We appreciate each and every one of you for taking the time to read Market Minds. Buckle up and enjoy the free value, and you might hate this week’s house (we’re assuming you enjoy privacy).

Rewriting Real Estate for the Next Decade

The Lock-In Effect: Why Homes Aren’t Moving

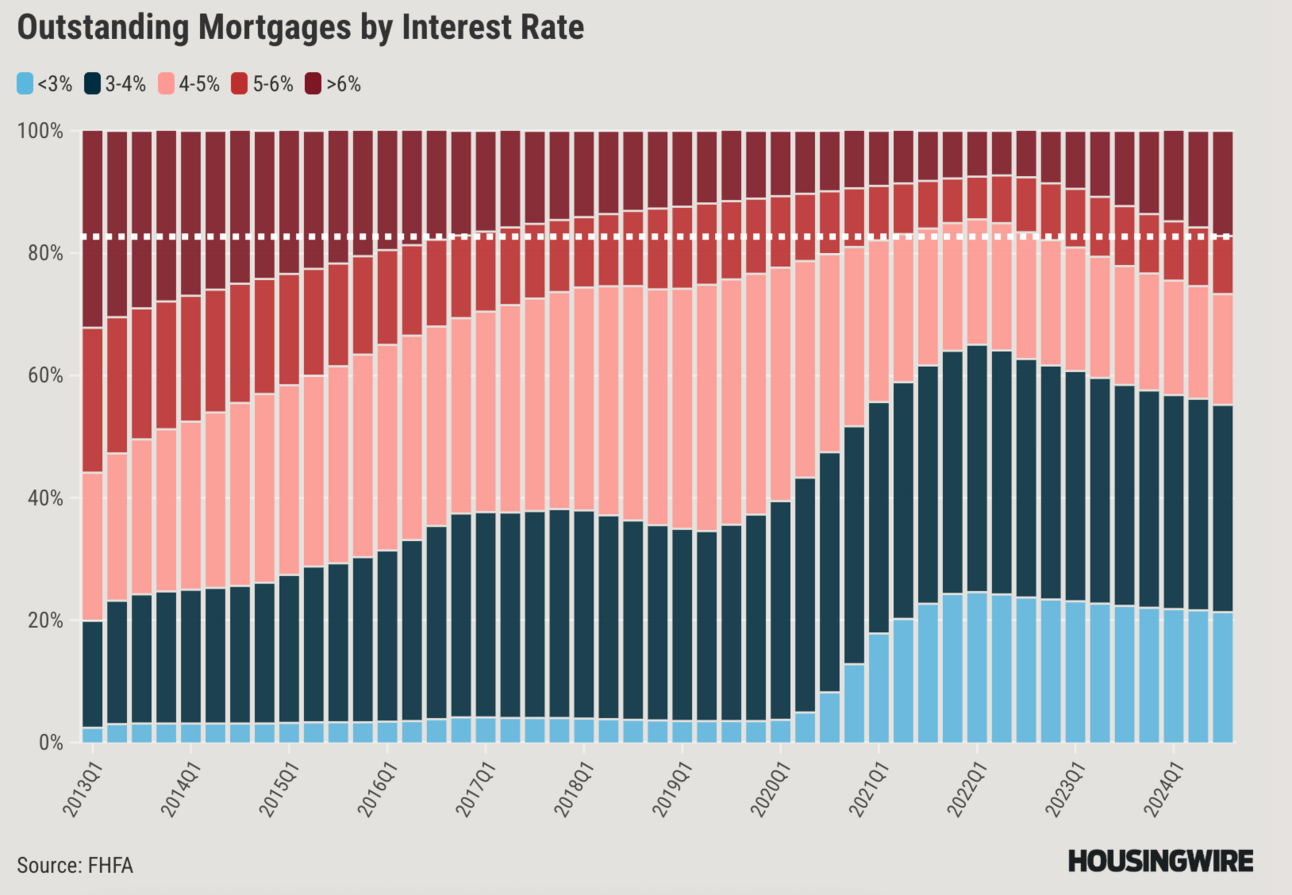

Mortgage rates over 6% are more than a financial pain point; they’re creating a tectonic shift in the housing market. With nearly 17% of U.S. borrowers locked into these higher rates, the once-fluid real estate cycle has stalled. Homeowners with sub-4% rates are staying put, holding on to cheap debt, and inventory is collapsing. The average homeowner now stays in their property for a decade—up from seven years just a decade ago.

This trend leaves buyers stuck in limbo. First-time buyers face a competitive landscape with fewer options, while would-be sellers hesitate, unwilling to sacrifice their low-rate loans. The result? A market chokehold that will take years to unwind.

Higher Rates, Higher Motivation

There’s a counterforce brewing: As mortgage rates climb, homeowners with rates above 6% are more likely to sell. These sellers—often strapped by cash flow or shifting priorities—are poised to gradually release inventory back into the market. Analysts expect the inventory of unsold homes to rise significantly by the end of 2025, potentially returning to pre-pandemic levels. This is where opportunity lies—for those willing to bet on a rebound in transaction volume.

Flat Prices, Rising Affordability

Don’t expect prices to skyrocket. With inventory increasing and demand still tepid due to affordability challenges, home prices are entering an era of flat growth. For investors, this means fewer speculative gains but a more stable market. For buyers, stagnant prices paired with rising incomes may finally bring relief to affordability metrics by decade’s end.

Investor Strategy: From Growth to Stability

The days of flipping properties for outsized returns are fading. Today’s real opportunity lies in buy-and-hold strategies. As rental demand continues to rise and homeownership remains elusive for many, income-generating properties with steady cash flow become the MVPs of a portfolio. Caution: Over-leveraging on high-rate loans could squeeze margins, so look for deals with strong fundamentals and room for adaptability.

The Never-Sell Generation: Boomers Tighten the Housing Squeeze

Source: Shutterstock

A Long-Term Hold: Why Homeowners Aren’t Listing

Redfin’s latest report reveals a seismic shift in homeowner behavior: over a third of homeowners—43% of those over 60—say they never plan to sell. Among those surveyed, more than 60% anticipate staying in their current homes for at least another decade. Baby boomers, with paid-off mortgages and little financial incentive to move, are solidifying this “forever home” trend.

These decisions are reshaping housing dynamics. Homeowners point to financial stability (nearly 40% have minimal or no mortgage payments) and personal contentment (37% simply love their homes) as reasons to stay. While rising home prices deter some, the so-called "mortgage lock-in effect" appears to be fading, with only 18% citing low mortgage rates as a key factor.

Inventory at a Breaking Point

Housing inventory is under siege, with turnover hitting record lows. In the first eight months of 2024, just 25 out of every 1,000 homes changed hands—the lowest rate in three decades. Despite a year-end rally, total sales remain far below historical norms, leaving markets under-supplied and creating fierce competition for buyers.

While inventory has seen modest improvements—active listings rose 22% year-over-year in December—over half of those homes have been on the market for more than 60 days. This reflects a pool of overpriced or less desirable properties rather than a true increase in high-demand housing stock.

Boomer Lock-In: A Double-Edged Sword

Baby boomers are the cornerstone of this inventory challenge. Nearly 60% have lived in their homes for over two decades and are mortgage-free, giving them little reason to sell. Their reluctance to move creates ripple effects across the housing market, particularly for younger buyers struggling to enter a market with limited supply.

But the trend isn’t absolute. Listings are increasing, albeit slowly, and rising home prices could eventually nudge more retirees to cash out. The key will be identifying motivated sellers—those driven by life events like downsizing, relocation, or financial necessity.

Out-of-State Investors: The New Geography of Real Estate Wealth

Source: SFR Analytics

Non-Local Buyers: A Persistent Force in Residential Real Estate

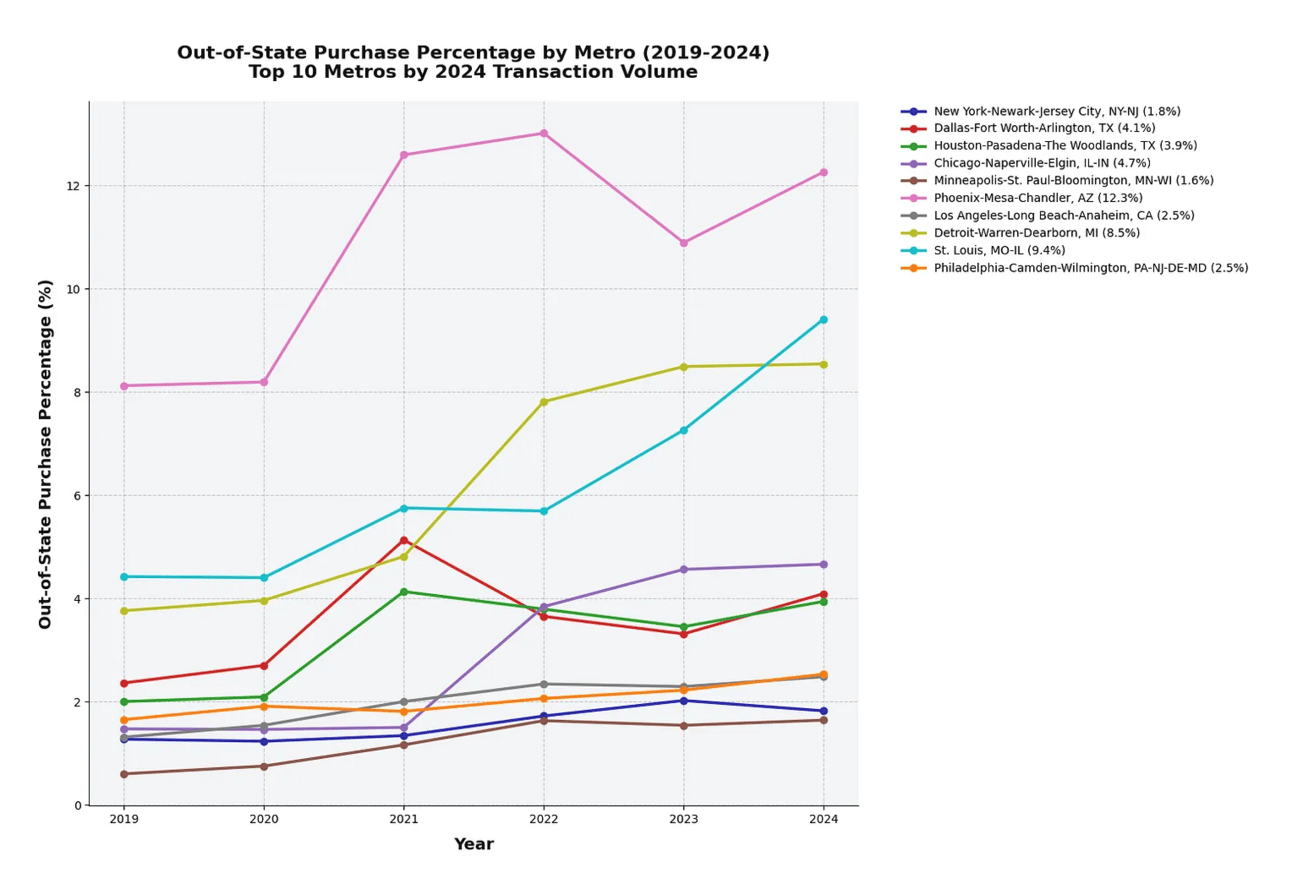

Out-of-state investors accounted for 6.96% of all single-family home purchases in 2024. While down slightly from 2023’s 7.12% and 2021’s peak of 8.82%, this is still well above the pre-pandemic norm of 5.8%. The numbers reveal a fundamental shift: non-resident investment is no longer a trend but a key pillar of market dynamics. These buyers are shaping markets nationwide, especially in metros where inventory tightens and affordability challenges locals.

Rising Stars: Rust Belt Markets on the Radar

Markets in traditionally industrial areas, such as Rochester, are undergoing a renaissance, with out-of-state purchases increasing 220%. These buyers are betting on affordable price points, improving economies, and overlooked opportunities. This shift highlights a growing appetite for secondary markets, where lower entry costs and potential for growth make them ripe for returns.

Phoenix to Minneapolis: A Tale of Two Extremes

The disparity among metros is striking. In Phoenix, 12.3% of all residential transactions involved non-local buyers, reflecting its enduring allure for investors. Meanwhile, Minneapolis sits at just 1.6%, showcasing how market fundamentals and local demand can drastically alter the investor landscape.

Cooling in Austin: A Shift in Strategy

Austin’s star has dimmed for out-of-state investors, with declining activity coinciding with falling rental prices. Formerly a magnet for West Coast capital, the city is now facing scaled-back portfolio expansion. This signals a recalibration in investor priorities, favoring cash flow stability over speculative growth.

Vacation Markets Dominate, but Some Stay Local

Florida leisure hotspots, such as Lake Havasu, lead the nation in out-of-state buyer concentration, with over one-third of transactions driven by non-residents. By contrast, regions like California’s Central Valley and Wisconsin show stronger local dominance, emphasizing the interplay between market type and investor interest.

Who’s Buying? The Players Behind the Numbers

Out-of-state buyers fall into three primary categories:

Corporate Investors dominate a third of transactions, often deploying large-scale capital.

Individual Portfolio Builders are expanding rental holdings, buoyed by stable rents and long-term appreciation potential.

Vacation Property Buyers target leisure markets, particularly in Florida, signaling sustained demand for second homes.

FREE Step-by-Step Playbook to Running Seller Lead Campaigns on Google (No Opt-In Required)

Ready to supercharge your lead generation? Our Free Google Ads Seller Lead Playbook is exactly what you need to get there. This comprehensive guide breaks down step-by-step strategies that leverage Google Ads to bring in high-quality seller leads—without the guesswork.

You’ll get the proven tactics on crafting ads we use and spend $1M+/year on. Plus, it’s completely free, so you can start implementing these high-impact strategies today without any upfront cost.

To your success 💪

The Glass House

This Fisher Islands, NY home is listed at $5.2M and is quite literally called the glass house - very fitting (because it never ends) 😂

Check it out 👇

TL;DR (Too Long; Didn’t Read)

The real estate market is undergoing significant shifts due to high mortgage rates, with homeowners holding onto low-rate loans and inventory collapsing to historic lows. While this "lock-in effect" has created challenges for buyers and sellers, rising rates could motivate higher-rate homeowners to sell, potentially increasing inventory by 2025. Baby boomers, with paid-off mortgages and little financial incentive to move, are further tightening supply, impacting younger buyers. Meanwhile, out-of-state investors remain a key force, focusing on secondary markets and stable cash-flow opportunities, while traditional hot spots like Austin see declining activity.

Have a great weekend - we’ll see you next Saturday.

Cheers 🍻

-Market Minds Team