We appreciate each and every one of you for taking the time to read Market Minds. Buckle up and enjoy the free value, and you won’t want to miss the house that has had TWO birthdays on the market…

Is a Balanced Market on the Horizon?

Are We Heading into a Balanced Market?

The tides in the housing market are shifting, and the days of sellers holding all the cards might be coming to an end. For real estate agents and investors, this potential shift could open new opportunities and strategies that were off the table in the past few years. But before you start celebrating, it’s important to understand where we really stand.

Inventory Growth: A Sign of Market Balance?

The national housing inventory has crept up from a three-month supply at the beginning of the year to a four-month supply. While this increase is modest, it nudges the market closer to the five-to-seven-month supply that typically defines a balanced market—where neither buyers nor sellers have a clear advantage. However, it's crucial to note that we're not there yet. The market remains in favor of sellers, just not as overwhelmingly as before.

Buyer and Seller Behavior Shifts

Several key changes are worth noting:

Homes Sitting Longer: With more options available, buyers are taking their time, which means homes are sitting on the market longer. Sellers need to adjust expectations and price their properties competitively.

Fewer Bidding Wars: The days of multiple offers within hours are fading. This gives buyers more leverage in negotiations, with many now insisting on inspections and appraisals.

Inspections Are Back: In a less frenzied market, buyers are more likely to insist on due diligence, including inspections. Sellers need to be prepared for negotiations over repairs.

What This Means for Your Strategy

For agents and investors, understanding these shifts is key. Pricing strategies need to be more precise, marketing efforts more targeted, and negotiation skills sharper. The market may still favor sellers, but the dynamics are becoming more nuanced, offering fresh opportunities for savvy professionals.

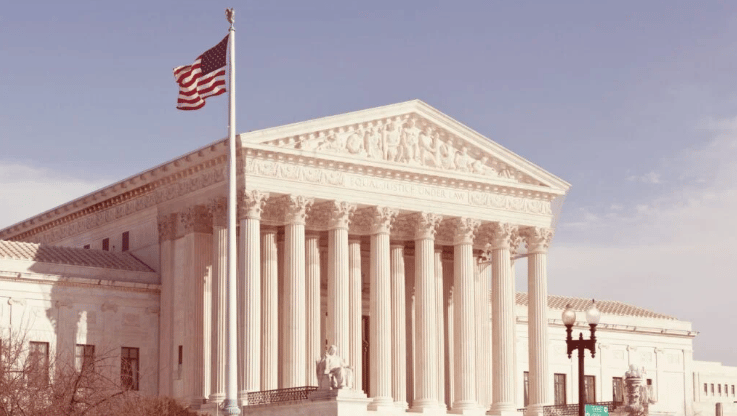

NAR vs. DOJ: A Supreme Showdown that Could Redefine Real Estate

Source: Canva

NAR's Supreme Court Gamble

The National Association of Realtors (NAR) is gearing up for a high-stakes legal battle, taking its ongoing dispute with the Department of Justice (DOJ) all the way to the U.S. Supreme Court. This isn't just another courtroom drama; the outcome could have far-reaching implications for real estate agents, brokers, and investors.

A Legal Battle Rooted in Commission Transparency

This clash stems from a 2020 lawsuit and settlement where the DOJ challenged NAR’s rules, particularly those related to commission transparency and the buyer broker system. Initially, the settlement aimed to make commission structures more transparent and to curb misleading claims about buyer broker services being "free." But the DOJ pulled out of the agreement in 2021, reigniting the investigation and escalating the conflict.

What’s at Stake?

If the Supreme Court sides with the DOJ, we could see a significant shift in how commissions are structured and disclosed. This would likely accelerate changes already spurred by recent consumer lawsuits, which have begun altering traditional commission practices. The outcome could redefine how agents and brokers conduct business, making it critical for real estate professionals to stay ahead of these potential changes.

Broader Implications for the Real Estate Industry

While this case is just one piece of NAR's ongoing struggle with the DOJ, the broader implications are clear. Should the DOJ’s stance prevail, it could set a precedent that further disrupts the commission landscape, potentially leading to more regulation and oversight. This is not just a legal skirmish but a battle that could reshape the fundamentals of the real estate industry.

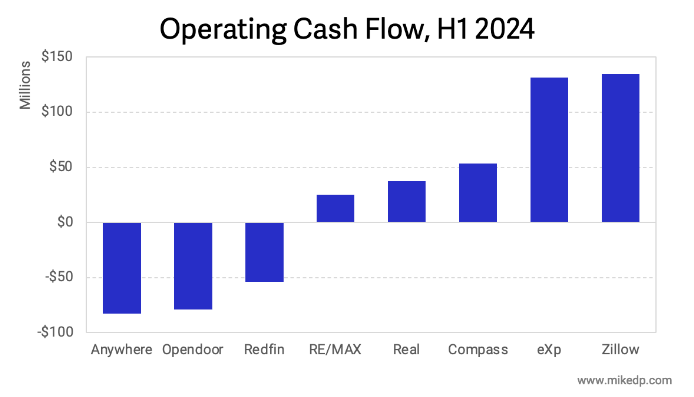

Cash is King: Which Real Estate Models Are Thriving Amidst Market Challenges?

Source: Mike DelPrete

eXp Realty and Zillow: Unexpected Equals in Cash Flow

In a surprising twist, eXp Realty, a brokerage, and Zillow, a tech-driven real estate portal, both reported identical cash flow figures for the first half of 2024. This is a striking revelation, especially given their vastly different business models. It underscores the importance of focusing on operating cash flow—a clear indicator of a company's core financial health, cutting through the noise to reveal true profitability.

Anywhere’s Decline: Market Pressures Expose Weaknesses

The market's current challenges have hit Anywhere (formerly Realogy) particularly hard, reducing its once-strong cash generation. The decline highlights the fragility of its business model in tough market conditions, suggesting that its operational structure may not be as resilient as some of its competitors.

Global Portals Outshine U.S. Counterparts

When looking at real estate portals worldwide, Australian giant REA Group and the UK’s Rightmove emerge as the most profitable, outperforming even the U.S. market leader, Zillow. REA Group’s ability to monetize its market is especially impressive, with an operating cash flow per capita 16 times higher than Zillow's. This raises questions about the scalability and efficiency of different market models, particularly as companies like CoStar look to replicate Australia’s success with Homes.com in the very different U.S. market.

Local Dynamics Trump Market Size in Profitability

Despite the vast size of the U.S. real estate market, it’s clear that larger market size doesn’t automatically translate to higher profits. Local market dynamics, such as the absence of MLSs in Australia or vendor-funded advertising, play a significant role in determining profitability. This means that real estate companies need to adapt their strategies to local conditions rather than assuming that what works in one market will work in another.

Grow With Us!

Join our exclusive network of innovation-driven real estate agents and investors, designed to accelerate your growth and SCALE exponentially. Connect with top-tier professionals and access game-changing resources curated from the industry's best—ready for you to implement TODAY.

Our dynamic, tiered pricing model ensures your investment holds its value; prices rise as the community grows, so lock in your lifetime rate by joining now.

We’ll see you on the inside 💪

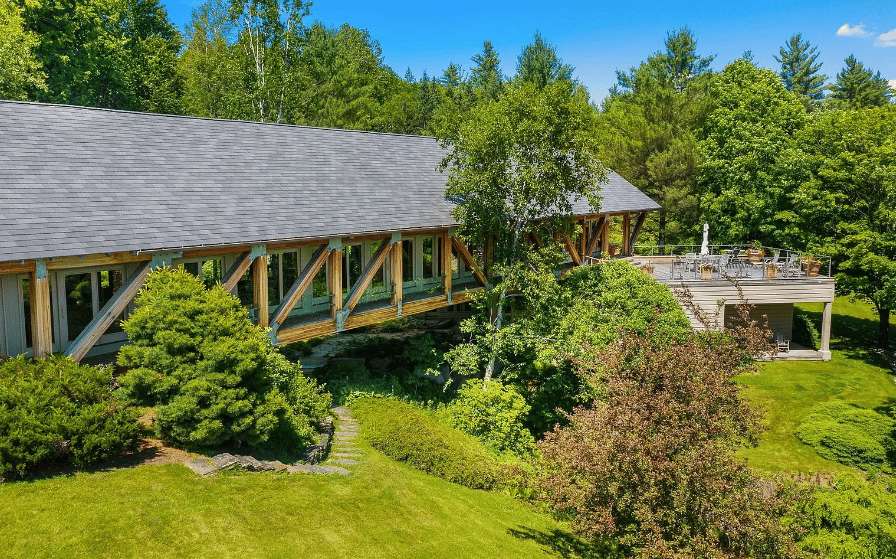

Covered Bridge Conversion

This Stowe, VT home sits on 80± acres and can be yours for only $10.5M (down from $17.5M when it was listed TWO years ago).

But it’s pretty unique, check it out 👇

TL;DR (Too Long; Didn’t Read)

The real estate landscape is gradually moving towards balance, and this transition could redefine how you approach your deals. Whether you're buying, selling, or advising clients, staying ahead of these changes will be crucial to maintaining your edge in the market. As NAR prepares for its Supreme Court faceoff, the real estate community should be bracing for impact. The decisions made in this case could alter the business landscape, forcing agents and investors to adapt to new rules and expectations. Staying informed and agile will be key to navigating whatever changes lie ahead. In today’s tough market, the ability to generate cash is the ultimate litmus test for a company’s business model. As the tide recedes, it reveals which companies are merely surviving and which are truly thriving. For real estate agents and investors, understanding these cash flow dynamics is crucial to making informed decisions and staying ahead in a competitive landscape.

Have a great weekend - we’ll see you next Saturday.

Cheers 🍻

-Market Minds Team