We appreciate each and every one of you for taking the time to read Market Minds. Buckle up and enjoy the free value, and you won’t want to miss the house of the week if you take extreme pride in your landscaping…

Creative Financing Tactics for Buyers Battling High Mortgage Rates

Source: Yahoo! Finance

With mortgage rates inching closer to a gut-wrenching 7%, today’s homebuyers are discovering just how creative they need to be to get a deal that fits. A recent Zillow survey reveals that nearly half of recent buyers managed to secure rates below 5% in a market where the cost of a mortgage has shot up by over 100% since pre-pandemic days. Let’s break down how these savvy buyers are sidestepping conventional approaches and what it could mean for your own strategy.

Creative Deal-Making in a High-Rate Market

To outsmart the high-rate environment, buyers are leveraging unconventional financing tools:

Special financing and rate-dependent offers: Roughly one in three buyers relied on special financing, while 26% made offers contingent on rate reductions.

Support networks: Friends and family play a role, too; 28% of buyers benefited from financial help, while one in four buyers refinanced quickly to secure better terms.

This environment is pushing both buyers and sellers to explore financial alternatives that would have been left on the table in calmer times. Think of these moves as a new form of currency for getting deals done.

ARMs, Short-Term Loans, and ‘House Hacking’ Rise in Popularity

The survey shows a clear trend: buyers with rates between 4% and 5% are going for adjustable-rate mortgages (ARMs), shorter-term loans, and “house hacking”—using rental income to improve loan eligibility. Among this group:

60% tapped projected rental income to help meet lender requirements.

57% chose ARMs, taking on short-term risk for lower upfront rates.

65% opted for shorter-term loans, like 15-year mortgages, compared to 45% of all buyers.

Buyers and agents are increasingly using projected income and flexible loans to lower their effective mortgage rates, an adaptive tactic that helps make ownership achievable, even amid rising rates.

Key Strategies for Buyers and Agents in Today’s Market

Zillow’s advice for buyers facing high rates? Don’t settle for default options. If you’re a buyer or advising one:

Credit improvement: Boosting credit can shave points off your rate.

Rate buydowns and mortgage points: These are back in vogue as effective cost-saving mechanisms.

Down payment adjustments: A larger upfront investment can mean long-term savings on interest.

Explore less traditional loan types: ARMs, mortgage points, and rental income are rapidly becoming essential parts of the real estate lexicon again.

If you’re advising a client or considering an investment, know that the days of the straightforward 30-year fixed mortgage are on pause. This is a period where flexibility, financial creativity, and a deep understanding of evolving financing tools will set you apart in a competitive market.

October Jobs Report: Signs of a Slowing Economy

Source: HousingWire

The October jobs report offers a snapshot of an economy in flux, with fewer gains than anticipated, and clear shifts in the types of jobs added. For real estate investors and agents, understanding the nuances behind these numbers is essential for navigating market conditions that could sway interest rates, buyer sentiment, and property values.

Unprecedented Hiring Slowdown: A Warning for Investors

October saw only 12,000 new jobs, marking the lowest growth since December 2020, a significant departure from the past year’s average monthly gains of nearly 194,000. Health care and government jobs led the modest gains, while manufacturing took a hard hit, losing 46,000 jobs—a signal that sectors tied to discretionary spending are experiencing real turbulence. Slowing job growth could foreshadow consumer hesitation, impacting sectors like retail real estate and residential leasing as potential buyers and tenants rethink big financial commitments.

Construction’s Resilience – But For How Long?

The construction sector continued to add jobs, with 8,000 new roles in October. However, residential construction added only 1,300 positions, while residential specialty trades shed 6,600. This trend suggests resilience in the commercial and industrial real estate segments, while residential builders may begin feeling the pinch. The good news: sectors linked to infrastructure and commercial projects appear steady, with non-residential specialty trade contractors adding 14,300 positions. Still, residential developers should watch for signs of decelerating demand as consumers and investors assess ongoing interest rate impacts.

Interest Rate Relief Ahead? Not So Fast.

With October’s jobs data undershooting expectations, economists expect the Federal Reserve to cut rates again soon—likely by 25 basis points. For real estate, lower rates typically spark buyer interest, particularly in the residential sector, yet volatility in job creation can temper demand. The report’s modest real estate sector gains (1,300 jobs, with only 600 tied to real estate roles) hint at an industry holding steady but facing reduced momentum.

For agents and investors, this report emphasizes the importance of preparing for potential shifts in client behavior. A slower job market could mean delayed buying decisions and longer lease negotiations, while continued rate adjustments provide opportunities for savvy refinancing and portfolio balancing.

As this “new normal” of economic uncertainty unfolds, anticipate a real estate market where flexibility and a finger on the pulse of macro trends are not just advantages—they’re necessities.

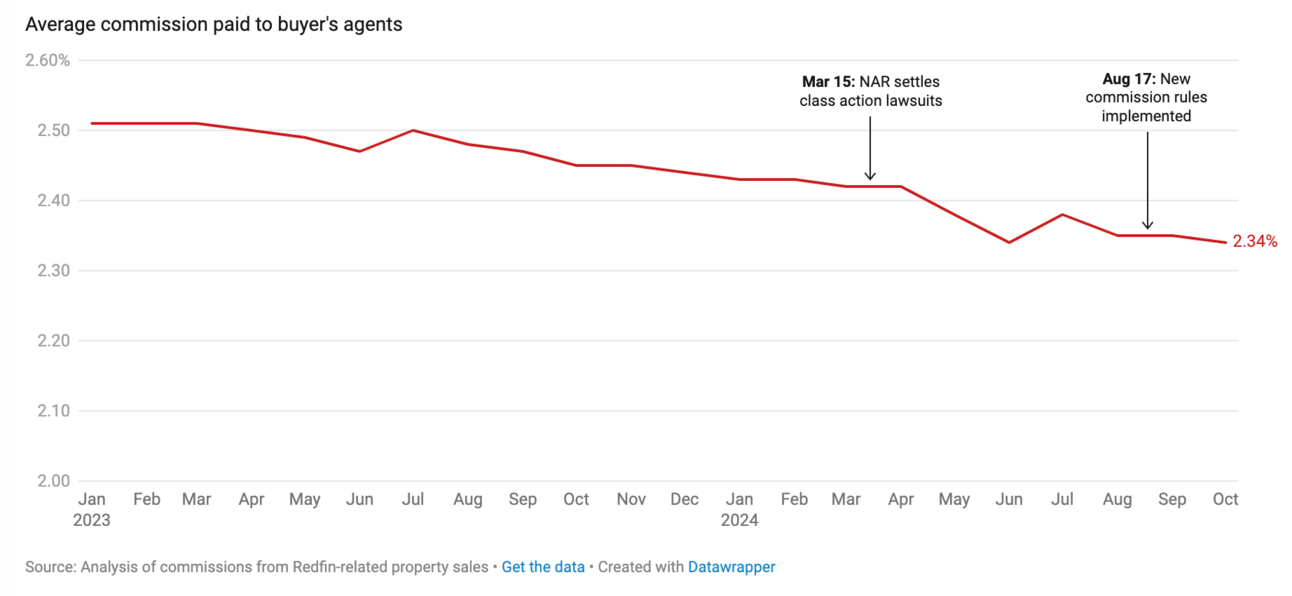

Buyer Agent Commissions: Holding Steady Post-Rule Change, But Shifts Could Be Ahead

Source: Redfin

The recent data on buyer’s agent commissions shows subtle but telling adjustments in response to the August 17 changes from the National Association of Realtors (NAR). With commissions holding around 2.34% on average since the new rules, it’s a waiting game to see whether this trend will solidify or shift as more buyers and sellers adapt to a new norm in real estate transactions.

Slight Increases for Lower-Priced Homes, Declines for High-End Properties

Buyer’s agent commissions for homes listed under $500,000 have ticked up slightly, reaching 2.43% in October, while those for homes listed above $1 million have seen pressure, dropping to an average of 2.11%. This could hint at a future where lower-end listings sustain or even see slight increases in commission to attract agents, while high-end sellers, with properties that sell quickly, feel empowered to negotiate down.

New Rules Mean More Negotiation on Fees

A key change agents are reporting? Increased upfront discussions around commission fees. While sellers traditionally covered buyer agent fees, some are now opting to hold back, negotiating terms as part of offers instead. In competitive markets, the flexibility to negotiate is becoming a strategic tool—one that agents may need to guide sellers through if they hope to attract robust buyer interest without inflating costs.

Market Shifts Could Put Downward Pressure on Commissions in 2025

As both agents and clients settle into the new system, expect further negotiation to play out based on property demand. For homes that attract strong offers, buyers may cover more of the agent’s commission, while less popular listings may prompt sellers to increase commission offers to appeal to buyer agents. If economic conditions bring a resurgence in bidding wars, this trend could accelerate, especially in higher-demand markets.

For real estate professionals, the takeaway here is that transparency is paramount. Educating clients early on about commission structures and using flexibility as leverage can help secure deals in this shifting environment. Commissions, while steady for now, could face downward pressure in certain markets in 2025—being prepared to navigate these conversations effectively could be your edge.

FREE Step-by-Step Playbook to Running Seller Lead Campaigns on Google (No Opt-In Required)

Ready to supercharge your lead generation? Our Free Google Ads Seller Lead Playbook is exactly what you need to get there. This comprehensive guide breaks down step-by-step strategies that leverage Google Ads to bring in high-quality seller leads—without the guesswork.

You’ll get the proven tactics on crafting ads we use and spend $1M+/year on. Plus, it’s completely free, so you can start implementing these high-impact strategies today without any upfront cost.

To your success 💪

“Highly Landscaped”

This Brownsville, TX home may just be exactly what you’re looking for if you have weekends free to do nothing but landscaping 😂

Check it out 👇

TL;DR (Too Long; Didn’t Read)

With mortgage rates around 7%, homebuyers are adopting creative financing tactics to secure affordable deals. Many are leveraging unconventional tools like special financing, adjustable-rate mortgages (ARMs), shorter-term loans, and projected rental income to combat high mortgage costs. Economic indicators, such as a slowdown in job growth, signal potential caution in real estate demand, affecting sectors differently, with residential construction showing vulnerability. Additionally, changes in buyer-agent commission structures following new NAR rules are leading to more fee negotiations, with lower-end listings seeing slight commission increases and high-end properties experiencing reductions.

Have a great weekend - we’ll see you next Saturday.

Cheers 🍻

-Market Minds Team