We appreciate each and every one of you for taking the time to read Market Minds. Buckle up and enjoy the free value, and if you’re a professional organizer, your next client awaits in this week’s listing (don’t look if you’re a minimalist).

When Rent Eats Your Paycheck, Co-Buying Offers a Way Out

Source: KCM

Affordability Crisis Meets Creative Ownership

Here’s the reality: Housing affordability is at a breaking point. According to a Redfin report, more than one in five renters in the U.S. say their entire paycheck goes to rent, leaving little room for savings, let alone the dream of homeownership. With home prices still historically high and mortgage rates squeezing budgets, even well-qualified buyers feel stuck.

But there’s a silver lining. For those ready to think outside the box, co-buying is emerging as a powerful strategy. By sharing costs and responsibilities, buyers can break into the housing market and create new opportunities—whether that’s affording a better home, generating rental income, or building equity instead of paying rent.

Co-Buying: The Affordability Game-Changer

Co-buying—where friends, family members, or even like-minded partners join forces to buy property—has become a viable solution for many aspiring homeowners. Nearly 15% of Americans have already co-bought, and nearly half would consider it, according to recent surveys.

Here’s why:

Sharing Costs: Split the down payment, monthly mortgage, and upkeep, reducing individual financial strain.

Affording a Better Home: Co-buyers can pool resources to buy a larger or higher-quality property than they could afford individually.

Building Equity Together: Unlike renting, co-buying allows all parties to build wealth, creating a path toward financial freedom.

Passive Income Potential: Co-buyers can turn properties into rental opportunities, creating a steady cash flow.

For renters who feel trapped, co-buying isn’t just an option; it’s a lifeline.

Why Co-Buying Works in Today’s Market

The affordability squeeze is driving many renters to reconsider their options. Instead of funneling every paycheck into rent, co-buyers can shift their spending toward homeownership. This strategy becomes especially appealing as rents stabilize but remain high, making the idea of “buying power in numbers” more attractive than ever.

For agents, the rise of co-buying introduces a new type of client: one that is collaborative, resourceful, and highly motivated. Investors, too, should pay attention to this trend. Co-buyers bring greater purchasing power to competitive markets, potentially stabilizing price ceilings in key neighborhoods.

Challenges to Watch For

While co-buying can be a game-changer, it’s not without risks. Misaligned expectations and unclear agreements can create friction down the road. Here’s what you—and your clients—need to consider:

Legal Agreements: It’s essential to draft a co-ownership agreement that outlines ownership shares, responsibilities, and exit strategies. This protects everyone involved if circumstances change.

Financial Clarity: Buyers need to ensure all parties are transparent about their finances, credit scores, and long-term goals.

Emotional Dynamics: Co-buying can strain relationships, especially if responsibilities or costs feel unevenly distributed. Encourage buyers to discuss these issues upfront.

Market Volatility: Shared ownership can amplify risks during downturns. Buyers need to prepare for unforeseen challenges like refinancing or selling during tough market conditions.

Bottom Line: Co-Buying’s Edge in an Unaffordable Market

When rents consume entire paychecks, and traditional homeownership feels out of reach, co-buying offers a way forward. It’s a creative, collaborative strategy that helps renters transition into buyers, unlocking financial freedom and access to better opportunities.

For you, this shift presents a golden opportunity. Educate your clients, anticipate their challenges, and position yourself as the expert who can turn their co-buying vision into reality.

Claim Your 7-Day Free Trial (Limited Time Only)

Join our exclusive network of innovation-driven real estate agents and investors, designed to accelerate your growth and SCALE exponentially.

Prices rise as the community grows, so lock in your lifetime rate by joining now.

We’ll see you on the inside 💪

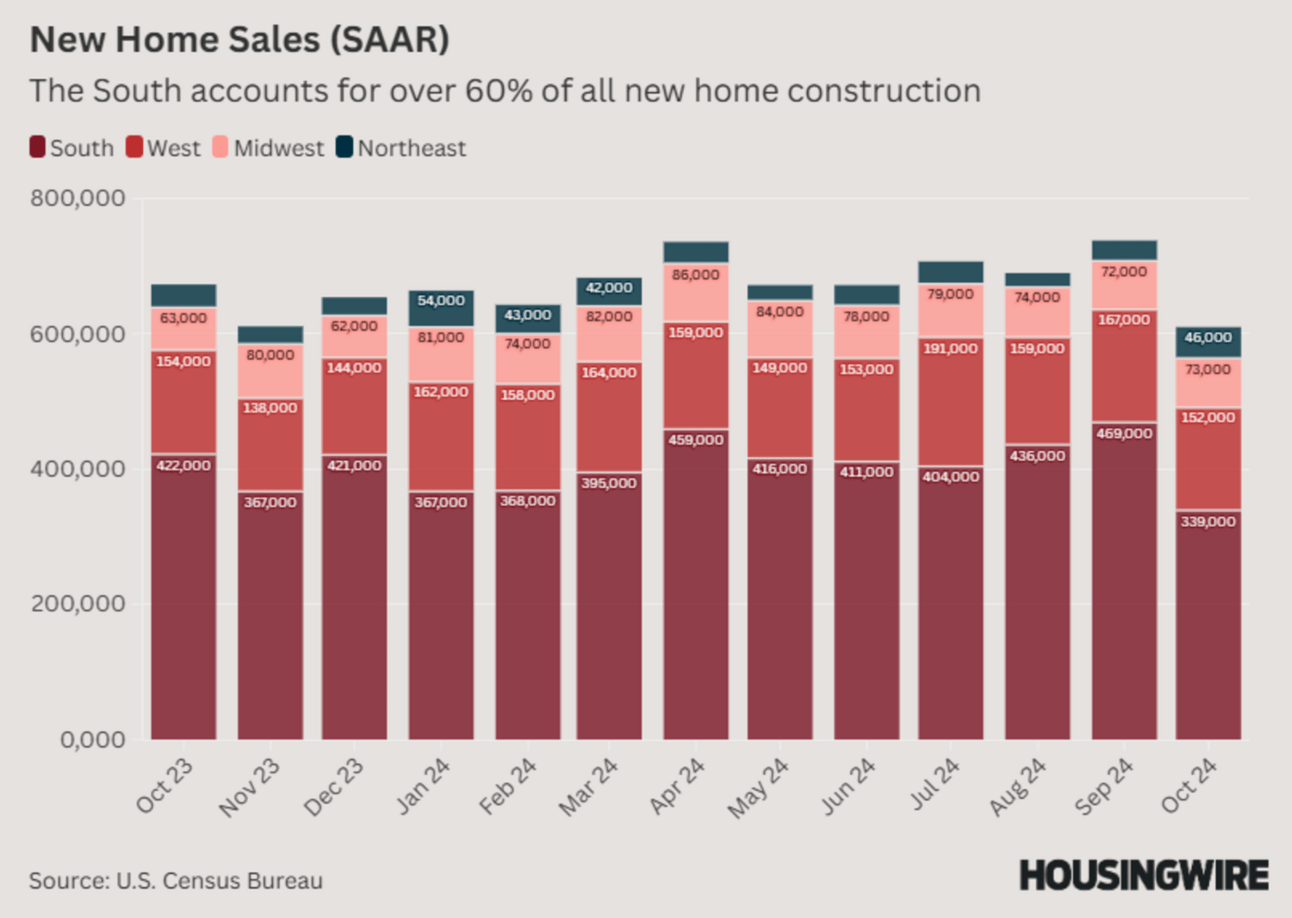

The South, Hurricanes, and Rates: Untangling the Latest Housing Market Numbers

Source: HousingWire

New Home Sales Drop, But Context is Key

A 17.3% decline in new home sales from September to October sent shockwaves through headlines, but the story beneath the numbers offers a different perspective. Southern states, accounting for nearly 40% of housing market activity, bore the brunt of this dip, influenced by recent hurricanes and the region’s susceptibility to rising mortgage rates. Excluding the South, new home sales actually rose 8% year-over-year—proving regional trends can significantly skew national data.

Southern Markets Feel the Pressure

The South, known for its dynamic growth, now grapples with a perfect storm of challenges: escalating mortgage rates, skyrocketing property taxes, and climbing home insurance premiums. The region also leads in inventory growth, with Texas and Florida alone representing a significant share of the national supply. For buyers and sellers, this creates a double-edged sword—more options, but less purchasing power as financing costs surge.

Housing Supply Holds Firm Amid Volatile Demand

Despite volatile sales, inventory remains robust, with 481,000 new homes on the market, representing a 9.5-month supply—well above pre-pandemic norms. Homebuilders have been mitigating demand drops by actively buying down rates, which, while helping sales, continues to cap profit margins and delay significant rebounds in housing starts.

What to Watch Next

Mortgage rates hold the key. A sustained decline toward 6% could stabilize the market, encouraging homebuilders to ramp up starts and keeping construction teams employed as the backlog of existing projects dwindles. For now, higher rates and regional disparities mean the recovery will remain uneven, with the South’s performance acting as the bellwether for national trends.

Stay nimble, read the data critically, and focus on local market dynamics. The national numbers rarely tell the full story—especially when hurricanes and rates cloud the horizon.

Lessons From a Banana

Source: Inman

Value Lies Beyond the Transaction

Just like a $6.2 million duct-taped banana isn’t about the fruit, your work in real estate isn’t merely about listings and offers. The true value lies in the story you tell, the trust you build, and the expertise you bring. Buyers and sellers don’t pay for transactions; they invest in the moments and milestones you help create. Recognize that your worth isn’t in the mechanics—it’s in the magic you deliver.

Create a Narrative That Commands Attention

Maurizio Cattelan’s banana wasn’t just a stunt; it was a story that challenged norms and sparked conversation. Your narrative as a real estate professional must do the same. Are you simply another agent, or are you a trusted guide transforming the experience? Define and own your unique value proposition, and let your story set you apart in a competitive market.

Know Your Audience and Lean Into Boldness

Cattelan’s audience—collectors who value the provocative—saw the banana as priceless. Similarly, not every client will immediately grasp your worth, and that’s fine. Focus on those who appreciate your expertise and professionalism. Boldly articulate your value, even when competitors overpromise. Your authenticity and confidence will resonate with the right audience.

Buzz Builds Credibility

The media buzz around Cattelan’s art amplified its perceived value, supported by his reputation as a daring artist. In real estate, your buzz comes from testimonials, thought leadership, and social proof. Building a credible, buzz-worthy reputation will position you as an essential, sought-after professional in your market.

Perception Drives Success

A banana taped to a wall showed us that value is all about perception, not the object itself. In real estate, your success hinges on how clients perceive you—not as a transaction facilitator but as a creator of experiences, a protector of investments, and a visionary advisor. When you embrace your unique value and share your story boldly, you don’t just close deals—you redefine the market.

Life’s most meaningful moments are sold, not bought. Position yourself as indispensable, and you’ll thrive far beyond the next transaction.

The Clutter Doesn’t End Here…

This Roanoke, VA home is listed at $1.35M, but the buyers may need to have a flexible schedule to allow the sellers to move all this sh*t…

Check it out 👇

TL;DR (Too Long; Didn’t Read)

Housing affordability challenges are pushing many renters to reconsider homeownership, with co-buying emerging as a creative solution. By pooling resources, buyers can share costs, afford better homes, build equity, and even generate rental income. Meanwhile, regional housing market trends, such as those in the South affected by rising rates and natural disasters, highlight the importance of localized strategies over national averages. Finally, success in real estate lies beyond transactions—it’s about crafting a compelling narrative, building trust, and positioning yourself as an indispensable advisor who delivers transformative experiences.

Have a great weekend - we’ll see you next Saturday.

Cheers 🍻

-Market Minds Team