We appreciate each and every one of you for taking the time to read Market Minds. Buckle up and enjoy the free value, and you won’t want to miss “the rock house.”

Powell Signals Rate Cuts – A Silver Lining for Real Estate?

Source: TRD

As inflation cools and mortgage rates teeter, Jerome Powell's recent statements at the Jackson Hole conference are stirring optimism across the real estate industry. With the possibility of a September rate cut, market watchers and real estate professionals are eyeing significant shifts that could impact buyers, sellers, and investors alike.

Rate Cuts Could Ease Mortgage Rates

Federal Reserve Chair Jerome Powell’s declaration that "the time has come for policy to adjust" signals the strong likelihood of a federal funds rate cut in September. Following Powell's speech, the 10-year U.S. Treasury yield dropped, hinting that mortgage rates—currently around 6.67% for conforming loans—could edge lower soon. Real estate experts, including the Mortgage Bankers Association's Mike Fratantoni, foresee rates dipping closer to 6% over the next year, potentially fueling a resurgence in housing demand.

Inflation in Check, Housing Gains Ahead?

Powell shared that inflation is retreating towards the Fed's 2% target, currently at 2.5%. His growing confidence in inflation's downward trajectory is welcome news for both the economy and housing markets. Coupled with the Fed’s tighter monetary policy over the past two years, which pushed rates higher, the upcoming shift could reverse this trend, benefiting homebuyers and revitalizing the real estate market.

Cooling Job Market Supports Lower Rates

The labor market, once overheated, is showing signs of cooling, with unemployment creeping up to 4.3%. This slower hiring pace and increase in the worker supply give the Fed confidence that inflation won’t spiral upward again. The softening job market reinforces the expectation of rate cuts, which could further alleviate mortgage costs and encourage homebuyers back into the market.

What Does This Mean for Real Estate?

For real estate professionals, Powell’s signals translate into opportunities. Lower rates could bring affordability back to the table for potential buyers who have been priced out of the market due to high borrowing costs. As mortgage rates trend downward, we could see a significant uptick in demand, which would not only stimulate home sales but also provide a boost to property values.

Stay tuned—the coming months could usher in a real estate resurgence as the Fed pivots and mortgage rates follow suit.

Beyond the Big Moments: What’s Driving Homebuyers in 2024?

Source: Jesus Arturo Lopez Llontop | Getty Images

As we look ahead to 2024, the motivations behind homebuying are evolving beyond the traditional life events like job changes, marriage, or family growth. According to a recent Inman-Dig Insights poll, buyers are motivated by a broader array of factors in today's challenging market environment. Here’s a closer look at what’s driving active and future homebuyers and how these trends are shaping the real estate market.

Bigger and Better Homes Still Enticing Buyers

Despite high mortgage rates, 32% of active buyers in July were seeking a larger or nicer home—one of the top motivators. This group is driven by a desire for an upgrade rather than major life changes, signaling that home quality remains a priority even as borrowing costs rise.

Job relocations remain a key driver, with 31% of current buyers moving for work. Meanwhile, 15% are looking for second homes or investment properties, underscoring the resilience of these segments despite affordability concerns.

Renters Are Focused on Financial Benefits

Renters, often entering the market for the first time, are heavily motivated by the financial advantages of homeownership, with 31% citing this as a key reason to buy. These buyers are particularly sensitive to affordability and are more likely to be searching for homes that meet their financial goals.

The Next Wave: Downsizing and Cost Efficiency

Looking ahead, future homebuyers are expected to be even more cost-conscious. A significant 19% of near-future buyers plan to downsize, while 36% of renters entering the market are driven by the financial benefits of owning rather than renting.

What This Means for Real Estate Professionals

For agents, understanding these nuanced buyer motivations is critical. As clients become more focused on home upgrades and financial benefits, especially amid high rates, tailoring strategies to highlight these aspects can help capture this evolving market. The next wave of buyers will likely be seeking affordability and long-term investment value—key factors to emphasize in your marketing efforts.

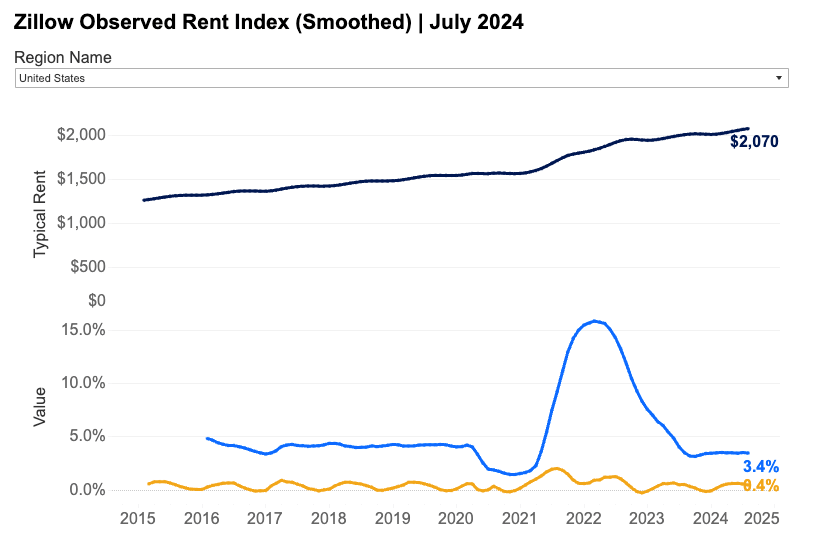

One-Third of Property Managers Offering Concessions

Source: TRD

As the U.S. rental market cools, more property managers are turning to concessions like free rent or parking to attract tenants. With an apartment construction boom increasing supply, renters now have more choices, putting pressure on landlords to sweeten the deal.

Concessions on the Rise

According to recent data, 33.2% of rental listings in July offered concessions, a sharp increase from last year’s 25.4%. This trend is most pronounced in high-growth metros like Raleigh, Charlotte, and Atlanta, where over half of the rental listings now offer incentives.

Rent Growth Slows, but Prices Still Climb

While rent growth has decelerated, rents are still inching upwards. The typical U.S. rent rose 0.4% in July to $2,070, and annual rent growth hit 3.4%. However, this slowdown has made rents slightly more affordable for the median renter, with 30% of income now going towards rent—just on the edge of affordability.

Multifamily Construction Boom Levels the Playing Field

A surge in multifamily housing completions is helping balance supply and demand, pushing the vacancy rate to 6.6%—the highest since 2021. This influx of new units is distributing rental demand across more listings, giving renters the upper hand in negotiations and keeping concession rates elevated.

What This Means for Landlords

For agents and property managers, understanding the growing use of concessions is critical. As supply rises and rent growth slows, leveraging incentives can be the key to securing tenants in a more competitive rental market. Emphasizing these perks in your listings could be a game-changer in attracting renters.

Grow With Us!

Join our private group for collaboration-driven real estate agents and investors aiming to iterate FASTER and SCALE, which also gives our readers an opportunity to connect.

We've curated resources from the top agents in the country with ACTIONABLE resources to implement TODAY.

We use a tiered pricing model in which the price increases as more people join. Join today and lock your price in for life.

See you inside 💪

Rock On!!

This Larkspur, CO home nestled around a 200 million-year-old red rock is quite unique to say the least…

And it get’s better inside 😂

TL;DR (Too Long; Didn’t Read)

Jerome Powell’s recent statements suggest potential rate cuts in September, creating optimism in the real estate market as inflation cools and mortgage rates hover around 6.67%. Lower rates could stimulate housing demand, making homes more affordable for buyers and boosting property values. At the same time, buyer motivations are shifting, with many seeking home upgrades or investment properties despite high borrowing costs. In the rental market, property managers are increasingly offering concessions to attract tenants as a surge in multifamily construction increases supply and competition. These trends are reshaping strategies for real estate professionals across sales and rentals.

Have a great weekend - we’ll see you next Saturday.

Cheers 🍻

-Market Minds Team