We appreciate each and every one of you for taking the time to read Market Minds. Buckle up and enjoy the free value - and you won’t want to miss the crazy listing with possibly TOO MUCH luxury.

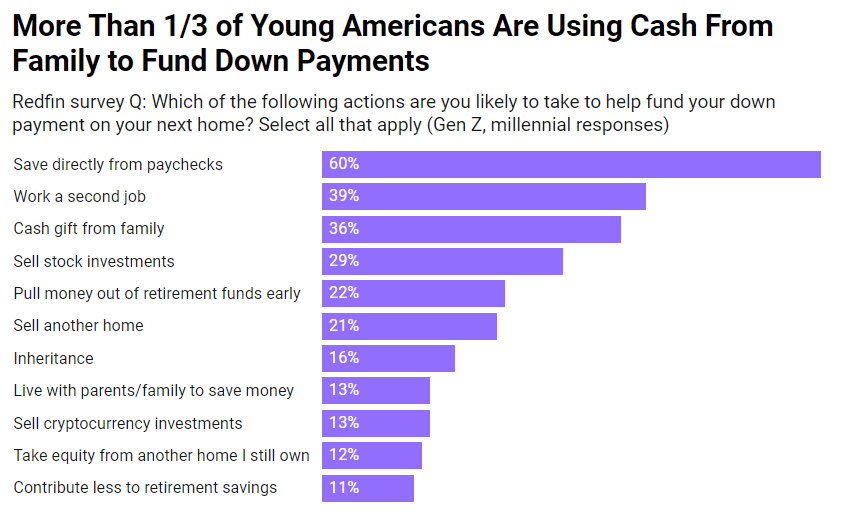

Gen Z/Millennials Calling in Favors

Source: Redfin

Calling in favors from family, that is.

Younger generations are turning to family for help with down payments as housing costs continue to soar. A recent survey conducted by Redfin and Qualtrics in February 2024 revealed that more than one-third of Gen Zers and millennials who plan to buy a home soon expect to receive a cash gift from family to help fund their down payment. This highlights the financial challenges faced by young homebuyers and the need for external support in navigating the expensive housing market.

This is a significant increase compared to previous years, where only 18% of millennials used family money for down payments in 2019. The share had only risen to 23% by 2023.

ZORI and Shelter CPI

Source: Zillow

Zillow Observed Rent Index (ZORI) and the Consumer Price Index (CPI)

Shelter CPI has traditionally been viewed as a lagging measure, with the belief that landlords respond to on-market pressure but can only act once annual leases come to an end. Even without landlords renewing leases in response to on-market rent increases, shelter CPI can still be influenced by renters moving from off-market to higher on-market rents. This mobility between on-market and off-market rents creates an enduring "lag" in shelter CPI, making it appear as though it is lagging behind market pressures.

To better understand the relationship between Zillow Observed Rent Index (ZORI) and shelter CPI, we can use a simple model of the housing market. This model takes into account the movement of renters from off-market to on-market rents over time. Even if on-market rent inflation proceeds at a 2% pace, which is consistent with the target and below the historical average, annualized month-over-month changes in shelter CPI are likely to remain closer to 3% until at least year-end 2026.

The elevated levels of shelter CPI should be taken into consideration by the Federal Reserve when making decisions about monetary policy. As other macro signals, such as the strength of the labor market and recent inflation readings, guide the Federal Reserve to maintain a restrictive policy rate, the sustained high levels of shelter CPI should not be seen as a worrisome signal. Instead, it may indicate that the economy is on a sustainable path towards inflation.

It’s Now More Affordable to Rent

Source: Inman

According to a new report from Realtor.com, renting has become more affordable than buying in every major US market. Elevated mortgage rates, high home prices, and low inventory have combined to make renting a more cost-effective option in all of the top 50 United States metro areas. In fact, the monthly mortgage payment on a starter home in each of these cities is now an average of $1,027 or 60% higher than the typical rent payment.

48 Leads in 48 Hours with $0 Spent, Guaranteed!

Implement our Facebook strategy to learn how to generate leads on autopilot without paying Google or a marketing company hundreds if not thousands of dollars to do so.

Or even better - without spending any money at all.

If you’re committed to starting 2024 strong, try it out here. If you wouldn’t jump into shark-infested waters after 48 hours to keep the guide, we’ll give you your money back. And you can keep your 48+ leads, too.

Too Much Luxury?

This Houston, TX home can be yours for a cool $36M. View the full listing here.

At least the HOA isn’t too bad at $36/mo. 😂

TL;DR (Too Long; Didn’t Read)

As housing costs rise, younger generations like Gen Z and millennials are increasingly relying on family cash gifts to afford down payments, with over one-third expecting this support. This contrasts sharply with previous years, indicating growing financial challenges for young homebuyers. Meanwhile, a comparison between Zillow's Observed Rent Index (ZORI) and shelter Consumer Price Index (CPI) suggests that shelter CPI may lag behind market pressures due to renters transitioning between on-market and off-market rents, influencing inflation trends. Renting has become more affordable than buying in all major US markets due to high mortgage rates, home prices, and low inventory levels.

Have a great weekend - we’ll see you next Saturday.

Cheers 🍻

-Market Minds Team