We appreciate each and every one of you for taking the time to read Market Minds. Buckle up and enjoy the free value, and you won’t want to miss the house of the week if you can appreciate architecture…

Home Equity: The Game-Changer in Real Estate Today

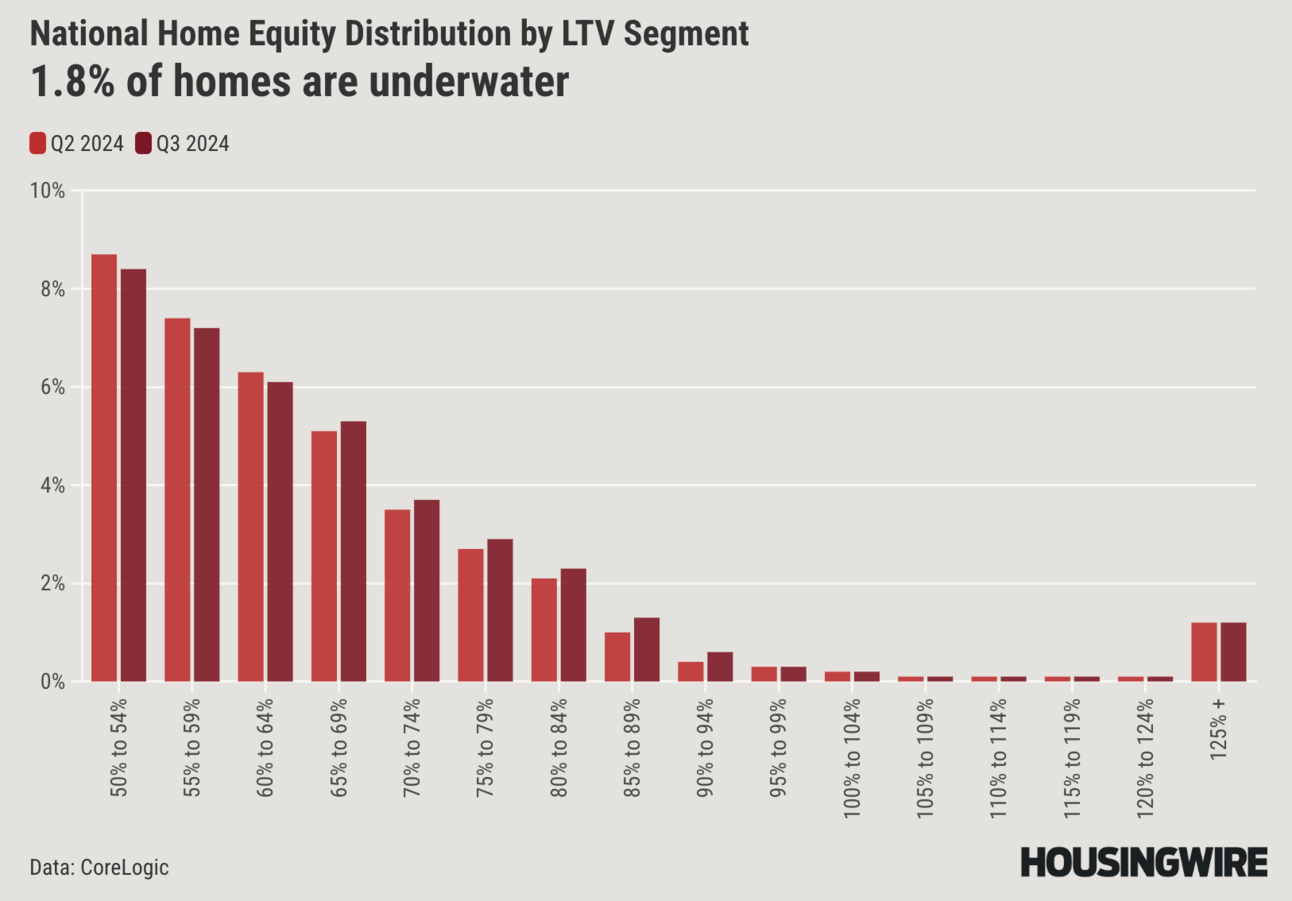

Source: Housing Wire

The CoreLogic Q3 Homeowner Equity Insights report paints a refreshingly optimistic picture for the housing market. Unlike the dark days of 2010 when nearly a quarter of American homeowners were underwater, today only 1.8%—or 990,000 homes—fall into that category. This is a seismic shift that opens doors for sellers and creates a resilient buffer against economic downturns. Let’s dig into why this matters.

The Return of Equity-Driven Sellers

For years, underwater mortgages froze sellers in place, a crisis that peaked after 2008 when distressed sales flooded the market and eroded property values. Today’s landscape is different: nearly 40% of homes in the U.S. are owned outright, and among those with mortgages, equity levels are soaring. This means sellers who’ve been sitting on the sidelines, especially those deterred by high interest rates, are increasingly likely to enter the market as rates stabilize. The equity they’ve built isn’t just a safety net—it’s buying power.

Down Payments Tell a Different Story

The median down payment for U.S. buyers today is 18%—a stark contrast to the single-digit figures seen during the housing bubble. This trend reflects not only stricter lending standards but also the financial health of recent buyers. With robust equity cushions, these homeowners are better positioned to weather economic storms and pivot when they need to buy or sell.

The Credit Renaissance

Another overlooked advantage in today’s housing market is the strength of U.S. homeowner credit. Unlike the pre-2008 period, when risky loans flooded the system, today’s homeowners boast solid FICO scores and stable loan terms. This adds a layer of security to the market, reducing the likelihood of widespread foreclosures even during economic downturns.

What Lies Ahead

As mortgage rates eventually trend downward, the potential for increased inventory looms large. Homeowners sitting on considerable equity can sell without fear of financial ruin, paving the way for new market dynamics. What does this mean for you? When interest rates ease, the surge in supply could meet pent-up buyer demand, sparking a new era of mobility and opportunity in the housing market.

Claim Your 7-Day Free Trial (if you’re serious about growing your business…)

Join our exclusive network of innovation-driven real estate agents and investors, designed to accelerate your growth and SCALE exponentially.

Prices rise as the community grows, so lock in your lifetime rate by joining now.

We’ll see you on the inside 💪

4 Real Estate Predictions for 2025: A Roadmap for a Rebound

Source: Inman

The National Association of Realtors’ (NAR) Real Estate Forecast Summit delivered a cautiously optimistic outlook for 2025, offering insights from leading economists and key industry players. Here's what you need to know as you prepare for a new chapter in real estate.

Mortgage Rates Will Trend Toward 6%

Mortgage rates are set to settle near the 6% range, thanks to continued Federal Reserve rate cuts aimed at reducing inflation. While a return to pre-pandemic rates of 4-5% is unlikely, economists agree that 6% represents a stabilizing benchmark for affordability and market activity. This trend could unlock the pent-up demand from buyers and sellers who have been sidelined by higher borrowing costs.

Home Equity Powers a Remodeling ‘Supercycle’

Homeowners are thriving, with rising equity and historically low mortgage delinquencies. This surge in equity—combined with aging housing stock—has sparked what experts are calling a “supercycle” in home renovations. Expect heightened demand for remodeling services and investment opportunities in markets with an older housing inventory.

First-Time Buyers Face an Uphill Climb

Affordability challenges remain a critical barrier for first-time buyers, with the median age for entering the market now at an all-time high of 38. Rising rents, persistent student debt, and limited starter home inventory mean younger buyers will struggle to make the leap. The ripple effect? A growing share of multigenerational and pooled-purchase buyers reshaping the market dynamic.

Regional Growth: The South and Midwest Heat Up

Markets like Charlotte, Indianapolis, and San Antonio are poised for robust growth, driven by positive migration trends, job creation, and relative affordability. These regions offer significant upside for those seeking higher transaction volumes and expanding demand for medium-density housing such as townhomes.

2025 Rental Market Outlook: A Competitive Landscape Takes Shape

Source: Zillow

The November 2024 Rental Market Report from Zillow hints at a shifting rental market dynamic as 2025 approaches. While rents saw modest seasonal dips, the data suggests a more competitive landscape may emerge, especially as new construction cools and demand intensifies. Here’s what you need to know to stay ahead in the rental game.

Rents Show Resilience Despite Seasonal Slowdown

The typical U.S. rent in November was $1,983, up 3.4% year-over-year, but down 0.2% month-over-month—a seasonal trend that historically signals a temporary cooldown. Interestingly, the month-over-month trend turned positive earlier than expected, a signal of rising demand heading into 2025. Single-family rents outpaced multifamily, growing 4.4% year-over-year compared to 2.4% for apartments, reflecting ongoing strength in larger, family-friendly rental options.

The Rise (and Potential Decline) of Concessions

Nearly 39% of rental listings offered concessions in November, the highest on record. However, the pace of growth in concessions has slowed, with only a marginal 0.9 percentage point increase from October. As new apartment deliveries dwindle and competition heats up in 2025, expect landlords to roll back incentives like free months of rent or reduced deposits. This trend is likely to favor markets with strong job growth and limited inventory expansion.

Renters Face Growing Affordability Challenges

The median household now spends nearly 30% of income on rent, up from the pre-pandemic average of 27.2%. The income required to afford rent has surged 33% since 2019, climbing to $79,301 annually. In markets like Miami, New York, and Los Angeles, affordability pressures are even greater, with renters dedicating over 37% of their income to housing. This affordability pinch will keep renters locked in longer, favoring landlords in high-demand areas while limiting turnover.

New Construction Boom Slows, Market Tightens

While 2024 saw a historic influx of new apartments, that surge is already retreating. The number of new building permits has plummeted, indicating a slowdown in future supply. This shift means the soft rent growth seen in 2024 will likely dissipate by late 2025 as competition for available units increases. Multifamily rent growth is forecast to rise from 2.4% in November to 2.8% over the year, while single-family rents will moderate slightly, growing at 4.1% compared to 4.4%.

Shifting Demographics Redefine the Market

Renting is increasingly becoming a long-term solution for families and older adults. Zillow’s Consumer Housing Trends Report reveals that renters are aging, with more families—including those with pets—opting for rentals. This trend highlights the enduring appeal of single-family rentals and family-friendly amenities in apartments, such as larger floor plans, green spaces, and community features. Catering to these needs will be key in capturing this growing demographic.

An Architect’s Dream

This Carmel Valley, CA home is listed at $4.995M looks like it’s straight out of a movie…

Check it out 👇

TL;DR (Too Long; Didn’t Read)

The real estate market is thriving due to high homeowner equity, stricter lending standards, and stabilizing mortgage rates around 6%, encouraging more sellers to enter the market. Remodeling activity is surging, regional growth is strongest in the South and Midwest, and cautious new-home construction continues despite policy challenges. In the rental market, demand is increasing while new construction slows, leading to tighter supply and rising rents. Demographic shifts toward families and older adults favor single-family rentals and family-friendly amenities.

Have a great weekend - we’ll see you next Saturday.

Cheers 🍻

-Market Minds Team