are scrambling to secure living arrangements. With inventory already tight, the fires have triggered a chain reaction of cancellations, relocations, and skyrocketing demand for both rentals and temporary housing.

Rental Markets Heat Up: A Frenzy of Bidding Wars

The demand for rentals has surged, with some properties seeing bids climb to nearly double the asking price. In one extreme example, a $16,000/month rental was bid up to $30,000, with the tenants signing a two-year lease to lock it in. Landlords are converting Airbnbs into long-term rentals, while second-home owners and investors are stepping in to meet demand.

Meanwhile, single-family rentals are vanishing within hours of listing. Families who might typically consider leasing are now exploring purchases as a less stressful, albeit riskier, alternative in an insurance-challenged market.

Buying and Selling: A Market in Chaos

The fires have disrupted buying and selling patterns. Homebuyers are pulling out of deals, with some sellers opting to rent out their homes to displaced residents instead. The uncertainty extends to financing, as many insurers are refusing to write policies for homes near fire-affected areas. The state-run California Fair Plan has become a last resort, but its high costs and limited coverage add complexity to an already strained market.

This insurance gap will likely cool sales further in fire-prone neighborhoods, forcing sellers to recalibrate their expectations and buyers to assess the financial risks.

Digital Demand Surges: Rentals Dominate Online Searches

Rental listing views in Los Angeles County have nearly doubled year-over-year, reaching their highest levels in two years. Google searches for "Los Angeles homes for rent" are up 186% since early January, reflecting the desperation of displaced residents. This surge in demand, coupled with limited supply, is pushing prices higher and fueling bidding wars in both digital and physical markets.

Prayers for Los Angeles.

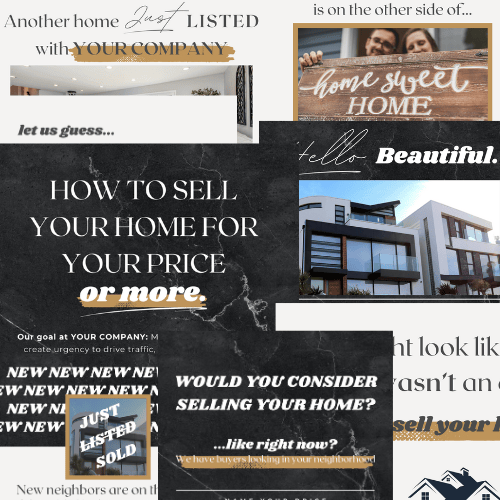

Dominate Your Market with the Postcard Pack

Use these editable postcards to dominate your desired area.

If you’re committed to adding another source of leads to your business, try it out for FREE here.

To your success 💪

Architectural Masterpiece?

This Greenwich, CT home for $3.75M is interesting inside and out, and sits on 4.22 acres!

Check it out 👇

TL;DR (Too Long; Didn’t Read)

Mortgage rates have surged to 7.25% before easing slightly, driven by Federal Reserve hints at potential policy shifts, including rate cuts by mid-2025. Absentee owners remain a valuable opportunity for agents, with tailored outreach unlocking significant deal potential. In Los Angeles, wildfires have destroyed thousands of homes, intensifying rental demand, causing bidding wars, and straining an already tight housing market.

Have a great weekend - we’ll see you next Saturday.

Cheers 🍻

-Market Minds Team