We appreciate each and every one of you for taking the time to read Market Minds. Buckle up and enjoy the free value - and you won’t want to miss the true masterpiece in Homestead, FL.

At the end, learn how to earn by sharing Market Minds with your friends!

New Inflation Data & Mortgage Rates

Source: Getty Images

Mortgage rates continue to surge this week as more worrisome inflation data has put to rest any lingering expectations for a Federal Reserve rate cut this spring.

The Federal Reserve had previously signaled that they expected to cut rates three times this year. However, the latest economic data has caused investors to rethink these expectations. The CME FedWatch Tool, which tracks futures markets' expectations of the Fed's next moves, now shows that investors see only a 4 percent chance of a rate cut in May, down from 38 percent in February.

The Department of Labor's report showing a drop in weekly unemployment claims could also be a concern for hawkish Fed policymakers. A strong job market provides support for wages and makes it difficult for employers to fill open positions. Many Fed policymakers are more worried about taming inflation than the prospect of a recession.

Blackstone Says Buy

Source: Getty Images

According to data submitted by Redfin buyers' agents across the country, home sellers gave concessions to buyers in 35% of U.S. home sales during the three months ending Oct. 31. While this percentage is little changed from the previous year, it has increased from 27.6% two years earlier.

Interest rates aside, sellers are more open to giving concessions due to major life events, such as divorces and new jobs, that prompt them to sell their homes quickly. This creates an opportunity for buyers to negotiate for concessions and make contingent offers without having to waive inspections and other important safeguards.

Blackstone Group President, Jon Gray said, "Perception is so negative, the headlines are negative, yet the value decline has occurred." And as Warren Buffet said, “Be fearful when others are greedy, be greedy when others are fearful.” But it’s important to note that Jon Gray is not anticipating a V-shaped recovery.

Disclaimer: Not financial advice 🙂

Buyers Take Action

Source: Pexels

Homebuyers have been quick to act as mortgage rates dropped, with purchase loan applications surging for the second consecutive week. However, rates are now on the rise again due to concerns over inflation and the timing of expected Federal Reserve rate cuts.

According to the Mortgage Bankers Association (MBA), applications for purchase loans increased by 5 percent last week compared to the previous week. Refinancing activity also saw a significant increase, with refi applications rising by 12 percent last week. This was driven by homeowners taking advantage of the falling mortgage rates to refinance their existing mortgages. Refi applications for government-backed FHA, VA, and USDA loans saw a particularly large surge of 24 percent.

48 Leads in 48 Hours with $0 Spent, Guaranteed!

Implement our Facebook strategy to learn how to generate leads on autopilot without paying Google or a marketing company hundreds if not thousands of dollars to do so.

Or even better - without spending any money at all.

If you’re committed to starting 2024 strong, try it out here. If you wouldn’t jump into shark-infested waters after 48 hours to keep the guide, we’ll give you your money back. And you can keep your 48+ leads, too.

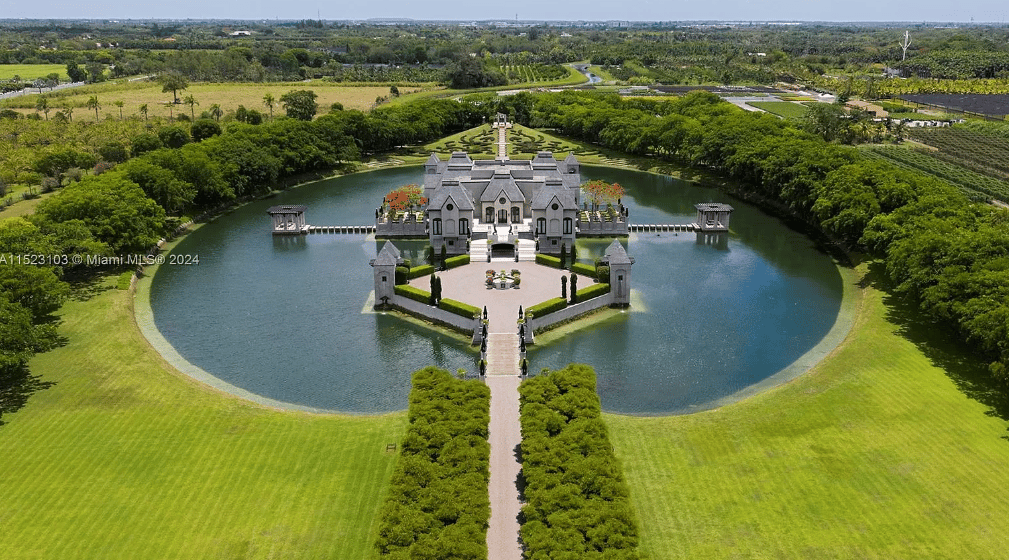

A True Masterpiece

This Homestead, FL home can be yours for a cool $21.8M. View the full listing here.

What do you think the monthly maintenance is on this house? 😂

TL;DR (Too Long; Didn’t Read)

Mortgage rates are climbing amid inflation concerns, squashing hopes for a Federal Reserve rate cut this spring. Investors have shifted expectations due to recent economic data, with only a 4 percent chance of a May rate cut according to the CME FedWatch Tool. Meanwhile, home sellers are increasingly offering concessions, creating negotiation opportunities for buyers amidst rising rates. Despite a recent surge in purchase loan applications, rates are now increasing again, prompting action from both buyers and refinancers.

Have a great weekend - we’ll see you next Saturday.

Cheers 🍻

-Market Minds Team