We appreciate each and every one of you for taking the time to read Market Minds. Buckle up and enjoy the free value - and you won’t want to miss the Alabama Castle.

Get a 20% Return On Your Database in 2024

Source: Kindel Media

What’s the best way to stay top of mind for your database?

The answer is simple: communicate with them regularly.

Below we’ve summarized a plan that accomplishes just that:

January: One-question (4-option) email to find out which people (and how many) are looking to buy or sell this year.

Source: Tom Storey

February: Send out a trades and services directory (physical copy) with your trusted HVAC companies, plumbers, etc.

March: Use Loom to create a personalized video CMA to each contact talking about an update, sales in the neighborhood, and any other valuable information. Talk about their dog, hobbies, etc. for extra brownie points.

April: Host a small, themed event such as ice-skating, pasta-making class, educational event, etc. (~20 people)

May: Send an email with a QR code for a free coffee at a local coffee shop.

June & July: In June, hand out invitations for the July Summer Client Event. Use the examples above to plan and host another event. (~150 people)

Read here for the rest of the calendar.

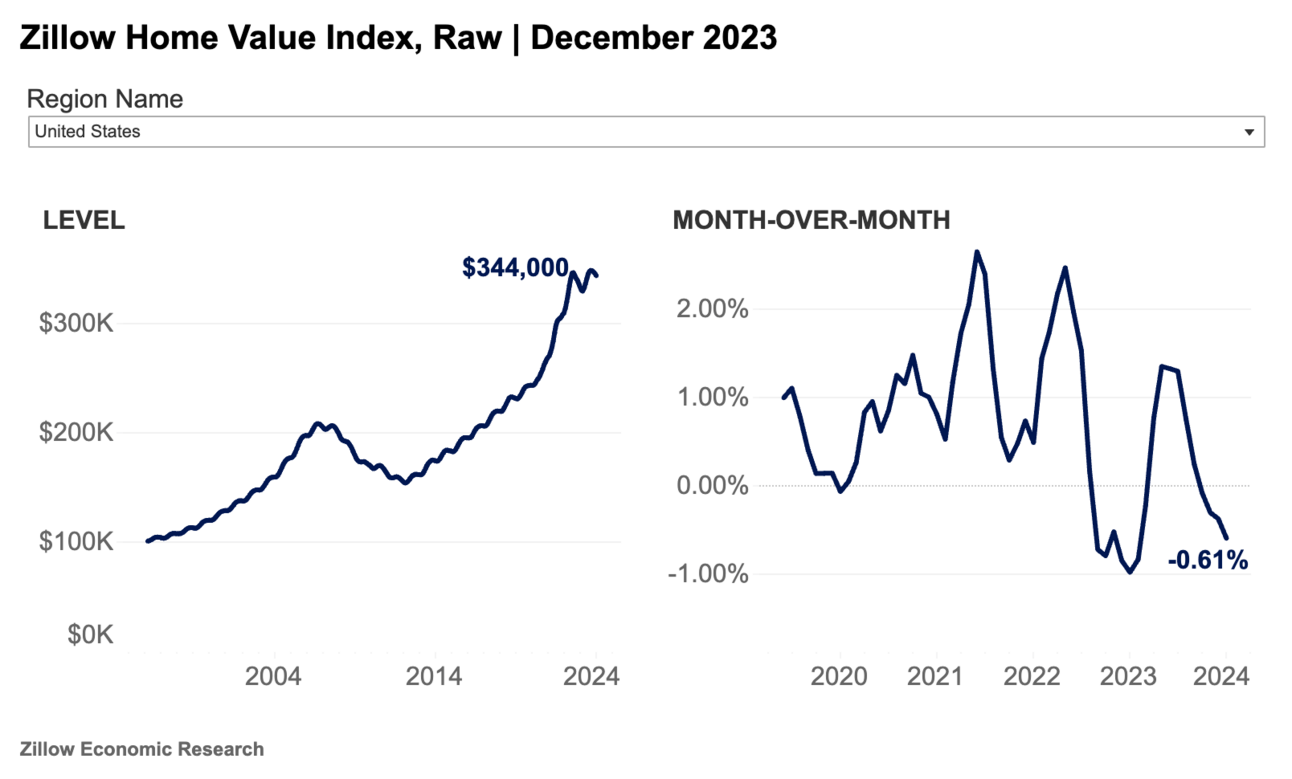

Increase in Homeowners Considering Selling

According to a recent survey conducted by Zillow, 21% of homeowners are considering selling their homes within the next three years. This is an increase from 15% a year ago.

Interestingly, the survey found that the share of homeowners considering selling was almost the same regardless of whether they had a mortgage rate above or below 5%.

This is a significant change from six months ago when homeowners with rates above 5% were nearly twice as likely to consider selling. It seems that current mortgage rates are becoming less of a determining factor when homeowners are considering selling their homes.

Fannie Mae Proposes Plan To Save Homebuyers $1,000 on Closing Costs

Source: NY Post

The plan involves expanding the types of mortgages that Fannie Mae will purchase, providing buyers with lower-cost alternatives to expensive title insurance.

Under the new proposal, homebuyers will have the option to use an "Attorney Opinion Letter" (AOL) instead of purchasing title insurance. An AOL is a document in which a real estate attorney confirms that there are no issues with the property's title.

According to Fannie Mae, borrowers who have used an AOL have saved an average of over $1,000.

48 Leads in 48 Hours with $0 Spent, Guaranteed!

Implement our Facebook strategy to learn how to generate leads on autopilot without paying Google or a marketing company hundreds if not thousands of dollars to do so.

Or even better - without spending any money at all.

If you’re committed to starting 2024 strong, try it out here. If you wouldn’t jump into shark-infested waters after 48 hours to keep the guide, we’ll give you your money back. And you can keep your 48+ leads, too.

The Alabama Castle

This Bremen, AL home can be yours for a cool $4.9M. View the full listing here.

The “Castle” sits on 6 acres, along with an 8,000 sq. ft. workshop 😲

TL;DR (Too Long; Didn’t Read)

A plan to stay top of mind with a database by communicating regularly. The plan includes activities for each month. A survey by Zillow indicates a 21% increase in homeowners considering selling within the next three years. Fannie Mae's is proposing to save homebuyers $1,000 on closing costs by expanding mortgage options and offering an alternative to title insurance through an "Attorney Opinion Letter" (AOL).

Have a great weekend - we’ll see you next Saturday.

Cheers 🍻

-Market Minds Team