We appreciate each and every one of you for taking the time to read Market Minds. Buckle up and enjoy the free value - and you won’t want to miss the medieval castle that took SIX YEARS to build.

Home Pricing Soaring, Flying

Source: Pixabay

As of late April, the median home sale price in the most populous U.S. metros has either risen or remained stable compared to the previous year.

This marks the first time such a trend has been observed since July 2022. Specifically, the median sale price across the nation escalated to a near-record $383,188, reflecting a 4.8% increase year over year.

Affluent metros have seen significant price jumps, with Anaheim, CA leading the charge with a more than 20% increase year over year. Other notable increases include:

Detroit, MI at 14.9%

San Jose, CA at 13.6%

West Palm Beach, FL at 13.4%

New Brunswick, NJ at 12.8%

In contrast, some Texas and Florida metros have experienced minimal increases, with Dallas seeing no change, and Austin, San Antonio, Fort Worth, and Tampa recording only slight rises.

There’s a Shortage of WHAT??

Source: Pixabay

A significant shortage of construction workers, estimated at about 500,000, is currently plaguing the industry.

The shortage of construction workers has been building up over the past four years, exacerbated by a surge in demand for labor sparked by new government funding for infrastructure projects.

This deficit is not just a number; it's a catalyst for increasing home prices and delaying project completions.

Jobs Report Data and What It Means For Rates

Source: Redfin

The April jobs report not only impacts homebuyers but also plays a significant role in shaping the Federal Reserve's policy decisions. Here's how:

Fed Policy and Inflation: The Federal Reserve closely monitors such employment data to gauge inflation pressures. A softer jobs report like April's can alleviate fears of rapidly accelerating inflation, potentially delaying any immediate rate hikes.

Rate Cut Expectations: Initially, there was anticipation of 5-6 rate cuts in 2024, but recent data had reduced these expectations to just 1-2 cuts. However, the April report's weaker-than-expected results have revived hopes for more aggressive rate cuts, possibly as early as July or September.

And a couple key findings from that jobs report:

Nonfarm Payrolls: There was an increase of 175,000 jobs, a decrease from March's 315,000, and below the anticipated 240,000. This slowdown in job creation is a critical factor in the potential easing of mortgage rates.

Unemployment Rate: A slight uptick from 3.8% in March to 3.9% in April, contrary to expectations that it would remain steady.

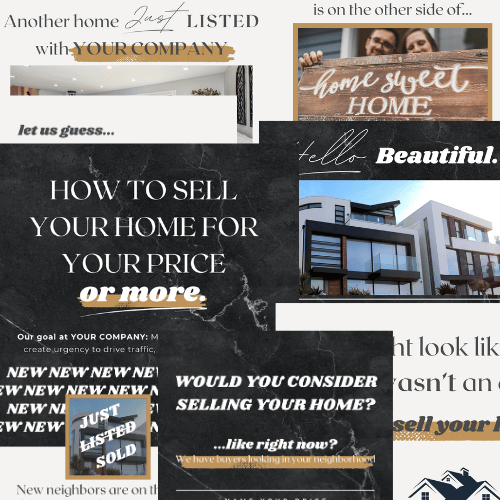

Dominate Your Market with the Postcard Pack

Use these editable postcards to dominate your desired area.

Delivered to you - instantly!

If you’re committed to adding another source of leads to your business, try it out here. If you wouldn’t jump into shark-infested waters to keep the mailers, we’ll give you your money back. And you can keep the mailers and the leads that come from them, too.

The Medieval Castle

This Rochester, MI home took 6 years to build and can be yours for only $2.2M.

It has quite the listing description 😂

TL;DR (Too Long; Didn’t Read)

As of late April, median home sale prices in major U.S. cities have risen or remained stable compared to the previous year, marking the first such trend since July 2022, with the national median reaching $383,188, up 4.8%. Affluent metros like Anaheim, CA, saw significant increases, while some Texas and Florida metros experienced minimal changes. A shortage of construction workers, estimated at 500,000, is affecting the industry, leading to delays and increased home prices. The April jobs report, impacting both homebuyers and Federal Reserve policy, showed a softer increase in jobs and a slight uptick in the unemployment rate, potentially influencing future rate decisions.

Have a great weekend - we’ll see you next Saturday.

Cheers 🍻

-Market Minds Team