We appreciate each and every one of you for taking the time to read Market Minds. Buckle up and enjoy the free value - and you won’t want to miss the crazy listing for the ultimate Disney fans.

Thrive in a Low Inventory Market

Source: Unsplash

Forget Thanksgiving and Christmas planning for a minute. As we head into the second half of Q4, it’s time to revisit your brand.

Actionable tips to help you thrive in the current market:

Invest in your brand. When’s the last time you updated your headshot? Website? Business cards? Ok, maybe you don’t use the physical business cards anymore. Either way - you only get one chance to make a first impression. Revisit these items to make sure you’re making a good one.

Elevate your pitch. Your buyer/listing presentation is not something that you set and forget. It should be constantly evolving. Look on sites like Etsy for digital downloads of fresh new presentations that you can use to win more clients. Most of them are less than the cup of coffee you bought this morning.

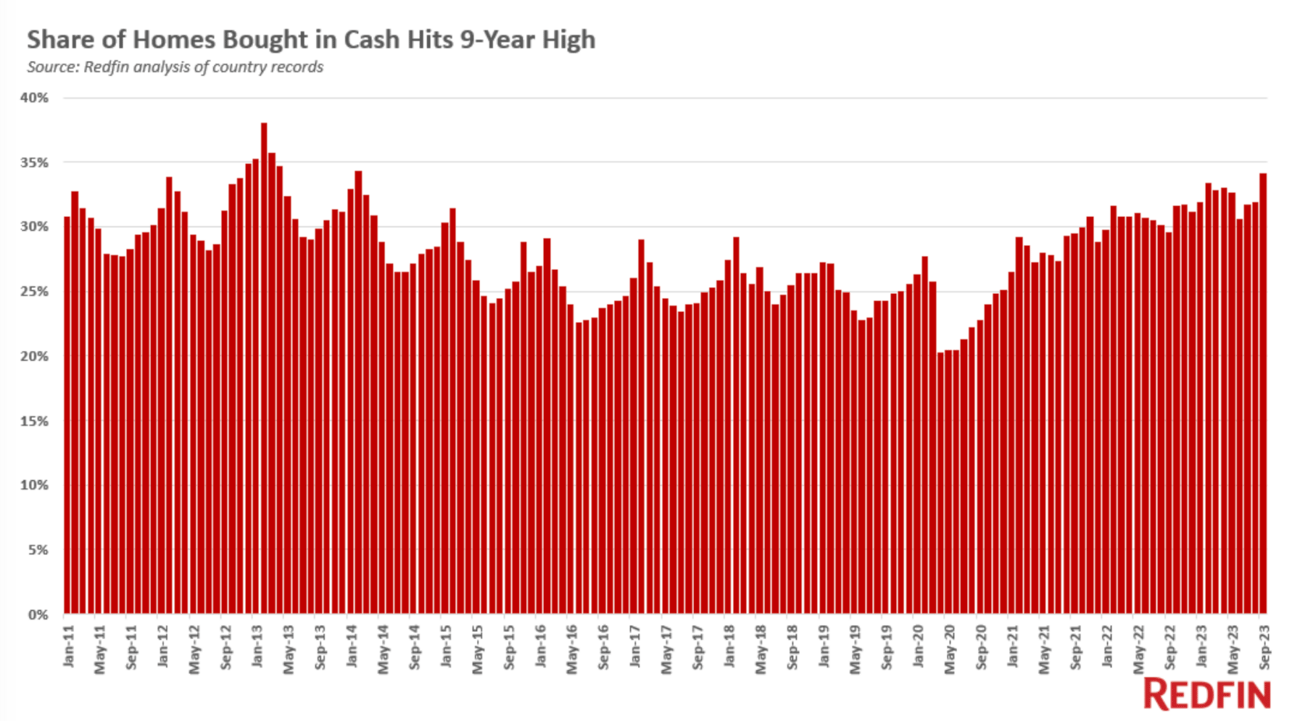

All-Cash Purchases on the Rise

Source: Redfin

All-cash purchases are becoming more common in the housing market for two main reasons:

Affluent Americans who can afford to pay cash are more inclined to buy homes in an expensive housing market. With the income required to purchase a home higher than ever before, avoiding interest payments altogether by buying in cash is an attractive option.

Elevated mortgage rates make cash purchases even more appealing. In September 2023, the weekly average 30-year fixed mortgage rate reached its highest level in two decades at 7.2%. Although rates have since come down a bit, they are still significantly higher than pre-pandemic levels.

The Impact of High Mortgage Rates

Source: Bankrate

The rise in mortgage rates is deterring homebuyers who rely on mortgages more than it is deterring all-cash buyers.

Overall home sales in 40 analyzed metros have declined by 23% year over year, compared to an 11% decline in all-cash sales. High mortgage rates not only make it more difficult for buyers to afford a home, but they also exacerbate inequality between homeowners and non-homeowners.

Affluent Americans who can afford to pay in cash are able to avoid the burden of high mortgage rates and keep more money in the bank.

Andy Coleman the Rental King

It’s a tough market right now. It’s becoming difficult to work with buyers and sellers because nobody needs to buy and nobody needs to sell.

But there’s another solution, an untapped market that nobody teaches or talks about.

It’s how Andy Coleman made $1.6 million in his last 3.5 years of real estate by working with renters.

Last year alone, he made $510,000 in net commission income by working rental deals. He’s kept it a secret because he didn’t want competition but now he’s releasing his entire strategy!

How to get the FREE leads, how to convert them to clients, how to put offers in, how to negotiate, and everything else it takes to get paid.

And the best part? Your renters will turn into buyers.

Want 48 Leads in 48 Hours with $0 Ad Spend?

Implement our Facebook strategy to learn how to generate leads on autopilot without paying Google or a marketing company hundreds if not thousands of dollars to do so.

Or even better - without spending any money at all.

If you’re committed to finishing 2023 strong, try it out here. If you wouldn’t jump into shark-infested waters after 48 hours to keep the guide, we’ll give you your money back. And you can keep your 48+ leads, too.

Disneyland at Home

Source: Zillow

This Davenport,FL home brings Disneyland to YOU. And if you think it’s just these 4 rooms that look like this, you’d be sadly mistaken. View the full listing here.

How would you write this listing description? 😂

TL;DR (Too Long; Didn’t Read)

Focus on your brand. Update your visual elements, like your headshot, website, and perhaps even business cards. First impressions matter, and these details contribute to it. Constantly refine your buyer/listing presentation for a competitive edge. Digital downloads from sites like Etsy can provide fresh and affordable templates. There’s an increasing prevalence of all-cash purchases in the housing market. Affluent Americans are opting for cash to avoid high mortgage rates in expensive markets. This, coupled with elevated rates, is leading to a decline in overall home sales, particularly affecting those reliant on mortgages. The disparity between homeowners and non-homeowners is widening, with cash buyers avoiding the impact of high mortgage rates and maintaining financial flexibility.

Have a great weekend - we’ll see you next Saturday.

Cheers 🍻

-Market Minds Team