We appreciate each and every one of you for taking the time to read Market Minds. Buckle up and enjoy the free value, and you won’t want to miss the house of the week…

The Federal Reserve’s Next Move: A New Wave of Opportunity in Real Estate?

Why a Federal Funds Rate Cut Could Unlock the Market

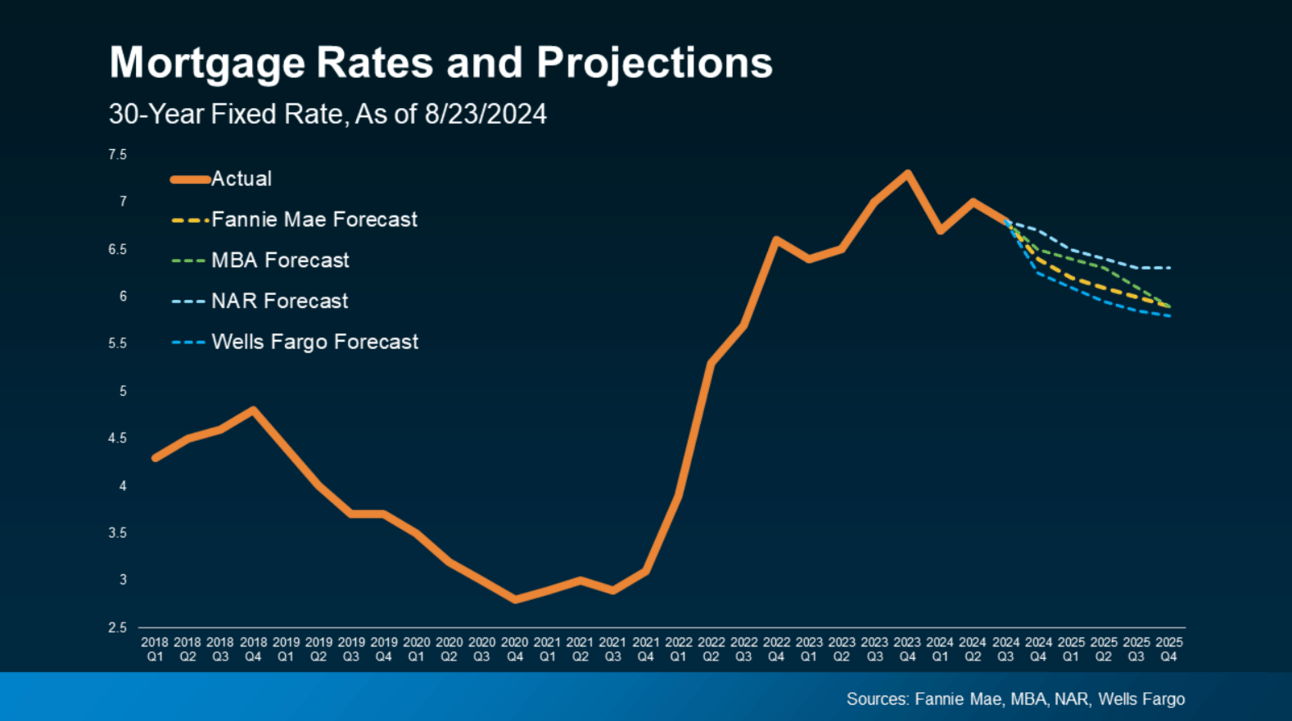

The Federal Reserve is poised to cut interest rates soon, with leading economists expecting a series of reductions through 2025. While a rate cut might not immediately send mortgage rates plummeting, it could set the stage for a gradual decline, a critical shift for real estate agents and investors looking to navigate a cooling market.

Easing the Lock-In Effect: Sellers Back in Play

One of the biggest challenges in today’s market has been the “lock-in effect,” where homeowners feel trapped in their homes by ultra-low mortgage rates secured in previous years. A modest rate reduction may encourage some homeowners to reconsider listing their properties, especially if they’ve been reluctant to give up their current favorable mortgage terms. But don’t expect a flood of new listings—many sellers will remain cautious about leaving behind historically low rates.

Buyer Activity Set to Surge

On the buyer side, any dip in rates, no matter how incremental, makes homes more affordable. Investors and buyers who’ve been sitting on the sidelines due to high borrowing costs might start dipping their toes back into the market. However, agents should be prepared for a market where pent-up demand doesn’t necessarily meet new supply—meaning the right property strategies will be key.

The Long Game for Mortgage Rates

Experts predict that this potential Federal Funds Rate cut won’t be a one-off. According to projections, a series of cuts could lead to six to eight reductions through 2025, helping to slowly but steadily bring down mortgage rates. This is crucial for real estate investors thinking long-term and planning their next move in an uncertain market.

What Real Estate Pros Should Do Now

Timing the market is always tricky, and while mortgage rates might dip, the exact trajectory is unpredictable. Investors and agents need to stay ahead of the curve by partnering with clients now to prepare for shifts in the market. Real estate opportunities won’t fall out of the sky, but those who plan for moderate rate declines could capitalize on the potential buying frenzy to come.

Multifamily Goldmine: The Coming Supply Crunch and What It Means for Investors

Source: The Real Deal

Construction Slowdown: A Landlord's Dream?

Multifamily construction is significantly cooling down after a pandemic-induced surge, with starts dropping 22% year-over-year in July, and down 41% from their April 2022 peak. After years of developers racing to meet skyrocketing demand, financing is drying up, and the pace of new builds is slowing to a crawl. With fewer units entering the market in the coming years, the current glut could give landlords the chance to regain pricing power and drive rents upward.

Supply Meets Demand: Rent Hikes on the Horizon

We’re heading toward the highest level of multifamily completions since the 1980s, with 610,000 units set for delivery this year. But the future tells a different story—completions are expected to sharply decline over the next two years, potentially putting pressure on supply. As new deliveries dry up, landlords could see rents rise as demand continues to outpace supply. A market correction is coming, and those with existing assets are poised to benefit.

Institutional Investors Are Betting Big

The smart money is already moving in. Institutional heavyweights like KKR, Brookfield, and Blackstone have made billion-dollar bets on the multifamily sector in 2023, positioning themselves to capitalize on future rent increases. In June, KKR closed a record $2.1 billion deal for 18 apartment complexes, signaling confidence in the sector’s long-term profitability.

What Does This Mean for Investors?

As new construction slows and demand remains strong, multifamily investors could see a significant boost in rental income and property values. For those holding multifamily assets, now is the time to prepare for future rent hikes and capitalize on reduced supply. And for potential buyers, this upcoming slowdown in new deliveries presents a limited-time opportunity to enter the market before competition heats up again.

Jobs Report Signals Opportunity: What the Cooling Labor Market Means for Real Estate

Source: Inman

Cooling Job Growth: A Double-Edged Sword for Real Estate

The August jobs report delivered weaker-than-expected job growth, with only 142,000 nonfarm payrolls added, and sharp downward revisions to previous months' estimates. This has renewed recession fears but has also pushed mortgage rates down, a potential lifeline for real estate agents and investors. Fewer jobs could signal a slower economy, but the flip side is that falling mortgage rates may spur buyer interest and ease some market pressures.

Mortgage Rates Drop as Job Market Stumbles

Mortgage rates often track with bond yields, and as investors seek the safety of bonds amid recession worries, rates on 30-year fixed mortgages dropped to 6.26%, down a full percentage point from their April 2024 peak of 7.27%. Lower rates are a gift to buyers who've been priced out by high borrowing costs, but the real opportunity lies in capturing buyer demand before the Fed makes any more aggressive rate cuts, which could fuel a market resurgence.

Federal Reserve Poised to Cut Rates Further

The Fed's potential shift in policy could have a profound impact on the real estate market. Futures markets are pricing in a 75% chance of a 25-basis-point rate cut at the Fed’s September meeting, with further reductions likely through 2025. As the job market cools, more aggressive cuts—up to 2.75 percentage points by mid-2025—are on the table, signaling a likely reduction in borrowing costs for both homebuyers and developers. Agents and investors should prepare for a period of lower financing costs and renewed market activity.

Rising Unemployment: Risk or Opportunity?

While the unemployment rate ticked down slightly in August to 4.2%, experts believe this is a temporary dip, with job losses expected to accelerate. The "Sahm Rule" indicates a recession may already be underway, with unemployment likely rising to 5% in the next year. For the real estate sector, this means both opportunity and risk. On the one hand, lower mortgage rates could revive buyer interest; on the other, rising unemployment may dampen consumer confidence.

How Agents and Investors Should Prepare

The job market’s slowdown presents a critical juncture for real estate professionals. As mortgage rates fall, there will be a window for increased buyer activity—but this may be short-lived if unemployment rises significantly. Now is the time to advise clients on locking in lower rates and making strategic investments before broader economic conditions tighten further. Adaptability will be key in capitalizing on this evolving market.

Grow With Us!

Join our exclusive network of innovation-driven real estate agents and investors, designed to accelerate your growth and SCALE exponentially. Connect with top-tier professionals and access game-changing resources curated from the industry's best—ready for you to implement TODAY.

Our dynamic, tiered pricing model ensures your investment holds its value; prices rise as the community grows, so lock in your lifetime rate by joining now.

We’ll see you on the inside 💪

So How Do You Pull In…?

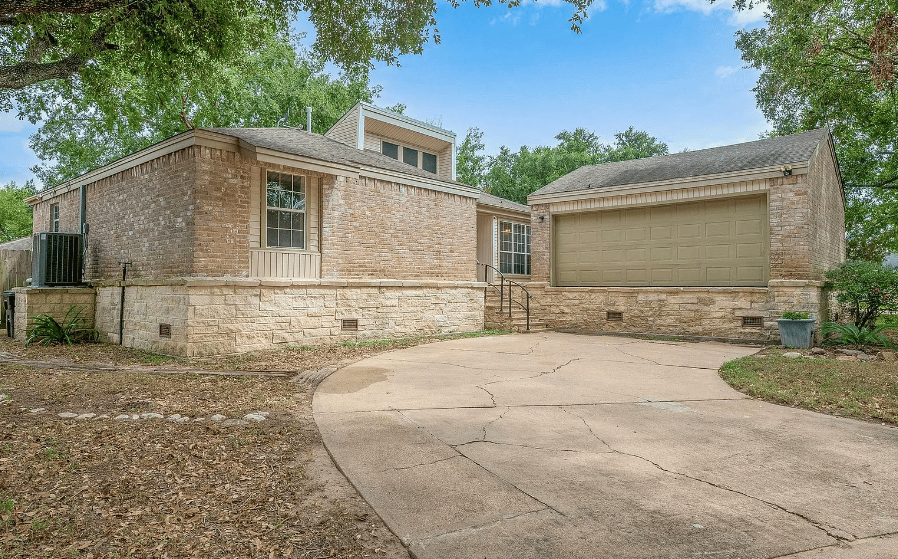

This Houston, TX home (with no garage — or at least one you can’t pull into) is actually reasonably priced at only $280k.

And you get all of that inside?? Count us in. Check it out 👇

TL;DR (Too Long; Didn’t Read)

The Federal Reserve's expected rate cuts through 2025 could gradually lower mortgage rates, easing the "lock-in effect" for sellers and boosting buyer activity, presenting a strategic opportunity for real estate agents and investors. As multifamily construction slows and demand remains strong, investors can expect rising rents and higher property values, making now a prime time to capitalize on reduced supply and position for future gains. The cooling job market has pushed mortgage rates down, creating a short-term opportunity for increased buyer activity, but rising unemployment may temper demand, making it crucial for real estate professionals to act strategically and advise clients to lock in lower rates now.

Have a great weekend - we’ll see you next Saturday.

Cheers 🍻

-Market Minds Team