We appreciate each and every one of you for taking the time to read Market Minds. Buckle up and enjoy the free value, and you won’t want to miss the home the indestructible retreat…

The housing market is kicking off 2025 with two dominant narratives: persistent affordability challenges and a cautious rebound in seller activity. Let’s dissect the insights and what they mean for your real estate strategy.

Affordability: The Ever-Elusive Dream

Mortgage rates have climbed back above 7%, with monthly payments hitting an unprecedented $2,290. While a few Southern markets have seen marginal price dips, national affordability remains at crisis levels. The prospect of meaningful relief hinges on interest rate cuts, but there’s no guarantee they’ll materialize this year.

The takeaway? Buyers are adapting, but many are priced out. Watch for creative financing solutions to play a bigger role as inventory builds slightly in certain markets. Seller concessions and rate buydowns could become the norm, particularly in regions feeling the affordability pinch.

Inventory Trends: A Glimmer of Hope?

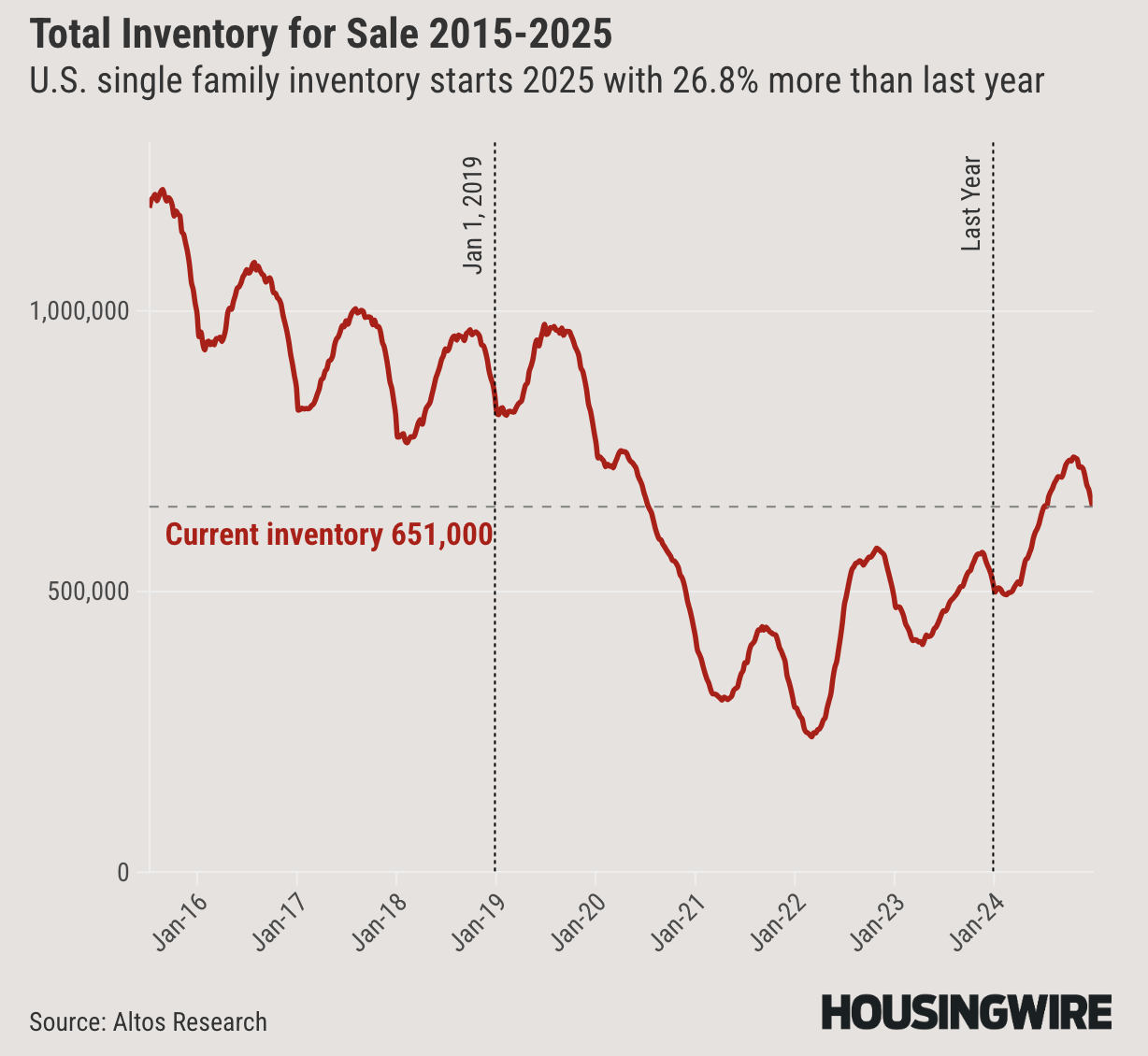

After years of historically low inventory, 2025 begins with 26.8% more homes on the market than last year. But here’s the catch: this uptick is uneven. Sun Belt cities lead the inventory growth while Northern markets remain tight. The volume of new listings is higher compared to recent years, but it’s still not enough to shift the needle significantly.

What to monitor: The number of “immediate sales” (homes snapped up upon listing) is at its lowest since the pandemic. Sellers are creeping back into the market, but buyers aren’t rushing to meet them at current rates.

Prices and Pending Sales: An Unyielding Market

Home prices nationally are up 4% year-over-year, defying expectations. With affordability in the spotlight, you’d expect price cuts to gain traction—but only 36% of listings show reductions, a slight increase from last year. Pending sales are showing modest growth, up 4.25% from 2024 levels, indicating that buyers are still active, albeit cautiously.

Insight: Sellers clinging to aspirational pricing may face longer wait times. Leverage this moment to highlight realistic pricing strategies to your clients—properties priced competitively will attract serious buyers in a tough lending environment.

Join Our FREE Community!

Join our exclusive network of innovation-driven real estate agents and investors, designed to accelerate your growth and SCALE exponentially.

Prices rise as the community grows, so lock in your lifetime rate by joining now.

We’ll see you on the inside 💪

Amazon’s $47K Tiny Home: A Luxury Shift in Affordable Living

Source: Canva Pro

The housing market is always evolving, but sometimes a seismic shift arrives in a compact, 600-square-foot package. Amazon’s latest luxury tiny home offering isn’t just a viral product—it’s a signal of where affordability, sustainability, and lifestyle preferences are converging. This is more than a trend; it’s a business opportunity wrapped in steel and glass.

Affordable Meets Aspirational

At $47,500, the two-story home by SEQ International is priced well below the $406,100 median home price, offering a significant reprieve for buyers squeezed by affordability concerns. Yet, it comes with a dose of luxury—a rooftop deck, glass sunroom, and customizable options that allow for up to four bedrooms. It’s a compelling alternative for buyers priced out of traditional homes or looking for a second property.

This affordability extends beyond just purchase price. Tiny homes have smaller footprints, reduced energy costs, and lower long-term expenses—making them doubly attractive to eco-conscious buyers.

While the base price is appealing, there’s more beneath the surface. Buyers must secure land, navigate permitting processes, and invest in essentials like foundations, plumbing, and electricity, adding $10,000–$15,000 to the initial cost. Insurance could also pose challenges, with policies often more expensive and complex than those for traditional homes.

Understanding these layers helps position these homes as a solution for specific types of buyers—those willing to navigate the trade-offs for the rewards of minimal living.

Big Players Betting on Tiny

Amazon’s move isn’t just about tiny homes; it’s about reshaping how we think about housing. Major retailers like Home Depot and Amazon are making pre-fabricated homes mainstream, addressing affordability without sacrificing modern design. This could unlock new buyer demographics: remote workers seeking simplicity, retirees looking to downsize, or younger generations embracing alternative housing.

Opportunities in the New Normal

The success of Amazon’s tiny homes underlines a broader shift: buyers are searching for affordable housing options in a constrained market. This opens doors for those ready to think differently, whether it’s investing in land tailored for tiny home developments, offering services to streamline permits and installations, or even creating partnerships to build communities tailored to this lifestyle.

As the housing market continues to strain under affordability challenges, Amazon’s $47K tiny home is a timely reminder that where some see limitations, others see potential.

America’s Renters Are Staying Put

Source: Inman

A fundamental shift is occurring in the U.S. rental market, with renters moving less frequently than ever before. The reasons are complex—skyrocketing homeownership costs, stagnant rent prices, and demographic factors—but the implications are clear: mobility is declining, and the rental market dynamics are evolving in ways that demand a fresh approach.

A Third of Renters Now Stay Five Years or Longer

According to Redfin’s latest analysis, 33.6% of U.S. renters have lived in the same home for at least five years, up from 28.4% a decade ago. For renters aged 56 and older, over a third (34.1%) have stayed in the same home for more than a decade. These long-term renters are anchoring stability into markets that once thrived on turnover.

This trend represents a fundamental recalibration in how rental properties perform. Tenants are no longer just transient; they’re becoming semi-permanent, which reshapes rent growth potential and the frequency of turnover expenses.

High Housing Costs Are Cementing Renters in Place

Home prices have risen significantly in the past decade, and mortgage payments have nearly tripled. For renters, this means buying a home is increasingly out of reach, making staying put the most viable option. Pandemic rent spikes have leveled off, and a surge in new apartment construction has kept rent prices relatively flat over the past two years.

For those renting in high-cost cities like New York and Los Angeles, even the cost of moving—such as rental broker fees—acts as a deterrent to mobility. The result? More tenants are sticking with their current leases, slowing the pace of market churn.

Generational Mobility Gaps Are Growing

Younger renters, particularly Gen Z, remain the most mobile, with over half having lived in their homes for less than a year. This mobility often ties to education, career shifts, or life transitions. In contrast, baby boomers are increasingly entrenched in their rentals, with 56% having stayed for at least five years.

This bifurcation creates opportunities to tailor strategies based on tenant profiles. Younger renters demand flexibility and trendy amenities, while older renters value stability and long-term comfort.

The 2025 Rental Market: What’s Ahead

With 2025 shaping up as a renter’s market thanks to a record influx of new apartment inventory, the stability among renters creates opportunities to rethink acquisition and leasing strategies. High turnover is no longer a given, and neighborhoods with lower mobility rates may see reduced vacancy rates but also slower rent growth. This nuanced landscape demands an adaptive approach, leveraging data to target high-yield renter demographics and capitalizing on the preferences of long-term tenants.

An Indestructible Retreat

This Santa Moninca, CA home is listed at $3.995M. Constructed from concrete, steel, and glass, it’s a house you won’t want to miss…

Check it out 👇

TL;DR (Too Long; Didn’t Read)

The 2025 housing market faces affordability challenges with mortgage rates above 7% and rising monthly payments, pricing many buyers out despite a slight inventory rebound led by Sun Belt cities. Amazon’s $47K tiny home highlights the growing demand for affordable, sustainable housing, offering opportunities for innovation in land development, permitting, and community building. In the rental market, mobility is declining as renters stay put due to high housing costs and flat rent growth, reshaping market dynamics and creating opportunities to cater to both younger, mobile tenants and long-term renters. Navigating these shifts requires adaptive strategies to address evolving buyer and renter preferences.

Have a great weekend - we’ll see you next Saturday.

Cheers 🍻

-Market Minds Team