We appreciate each and every one of you for taking the time to read Market Minds. Buckle up and enjoy the free value, and you won’t want to miss the home that you better hope doesn’t get any hail…

Why the ‘Silver Tsunami’ Won’t Cure the Housing Crisis

Source: BAM

Housing headlines often swirl with the hope of a “silver tsunami”—the idea that aging homeowners will vacate their properties en masse, solving the affordability crisis. But like a wishful wave dissipating before shore, the reality is far more complex. Here’s why this theory doesn’t hold water and what that means for your portfolio.

Where the Homes Are—and Where the People Aren’t

The data tells a story of misalignment. Zillow’s latest findings reveal that while 20.9 million households in 2022 were empty nesters—up from 20.2 million in 2017—their properties are concentrated in regions with lower housing demand. Think Pittsburgh (22% of households are empty nesters) or Buffalo (20%), not Austin or Seattle where job-seekers and younger buyers are flocking.

Even if a mass sell-off occurred, these homes wouldn’t move the needle where inventory is critically short: high-cost coastal metros with robust job centers.

The Growing Divide

Here’s the kicker: Empty nest households have grown by nearly 700,000 since 2017, but families doubling up with relatives (a likely indicator of housing need) are up over 500,000 in the same timeframe. That’s 2.6 times as many empty-nester homes as families in need—a tantalizing imbalance for those hoping for relief. Yet, geographic realities keep these populations from syncing up.

The Real Solution Lies in Supply, Not Redistribution

The grim truth? Relying on a generational handoff of homes won’t fix the housing squeeze. Housing affordability hinges on new construction, particularly in dense urban hubs where demand outpaces supply. But that’s easier said than done. Builders face barriers from zoning restrictions to escalating material costs.

What It Means for You

A shifting demographic landscape creates opportunity. While the empty nesters’ homes may not ease urban affordability, they could reshape demand in suburban and rural markets. Investors should watch for emerging migration patterns fueled by remote work and affordability pressures. Agents? You might find opportunity not in helping buyers “trade up” but in carving niche strategies around resales in overlooked markets.

Claim Your 7-Day Free Trial (Limited Time Only)

Join our exclusive network of innovation-driven real estate agents and investors, designed to accelerate your growth and SCALE exponentially.

Prices rise as the community grows, so lock in your lifetime rate by joining now.

We’ll see you on the inside 💪

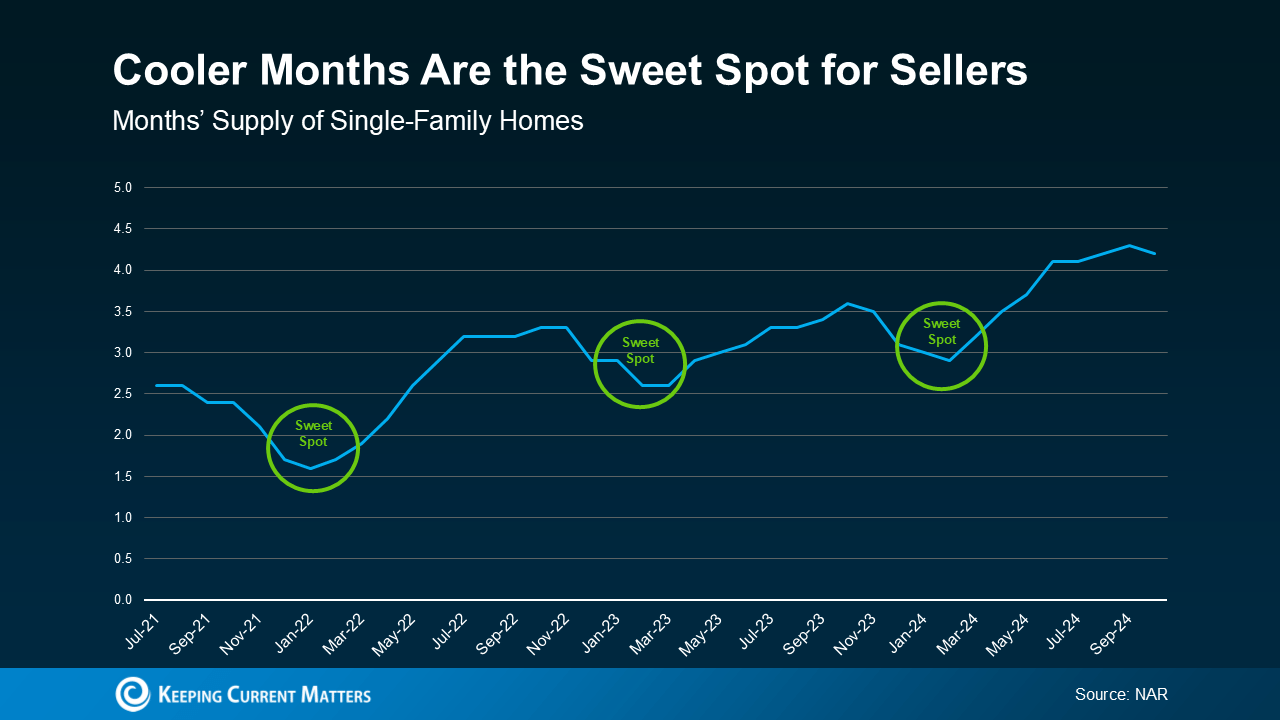

Why Winter is the Real Estate Sweet Spot You’ve Been Overlooking (Send This To Your Sellers)

Source: KCM

While most sellers are holding off for the spring surge, the strategic move is to act now. Winter isn’t just a cold season; it’s a hot opportunity. Here’s why timing your sale for the cooler months could give you the edge you need.

Fewer Listings, Bigger Spotlight

The winter months consistently see a dip in housing inventory, as the data from the National Association of Realtors confirms. This annual lull means buyers have fewer options, making your property stand out. Even with inventory levels higher this year than in previous winters, listing now positions your home in a less crowded market, maximizing its visibility and appeal.

Serious Buyers Only

Forget casual browsers—winter buyers are the real deal. Motivated by factors like job relocations, lease deadlines, or end-of-year tax planning, these shoppers are ready to make decisions. Unlike spring’s parade of window-shoppers, winter buyers are focused and prepared to move quickly, which puts you in the driver’s seat for negotiations.

Beat the Spring Wave

By listing before the seasonal influx of spring properties, you sidestep direct competition and avoid the price wars that can erode your margins. It’s about seizing control of the market rather than waiting for it to dictate your strategy.

The Window Won’t Stay Open Forever

Winter gives you a rare advantage: a motivated audience with less distraction from competing listings. Acting now isn’t just a good idea; it’s the smarter play. Get ahead of the curve, capture demand while it’s concentrated, and make your move before the floodgates open in spring.

When Innovation Turns Sour: The Rise and Fall of EasyKnock

Source: Inman

Not all disruptions in real estate end with a tidy exit or an acquisition. Sometimes, they unravel into lawsuits and closures, as we’ve seen with EasyKnock. Here’s what its implosion tells us about the challenges of navigating innovative but risky business models in real estate.

From Funding Success to Legal Fallout

EasyKnock launched in 2016 with a promising pitch: sale-leaseback solutions for cash-strapped homeowners. Backed by significant funding, including a $57.2 million Series C in 2021 with investors like Zillow co-founder Spencer Rascoff, the platform seemed poised for long-term success. But behind the glossy funding announcements were consumer lawsuits and enforcement actions that eroded trust. Allegations ranged from predatory practices to undervaluing homeowner equity, putting the company at odds with regulators across multiple states.

The Business Model Breakdown

EasyKnock’s value proposition was to buy homes from owners who needed cash but couldn’t qualify for traditional financing, allowing them to lease the property back with an option to repurchase later. While innovative on paper, critics argued this approach preyed on vulnerable homeowners. Several cases documented scenarios where homeowners received far less than their equity was worth, turning EasyKnock’s model into a lightning rod for scrutiny.

What This Means for Real Estate

The closure highlights the importance of balancing innovation with ethics. As financing models evolve, the potential for misaligned incentives grows. EasyKnock’s rapid downfall is a cautionary tale about ensuring that solutions for distressed homeowners genuinely add value without exploiting their circumstances.

The Bigger Picture: Trust is Everything

The lesson here is that no amount of funding can shield a company from the consequences of broken trust. Real estate depends on reputation and transparency. When trust erodes—whether due to legal challenges or perceived exploitation—the entire house of cards can collapse.

This isn’t just a story about EasyKnock. It’s a reminder to evaluate opportunities critically, understanding not just the upside but the risks inherent in disrupting a market as personal and foundational as homeownership.

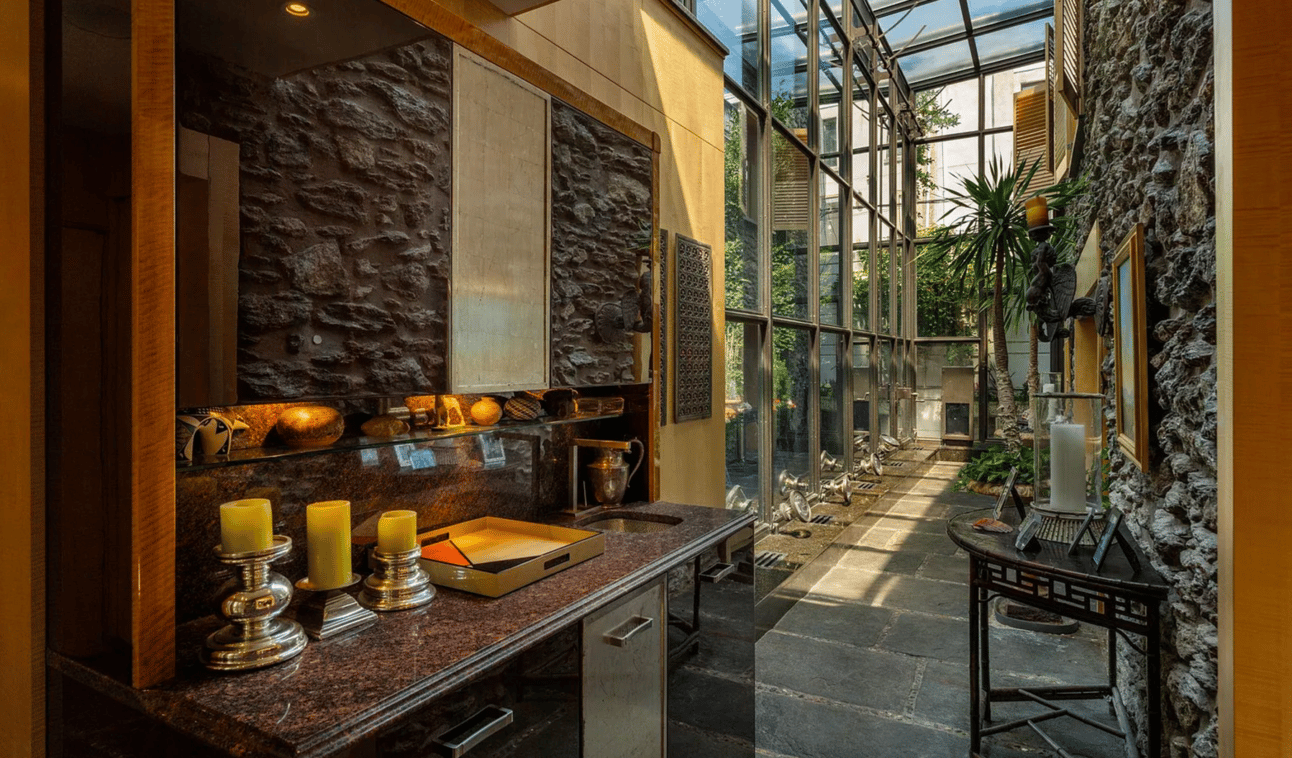

A Magical Retreat

This Philadelphia, PA home is listed at $2.5M, and has far too many features to list. Just read the listing description…

Check it out 👇

TL;DR (Too Long; Didn’t Read)

The housing crisis won’t be solved by a “silver tsunami” of aging homeowners selling their properties, as these homes are often in low-demand areas, not urban markets where inventory is needed. Winter, however, offers sellers a unique opportunity with less competition and motivated buyers, making it a smart time to list. Meanwhile, EasyKnock’s collapse underscores the risks of prioritizing innovation over ethics, as its sale-leaseback model eroded trust and faced regulatory backlash. Together, these insights highlight the importance of strategic timing, ethical practices, and thoughtful solutions in real estate.

Have a great weekend - we’ll see you next Saturday.

Cheers 🍻

-Market Minds Team