We appreciate each and every one of you for taking the time to read Market Minds. Buckle up and enjoy the free value - and you won’t want to miss the $2M underground bunker.

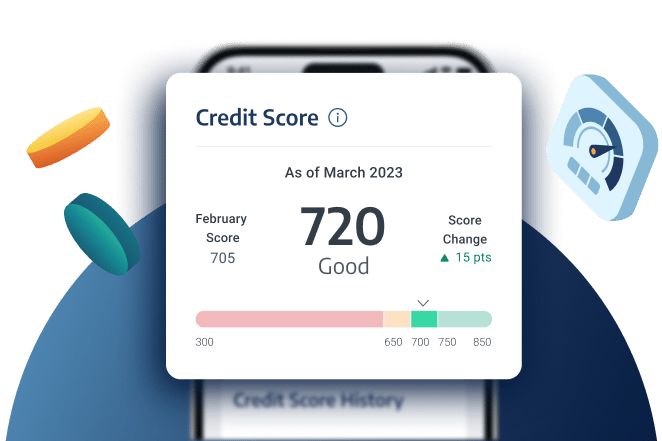

VantageScore Unveils New Credit-Scoring Model

Source: Axos Bank

In a significant development for the financial industry, VantageScore has introduced a pilot of its latest credit-scoring model, VantageScore 4 Plus. This new model is designed to integrate alternate open banking data with traditional credit data, promising a substantial improvement in predictive capabilities for lenders.

Key Features of VantageScore 4 Plus

Integration of Data Sources: By combining alternate open banking data with traditional credit data, VantageScore 4 Plus offers a more comprehensive view of a borrower's financial health.

Predictive Performance: The model claims to provide a predictive lift of up to 10% over the previous VantageScore 4.0, which already boasted an 8% lift over conventional scoring models. This enhancement could lead to more accurate lending decisions.

Compatibility with Major APIs: The pilot model is designed to work seamlessly with all major aggregator advanced programming interfaces (APIs), ensuring easy integration for users across various platforms.

Maintained Scoring Range: The scoring range remains the same as VantageScore 4.0, from 300 to 850, which means most lenders will not need to adjust their credit or lending policies to accommodate the new model.

Use of Score-to-Odds Ratios: This feature allows lenders to maintain consistent risk assessment practices while integrating the new scoring model.

These requirements are expected to take place in Q4 of 2025.

Investor Purchases on the Rise

Source: Getty Images

After a two-year lull, the real estate market is witnessing a notable shift as investor purchases have increased for the first time since the first quarter of 2022. This resurgence is highlighted in a recent report by Redfin, which indicates a slight but significant uptick in investor activity during the first quarter of 2024.

Key Findings from the Report

Increase in Investor Purchases: Approximately 44,000 homes were bought by investors in the first quarter of 2024, marking a 0.5% increase from the same period in 2023.

Market Share: Investors accounted for 19% of all home sales in the first quarter, up from 17.9% the previous year, showcasing their growing influence in the market.

Profit Margins: The profit margin on homes sold by investors in March 2024 was notably higher, with homes selling for 55% more than their purchase price, compared to 46.3% in March 2023.

Impact of the April CPI Report on Mortgage Rates

Source:Redfin

The Consumer Price Index (CPI) for April has provided some interesting insights, which are particularly relevant for those in the housing market. Here’s a breakdown of the key points:

Slight Decrease in Inflation: The core CPI, which excludes the volatile food and energy sectors, rose by 0.3% month-over-month, aligning with market expectations and showing a decrease from the previous three months' readings of 0.4%.

Impact on Mortgage Rates: This softer inflation report suggests a potential decrease in mortgage rates, offering a glimmer of relief for homebuyers.

Federal Reserve's Next Moves: The data leaves room for the Federal Reserve to consider cutting interest rates later this summer, depending on upcoming economic data.

Dominate Your Market with the Postcard Pack

Use these editable postcards to dominate your desired area.

Delivered to you - instantly!

If you’re committed to adding another source of leads to your business, try it out here. If you wouldn’t jump into shark-infested waters to keep the mailers, we’ll give you your money back. And you can keep the mailers and the leads that come from them, too.

Bunker Home on 10 Acres

If this Polo, MO home doesn’t look like it’s worth $2M, you might want to check out the pictures…

Just don’t expect to see any natural light 😂

TL;DR (Too Long; Didn’t Read)

VantageScore has launched a pilot of its new credit-scoring model, VantageScore 4 Plus, which integrates alternate open banking data with traditional credit data to enhance predictive capabilities for lenders. Meanwhile, investor purchases in the real estate market have increased for the first time since early 2022, and recent inflation data indicates a potential decrease in mortgage rates, offering relief for homebuyers.

Have a great weekend - we’ll see you next Saturday.

Cheers 🍻

-Market Minds Team