We appreciate each and every one of you for taking the time to read Market Minds. Buckle up and enjoy the free value, and you won’t want to miss the postcard estate for a hefty price tag…

Year-over-Year Price Growth Slows, Market Faces Tipping Point

Source: MarketWatch

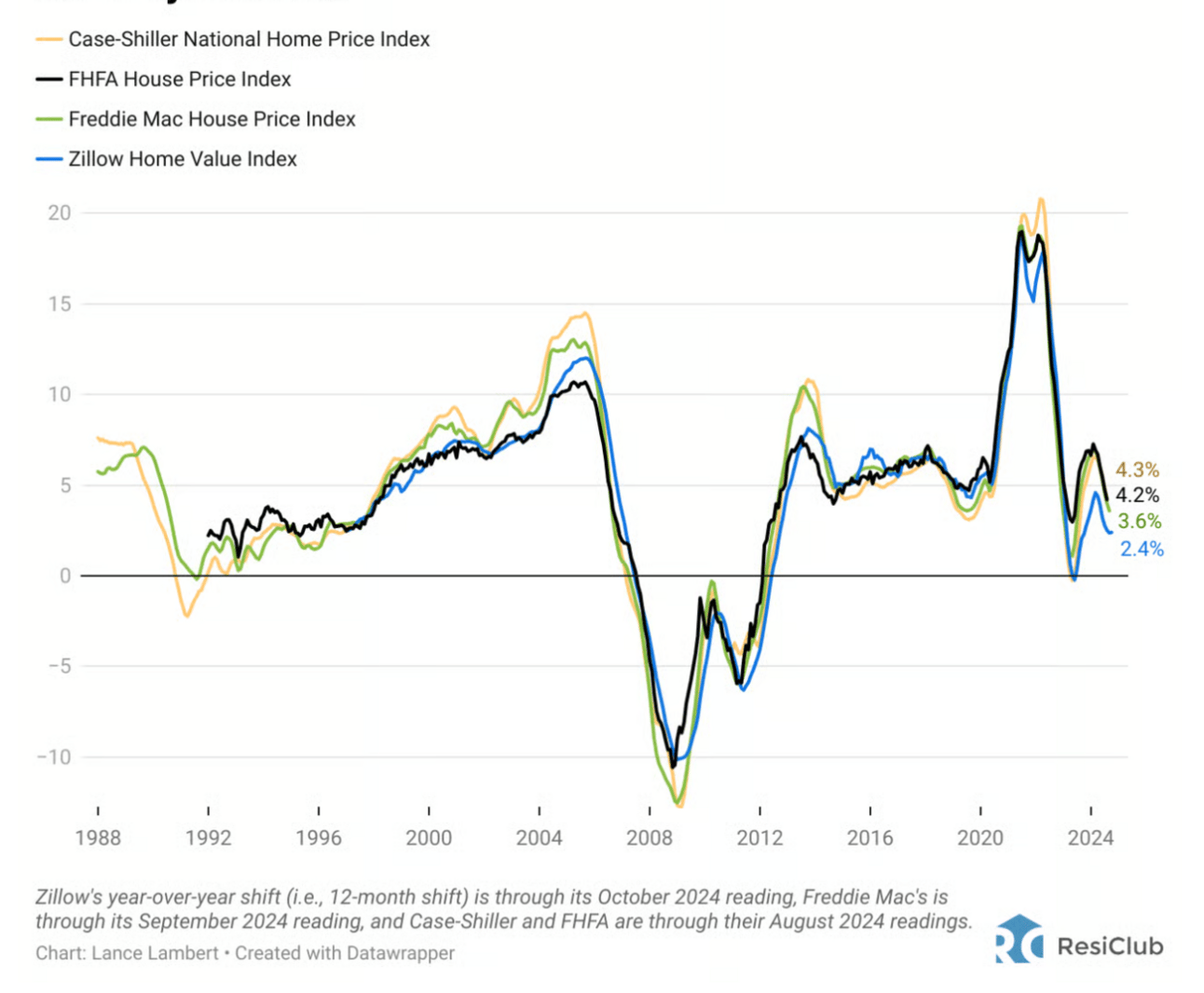

The U.S. housing market is cooling—and the data confirms it. While national home prices continue to rise year-over-year, the pace has significantly decelerated. Case-Shiller, FHFA, Freddie Mac, and Zillow each show a slowing growth trajectory. For real estate agents and investors, the message is clear: the rules of engagement in this market are shifting.

Active Inventory: The Silent Market Shifter

After a turbulent 2022 correction, particularly in overheated Western markets, 2023 brought stability. But now? The Sun Belt markets are showing signs of stress again. Elevated mortgage rates (hovering near 7%) and stretched affordability are the primary culprits. Coupled with competitive builder incentives like rate buydowns, inventory in the resale market is creeping upward year-over-year—a sharp pivot from the record-tight conditions we saw post-pandemic.

Why You Should Be Watching Early 2025 Like a Hawk

As we inch toward the spring selling season, months-of-supply metrics will be your leading indicator. If active inventory climbs faster than seasonal norms or refuses to decline as expected, brace for potential national price declines. Deceleration might find its floor—or plunge into outright reversal. This could redefine investment strategies heading into the second half of 2025.

What About the Numbers Behind the Numbers?

Zillow’s October reading underscores the shifting landscape: home values fell 0.3% month-over-month—less than typical seasonal strength, which averages flat. Yet, since the pandemic’s onset, home prices remain 44.6% higher. For investors, the takeaway? Despite short-term weakness, long-term resilience has been stunning, particularly for properties acquired during the early pandemic boom.

Claim Your 7-Day Free Trial (Limited Time Only)

Join our exclusive network of innovation-driven real estate agents and investors, designed to accelerate your growth and SCALE exponentially.

Prices rise as the community grows, so lock in your lifetime rate by joining now.

We’ll see you on the inside 💪

Buyers Are Back: Post-Election Home Tours and Mortgage Locks Surge

Source: Redfin

Post-Election Bounce: A Glimmer of Demand Amid High Rates

The dust from the election has barely settled, and homebuyers are already coming out of hibernation. Redfin’s Homebuyer Demand Index surged over 15% this past weekend to levels not seen in nearly 18 months. While early data (Nov. 7–11) suggests a demand uptick, it remains to be seen if this is a fleeting reaction or the start of sustained momentum. Mortgage-rate locks, a key signal of intent, more than doubled from a month prior—despite rates hovering near July’s peak levels.

Unleashing Pent-Up Demand: Election Uncertainty Lifts

The election was a psychological hurdle. Almost a quarter of prospective first-time buyers surveyed in October delayed their plans, waiting for political uncertainty to resolve. Now, with the Fed implementing its second consecutive rate cut, confidence is returning. For some, waiting isn’t worth it. Even with mortgage payments close to their all-time highs and stubbornly inflated home prices, the promise of stability post-election has reactivated a segment of buyers.

Pending Sales Rise: A Lagging but Promising Signal

Pending home sales, often a rearview mirror indicator, rose 4.7% year-over-year in the four weeks ending Nov. 10. If the post-election demand persists, expect pending sales to pick up further in the coming weeks. While the momentum is encouraging, Chen Zhao, Redfin’s economic research lead, tempers expectations: activity is still calibrated to 7% mortgage rates. The lesson? Recovery is cautious, not exuberant.

What Sellers Need to Know: Listing Trends Are Cooling

On the selling side, new listings are flat year-over-year—breaking the streak of increases seen earlier in 2024. Over the past month, listings have eked out gains of less than 1% for three of four weeks. Translation: while demand is recovering, sellers aren’t flooding the market yet, which could sustain price stability for those listing now.

Zillow’s Playbook: The Future of Real Estate is Here, and It’s Digital

Source: HousingWire

Leverage or Liability? Zillow’s Expanding Mortgage Empire

Zillow’s mortgage revenue soared 63% year-over-year in Q3 2024, driven by an 80% increase in purchase loan origination to $812 million. With an annualized $3.2 billion mortgage business, Zillow isn’t just a tech titan—it’s positioning itself as a formidable player in mortgage lending. This should make every agent and investor sit up: Zillow’s strategy intertwines its mortgage services with its real estate ecosystem.

Flex Leads and Flex Costs: Zillow’s High-Stakes Agent Game

The Enhanced Markets program, now in 43 U.S. markets, is Zillow’s crown jewel. Agents in this program pay no upfront fees but surrender up to 40% of their commissions. While leads come ready to transact, agents are also nudged to steer clients toward Zillow Home Loans. For top-performing agents, the payoff is worthwhile. But for the broader agent pool? Zillow’s high stakes could erode profitability. Agents should weigh whether this dependency is a partnership—or a trap.

Data Power: Zillow’s Funnel Outpaces Competitors

With 233 million unique monthly users across platforms, Zillow’s unmatched reach fuels its Enhanced Markets. While many users are “looky-loos,” Zillow is laser-focused on funneling serious buyers into transactions. Their tech stack, combining tools like ShowingTime and Follow Up Boss, strengthens conversions. But agents and brokers must ask: How much control are you willing to hand over to Zillow’s ecosystem?

A Postcard Estate

This Alexandria, VA home is one of the most expensive homes we’ve included, but it is truly stunning. Is all of this worth the $60M price tag?

Check it out 👇

TL;DR (Too Long; Didn’t Read)

The U.S. housing market is cooling, with year-over-year price growth slowing significantly as high mortgage rates and affordability challenges drive inventory increases, particularly in Sun Belt markets. Post-election, buyer demand has surged, with mortgage-rate locks and pending sales rising, though new listings remain flat, sustaining price stability for now. Zillow continues to expand its influence, with growing mortgage revenue and its Enhanced Markets program offering leads in exchange for significant commission splits, prompting agents to reassess their dependence on Zillow's ecosystem.

Have a great weekend - we’ll see you next Saturday.

Cheers 🍻

-Market Minds Team